Funding Circle Review

** Funding Circle review updated November 5th, 2020 **

Update: Secondary loan sale was completed after 144 days

With operations in four countries, Funding Circle is one of the biggest peer to peer companies having lent out £10bn+ globally since its launch.

Funding Circle is now focusing on government back CBILS lending which retail peer to peer lenders cannot participate in. I have been lending through Funding Circle for quite some time but decided to reduce my investment due to the lack of liquidity for selling loans, removal of default statistics and for other reasons.

After a recent share float and some rumours of Funding Circle’s struggles, is Funding Circle a place I’d invest through? No, but not for the reasons I originally wrote about…read my updated Funding Circle review to discover why.

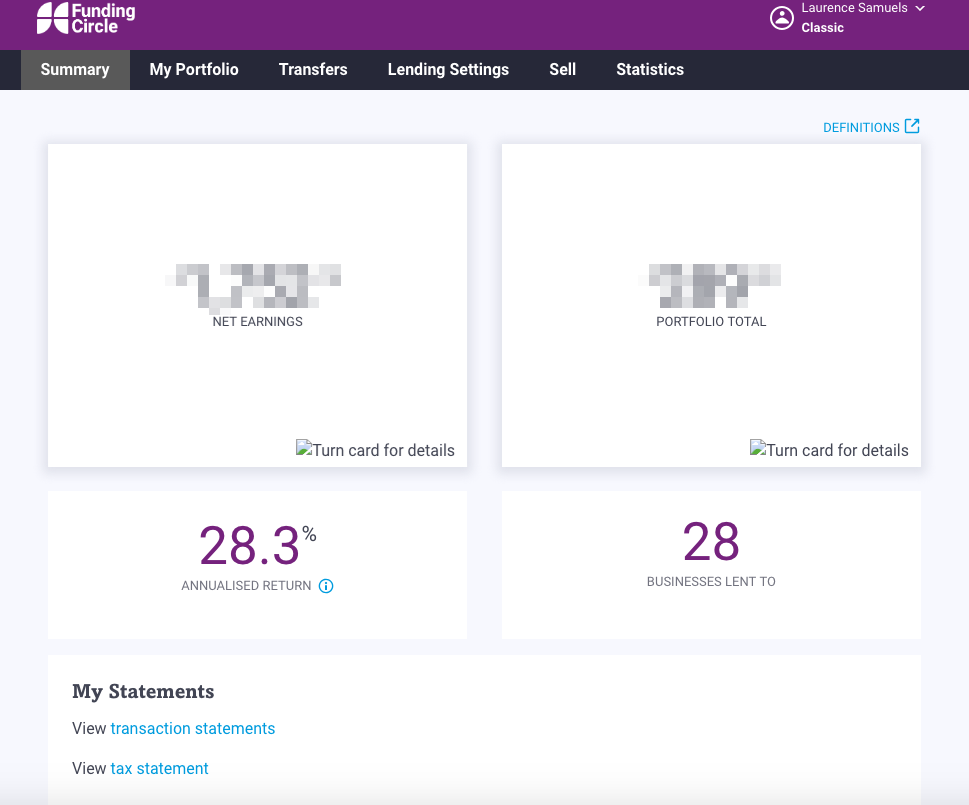

My Current Investment Amount: Click here

My annual rate of return: 4.7%

| Est. Annual Returns: | Up to 7% (after fees) |

| My Risk Rating *: | |

| Launched: | 2010 |

| Early Exit: | ✓ |

| Autoinvest: | ✓ |

| Provision Fund: | X |

| ISA Available: | ✓ |

| Loan Types: | Business, property development |

| Loan Security: | Business loans are unsecured. Development loans secured by property and land |

| Lender Fees: | 1% annual fee |

| Min Investment: | £10 per loan / £100 initial deposit |

| Time to Become Invested: | Varies based on demand / supply |

| Time Needed Managing: | Zero |

| Lending Agreements With: | Borrowers |

| FCA Regulation: | Full |

| Cashback Offer: | Invest £2,000+ and receive a £50 Amazon gift card |

| Sign Up: | Sign Up |

* This opinion risk rating factors in types of loans offered, interest rates, platform history, default numbers and my own investing experience. My risk rating explained.

How Do I Sign Up / Any Cashback Offers?

Sign up and lend £2,000 to receive a £50 Amazon gift card. (Read the terms and conditions on the signup page. When you open an account through my website, it helps me to continue to operate and offer new reviews.)

Funding Circle Review: What You Need To Know

Pros

- Founded in 2010 / good track record, growth and trading history

- Well funded

- Lots of institutional investors

- Autobid for those wanting hand-off investing

- Funded £10bn+ in global loans

- Received £80m in support from the government-owned British Business Bank

Cons

- Most loans are unsecured

- Loan re-sale on the secondary market is very slow

- High fees + new 1.25% loan transfer payment for loan sellers

- Company growth forecast recently halved

- Investor dashboard

- Interest return rates, not the best considering most loans are unsecured

- Limited default statistics and no loan book transparency

- Low recovery rates on bad debt

- Some of my funds were stuck in unlent purgatory for several weeks

- Idle funds can lead to cash drag (returns lost to uninvested money)

- Auto-invest only products will displease manual investors looking for higher returns

Equivalent Competitors

Assetz Capital, Ablrate, Lending Crowd

Funding Circle’s Company Financials

Funding Circle’s revenues totalled £105.7m and post-tax losses were £24.2m for the year ending December 31st, 2019. Full company accounts can be seen here.

Funding Circle Review (UK): My experiences so far….

When I initially began investing through Funding Circle in 2015, I was a little concerned about lending businesses using unsecured loans but I considered the interest rates worth the risk. But as time passed, the interest rates drastically dropped due to a change from a bidding system to a fixed-rate system. I found manual investing time-consuming for the rates offered and I ultimately decided to exit the platform.

In June 2017, curiosity once again got the better of me and I decided to give Funding Circle another try but this time, using the lower interest paying auto-bid feature. I was relatively happy for a while as returns were good.

As time passed, I became concerned by low bad debt recovery and when Funding Circle removed the ability for lenders to view default statistics and download the loan book, I reduced my investment.

I placed some loans for sale and was finally sent a loan sale notification email after 144 days. While I understand no peer to peer lending company ever guarantees an exit, the lack of loan sales is concerning but I have opinions on why this lack of liquidity is occurring.

Why The Lack of Liquidity For Exiting?

In October 2019, I tested the resale market and it took 144 days to exit my small loan portfolio.

With the Covid-19 situation, exiting loans has become even more challenging.

So let me address the most asked question by Funding Circle lenders. Why is it taking so long to exit?

Aside from the lack of liquidity caused by economic conditions caused by Covid-19, my opinion is that Funding Circle is no longer targetting retail peer to peer lenders, also known as lenders like you and I. Funding Circle is heavily invested with institutional money, which means money from big banks and investment houses.

Institutional investment sources usually target lower-risk investments that pay lower return rates. This, in turn, means Funding Circle must underwrite lower-risk loans.

With lower risk loans comes lower return rates and therefore, Funding Circle can’t continue to pay the returns they have been paying retail lenders like you and me. So with less retail investors on the platform, there is less demand on the secondary market, hence the longer sale times.

Selling Tool

On December 2nd, 2019, Funding Circle introduced its new selling tool. Currently secondary market loans are sold on a first come first served basis. Funding Circle states that, “the new tool will cycle through all investors wishing to sell loan parts as many times as possible within a 120 day period. This will mean investors start to receive money back more regularly from the loan parts that have sold”.

This new change is particularly unfair to those people who have been stuck in the seller queue for weeks. This change will likely sidestep their queue position unless Funding Circle has a prevention plan in place.

For the privilege of using this selling too, loan sellers will pay a transfer payment of 1.25% of the value of their sold loans, a payment the loan buyer will receive. For example if you sell a £100 loan, you would receive £98.75 while the buyer would receive the full £100.

Think of this transfer payment as a bonus given to the buyer in order to create more liquidity in the secondary market by encouraging more buyers.

I think that many loan sellers will be annoyed by this 1.25% transfer payment addition, especially those trying to exit large portfolios. However, if it means they will be able to exit their loans, they might soon forget about the cost.

What Is Funding Circle?

Funding Circle provides peer to peer lending loans to small and medium-sized British businesses. Lenders buy loan parts and receive monthly payments. Loans are rated by risk grades from A+ to E, and the interest rates are based on the grades. A+ loans pay the least interest while E loans pay the most. Most loans are unsecured (other than personal guarantees), except for certain property development loans, which are secured by real estate.

Funding Circle used to target retail investors like me and you, but now heavily relies upon and markets to institutional markets for investment.

How Can I Contact Funding Circle?

Web

UK Tel: 0800 048 8747

When Did Funding Circle Launch?

August 2010

Are They Regulated?

Yes, by the UK Government’s Financial Conduct Authority #722513 under full authorisation granted May 25th, 2017. Investments made through Ratesetter are not covered under the FSCS (Financial Services Compensation Scheme).

FCA regulation is nothing like the FSCS, which covers consumers when they deposit money in banks. The FCA reports to the UK government and has the ability to pursue criminal action against companies which violate its standards and codes of conduct.

Who Can Open An Account?

Any UK resident or non-resident who owns a UK bank account and can pass the identification checks.

What’s The Signup Process Like?

Pretty easy. Just pass the security checks and provide any requested documentation.

How Much Time Will It Take To Become Invested?

I tested the market in January 2019 with a smaller amount of money and it took 2 business days to become fully invested. Demand and supply is really the only indicator.

How Much Time Will I Need To Spend Managing My Investments?

Since auto-bid is the only option, you will spend zero time managing your investment.

What’s The Minimum Deposit / Investment?

Loans: £10 minimum

Deposit: £100 minimum using a debit card. No minimum for bank transfer

How Are Deposits Made?

You can instantly deposit via debit card or use a bank transfer which takes one to three business days.

Does Funding Circle Offer an Innovative Finance ISA?

Yes there is an IFISA

What Are The Different Lender Products?

Funding Circle offers two auto-bid products lending on businesses and property development loans. The two products are Balanced with an annual targeted return of 6-7% and Conservative with an annual targeted return of 5-5.5% after bad debts and fees. See below for more information.

Is Auto-Investing Available?

Yes. Funding Circle offers two auto-bid options:

Balanced: Your money is deployed across all loan risk levels A+ through E which result in higher return rates but with higher defaults.

Conservative: Your money is deployed across what Funding Circle considers higher quality A+ and A loans. That should, in theory, result in very low default rates and stable projected returns.

There are no other settings on the auto-bid presenting an extremely simplified process. Just choose which product you want and off you go.![]()

How Are My Autobid Loans Allocated?

Autobid will automatically diversify your funds across available loans. A maximum of 0.5% of your portfolio will go into a single loan resulting in a more stable return. New loan parts will be no larger than £100 each. For example, if an investor had a portfolio of £100,000, no more than £500 would be deployed into a single loan and that £500 would be split into £100 pieces.

How Much Interest Does Funding Circle Pay Lenders?

Target advertised rates are 4.5% – 6.5% per year p.a. for the Balanced product and 4.3% – 4.7% per year for the Conservative product. This estimated return is after bad debts and fees but before tax.

Is Interest Paid Immediately Or When Loans Begin?

Interest will be accrued once your money is deployed.

When Is Interest Paid?

Interest payments are staggered throughout the month.

What Are The Fees?

1% Annual Service Fee. This fee is not 1% of your interest but rather 1% of the remaining loan balance on each loan. This fee is actually quite hefty and for me has been over 10% of interest received. See my Thumbs Down Section for more.

How Long Are The Loans?

Most loans are 5 to 60 months but some loans may redeem earlier.

Is There A Secondary Market To Buy, Sell And Exit Loans?

Yes. You decide how much of your loan portfolio you want to sell and Funding Circle will do the rest. Exiting is free of charge which is a great benefit to lenders and there are no premiums and or discounts. I tested the resale market in December 2018 and was able to exit within five days. In June 2019, I retested the market and exit had increased to 144 days.

Funding Circle has an annoying policy stating that if your loans do not sell after 120 days, your loan sale will be cancelled and you will have to place your loans back on the resale market. This means you would be placed at the back of the loan sale queue. Thankfully this policy has been suspended until further notice.

Exiting is all based upon supply and demand and is never guaranteed.

What Types Of Securities Do Funding Circle Loan Against?

Most Funding Circle peer to peer lending loans are unsecured (other than personal guarantees). In April 2017, Funding Circle discontinued offering property development loans choosing solely to focus on lending to small businesses with an average of nine years trading history and six employees.

What Are The Reported Loan Bad Debt Rates

Funding Circle no longer publishes its default or bad debt statistics.

Am I Lending To Funding Circle Or Directly To Borrowers?

All loan contracts are between lenders and borrowers.

What Happens if Funding Circle Goes Out Of Business?

Funding Circle might be in the “too big to fail” category but if it were to fail, the FCA (Financial Conduct Authority) requires Funding Circle to have a wind-down procedure in place. This procedure includes a backup servicing arrangement whereby a provider would manage Funding Circle’s loan portfolio in order to collect and disburse loan payments. The provider is authorised by the HMRC as an ISA Manager and would take over the administration of the ISA accounts.

All unlent investor money is held in segregated Barclays and Natwest accounts. These funds are ring-fenced from creditors.

An administration company would work on behalf of the creditors (people owed money by Loanpad) and customers (loan borrowers) to recover as much money as possible. It’s important to know that we (peer to peer lenders) are not considered creditors.

If Funding Circle were to fail, I think the recovery of lenders’ capital could be small. Many of Funding Circle’s loans are unsecured by assets so recovery would be based on borrower personal guarantees which would be difficult to collect on. Also, Funding’s Circle’s loan book is large, so administration fees would be expensive.

In reality, a Funding Circle company failure would result in many unknowns. This is all part of the risk of peer to peer lending. As with any investment, be aware that your capital is at risk.

You can read more about Funding Circle’s wind-down policy here.

THUMBS UP FOR FUNDING CIRCLE:

Track Record & Growth History

The riskiest part of peer to peer lending is the unknown aftermath due to company failure. Some financial “experts” have deemed peer to peer lending riskier than loaning cash to your Uncle Ricky for his latest Internet start-up venture. But I view generally view peer to peer lending in a positive light, as long as you diversify and spread your money across multiple companies and loans.

Funding Circle is one of the older dogs in the peer to peer lending kennel and has loaned over £10 billion globally since 2010 and has operations in the UK, USA, The Netherlands, and Germany.

Deposits, Payments & Withdrawals

Deposits are made via Debit card transfer and show instantly. Withdrawal payments take 2-3 business days. Since you’re smart and will be owning 100+ loan parts, you’ll receive interest and capital payments frequently. If a business is late making a payment, it will show on your summary screen:

The Changes

Sometimes peer to peer companies make drastic changes, sometimes good, sometimes bad. Funding Circle made some big changes in 2017.

Here’s what changed:

- No more manual investing in loans

- Two auto-bid products, Balanced and Conservative

- No more than 0.5% of your portfolio will be lent to one business (£20 per loan min)

- Loan parts will be no larger than £100 making them easy to resell

- No more secondary market fees for reselling loan parts

The changes meant all lenders became equal and there are no more people manually snapping up the high-interest D and E loans in seconds and then using the secondary market to flip them for a profit.

The changes proposed fair returns for those who don’t take or have the time to research each business. Inability to correctly research businesses sometimes ended in lenders buying poorly performing loans that resulted in lower returns. The changes and usage of auto-bids meant instant diversification where lenders own small chunks of many loans. This is the same way companies like Landbay, Zopa etc.

The changes meant no more exit charges and an ISA introduction.

Manual investors and people who use automated systems to buy the highest interest rate D and E loans will be upset and will exit because their return rates will plummet. People like myself who don’t have access to higher rate loans because they sell in an instant will be happy that Funding Circle has presented a fairer system.

The big question. Did the changes affect returns? Depends on who you ask. My returns have remained stable while some Financial Thing readers have claimed their returns have fallen drastically while others haven’t seen a difference.

Most Loans Amortize

This means you receive interest and principal payments monthly. Each principle payment you receive on a loan reduces your loan exposure. The loans that are interest-only are clearly marked (usually the property development loans).

THUMBS DOWN FOR FUNDING CIRCLE:

Lower Interest Return Rates

Keeping in mind most loans are unsecured and that Funding Circle deducts 1% from each borrower repayment, return rates are on the low side.

Loan Sales Can Take Months

I’ve been receiving a higher than normal amount of emails from readers telling me exiting loans is taking months.

This lack of liquidty has been caused by Covid-19 and unlikely to change anytime soon. This suggests that investor demand is declining and loan supply is increasing. I tested the resale market on June 3rd, 2019 and the sale was completed on October 14th, 2019 meaning the sale took 144 days total.

Selling Loans Fee

If you want to sell you’ll pay a 1.25% transfer payment. Essentially the buyer of your loans receives a 1.25% discount. This payment is designed to increase buyer motivation so the secondary market can become more liquid.

This extra cost will surely allow people wanting to exit, especially those who have large portfolios and were used to paying zero costs for selling.

High Fees

While Funding Circle advertises their fees as only being 1%, this fee is 1% of the remaining loan balance on each loan. For example, let’s say a loan is £20 and 50p of capital and interest is repaid each month for a year, the fees would actually be £2.07 or 10.35%. While this fee isn’t taken directly from your interest, it is taken in the form of loan costs, therefore reducing investors’ returns.

Throughout my total interest received since June 2015, I’ve paid 12.37% in fees! That’s a hefty sum.

Limited Default Statistics Or Loan Book Download

Funding Circle used to be one of the most transparent peer to peer companies but in mid-2018, detailed default statistics and loan book download features were removed. I presume this decision had something to do with the share flotation but for investors, this lack of transparency is negative and a decision I disliked so much, I drastically reduced my investment through Funding Circle.

Now Funding Circle has a statistics page which shows limited default information.

Low Recovery Results On My Defaulted Loans

Since most of Funding Circle’s loans are unsecured, low default recovery is to be expected. Between 2017 and 2018 only 2.48% of my bad debt amount had been recovered. My total default recovery amount now stands at 21.17%.

I imagine these numbers will decrease because of loans than in trouble due to Covid-19.

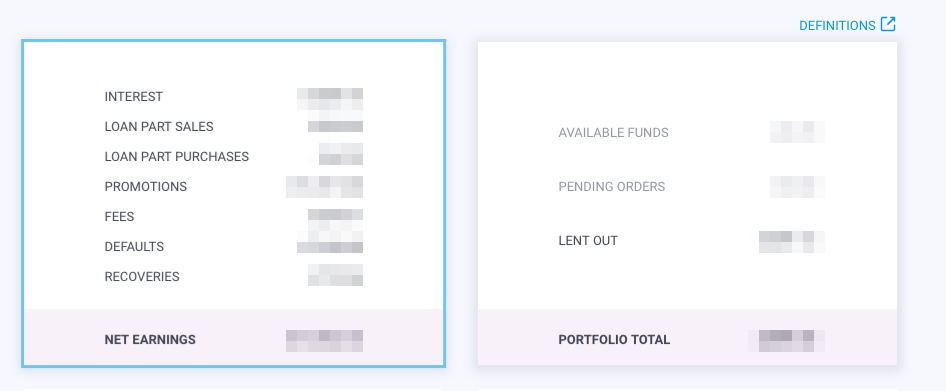

Investor Dashboard

Usually, I’m all for simplicity but Funding Circle redesigned their investor dashboard and I think it’s complicated and difficult to understand:

You can click on either of the larger blocks for a more detailed look:

Personally, I’m not a fan of the redesign.

Personally, I’m not a fan of the redesign.

Most Loans Are Unsecured

Loans other than property development loans are unsecured which means if a company defaults, the chance of money recovery could be lower. This is why it’s so important to diversify across many loans. Funding Circle recommends you don’t invest more than 1% of your total balance into any single company and that you hold at least 100 loans.

Idle Funds Can Lead To Cash Drag (Returns Lost To Uninvested Money)

As I experienced, idle funds lead to a reduction in estimated returns. This happens when lender supply is greater than borrower demand. Since Funding Circle only offers autobid products, there is no way to manually invest this idle money into loans.

My Strategy

I stopped manual investing with Funding Circle in 2015 but I reinvested when manual investing was abolished in favour of their auto-investing feature. Manual investing was simply too time-consuming which is why I exited in the first place.

After reinvesting and trying the Balanced product, I once again exited. Two issues recently led me to reduce my investment through Funding Circle. Firstly, the removal of the default statistics and loan book download feature and secondly, the lack of bad debt recovery.

Funding Circle’s recent shares plummeted due to growth warnings. I believe the original share price offering was extremely overvalued. The share price was 440p in December 2018 and is now 76p as of November 2020.

I don’t any advantages to investing through Funding Circle, especially when the fees are so high and liquidity is so low. There are better options within the peer to peer lending sector.

Funding Circle Review Conclusion

Having lent over £10 billion globally, Funding Circle is a giant in the peer to peer funding world, plus it’s a well-funded company that has been growing year to year.

That being said, my frustrations have led me to reduce my investment to a minimum. I dislike the lack of default statistics and transparency, the high fees and the long exit times for selling loans (remember that exiting a peer to peer investment is never guaranteed).

With the addition of the 1.25% loan transfer payment, selling will add to the already hefty fees.

I believe Funding Circle will eventually pivot away form retail peer to peer lending focusing more on institutional investors such as banks and investment companies to fund their loan book.

For those wanting to try Funding Circle, their ISA will help lenders to achieve higher tax-free returns. Just remember, exiting is never guaranteed.

Thanks for reading my Funding Circle review.

Sign up and lend £2,000 to receive a £50 Amazon gift card. (Read the terms and conditions on the signup page. When you open an account through my website, it helps me to continue to operate and offer new reviews.)

Disclaimers: I’m not paid to write this Funding Circle review nor am I employed by any of the companies I write about. In most cases, I have invested or continue to invest my own money through these companies. The sign-up links contained in this website are referral links. When you sign up for an account through my website, I receive a referral fee directly from the companies, at no cost to you. Your support enables me to continue to operate the Financial Thing website. You can read more about my referral links and banner advertising here.

** This Funding Circle review is for information purposes only. This information is not financial advice and has been prepared without taking into account your objectives, financial situation or needs. You should consider its appropriateness for your circumstances. All investing carries risks. Opinions expressed in this Funding Circle review are current opinions based on my own personal experiences. The FSCS does not cover peer to peer lending and your capital is at risk. Please don’t invest more than you can afford to lose. **