Landbay Peer To Peer Lending Review

** Landbay review updated December 5th, 2019 **

Landbay was a peer to peer lending site developed around simplicity, safety, and ease of use. Investors’ money was lent to experienced Buy to Let landlords whose tenanted houses had lower loan to values (70% LTV average) and rental coverages at a minimum of 125% of the mortgage payment. I continue to happily lend through Landbay.

On December 5th, 2019, Landbay suddenly announced they were closing down their retail peer to peer lending to new and existing investors. This move was to focus on institutional money which makes up over 90% of Landbay’s portfolio.

My November 2019 Investment: Unchanged

My annual rate of return: 3.98% (After fees but before taxes)

[table “11” not found /]* This opinion risk factors in loan types, interest returns, company history, default numbers, and my own investing experience. Risk rating explained here.

How Do I Sign Up?

As of December 5th, 2019, Landbay will no longer offer retail peer to peer lending. New investors will no longer be accepted and existing investors funds were returned to their accounts.

Landbay Review: What You Needed To Know

Pros

- Safer peer to peer lending option

- Loans secured by buy-to-let property owned by experienced landlords

- ISA available

- Interest accrues instantly upon investment, even if your money was in the queue

- Zero defaults

- Possible exit depending on demand

- Very easy to use / set and forget with auto-reinvestment

- Received a £1 billion institutional credit line for growth

- You can choose to reinvest capital, interest or both

- Lending agreements directly with borrowers

Cons

- Lower risk = lower return rates

- Rates had been falling

- Secondary market exit has become slower

- No way to see what loans your money was invested in

- All property, no sector diversification

I liked Landbay as it was simple, very boring and relatively safe. Zero defaults and monthly paid interest on time. I chose between two lending options and that was that. Providing there were loans available, my money was invested quickly and started earning interest immediately. Even my your money was in the queue, I still received interest in the form of cashback.

I viewed Landbay to be one of the safest peer to peer lending options and was willing to accept their lower returns as part of my diversified portfolio. Landbay’s full loan book was very transparent and could be downloaded. The loan information showed how much interest borrowers were paying on each loan and how many payments had been missed.

Read on for my exclusive Landbay review.

Equivalent Competitors

Landbay: My experiences so far….

I had been investing in Landbay loans since September 2015. It was such an easy set and forget website. I deposited money, chose the instant access Tracker product, selected interest reinvestment and received monthly interest payments.

Interest rates were on the lowest side of peer to peer lending but this was because the risk was so low. Interest was still even paid on queued funds in the form of cashback.

I visited Landbay’s offices in January 2019 and was impressed with their operations. Aside from the selling times sometimes being slower than I’d like, all in all, my investing experiences were great through Landbay.

When Did Landbay Launch?

April 2014

Were They Regulated?

Yes, by the Financial Conduct Authority #719626 under full permissions granted December 22nd, 2016. Investments made through Landbay were not covered under the FSCS (Financial Services Compensation Scheme).

FCA regulation was nothing like the FSCS, which covers consumers when they deposit money in banks. The FCA reports to the UK government and has the ability to pursue criminal action against companies that violate its standards and codes of conduct.

Was An Innovative Finance ISA Available?

Yes and the minimum investment was £5,000

How Much Annualised Interest Could Landbay Lenders Expect?

(December 2019 rates)

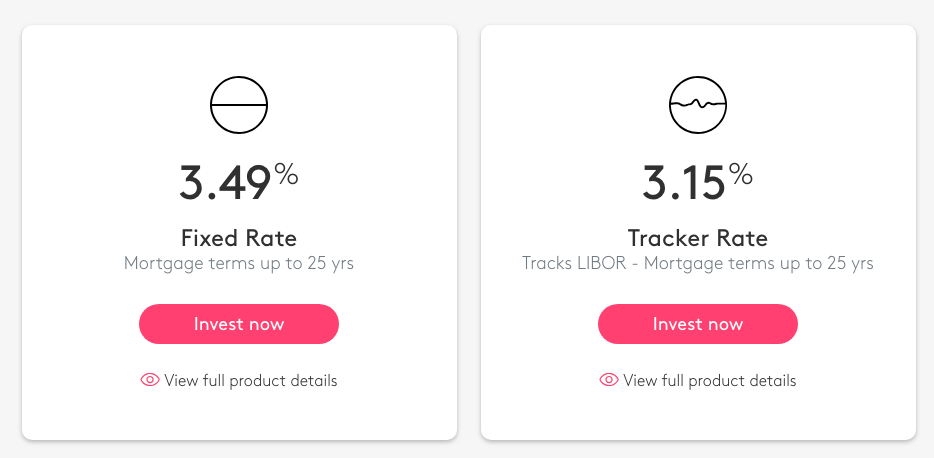

Tracker Rate For New Investments: 3.19% (with reinvested repayments)

Three Year Fixed Rate: 3.49% (with reinvested repayments)

Did Interest Accrue Immediately?

Interest accrued within 24 hours of deposit receipt providing loans were available. Even if your money was sitting in the queue, interest accrued but was paid in the form of monthly cashback.

What Were the Loan Default Rates?

From 2014 to December 2019, Landbay’s defaults stood at 0.00%. This isn’t too surprising since their lending criteria were some of the strictest in the peer to peer lending space. Landbay’s expected default rate was only 0.10%. You can see current statistics here.

What Were The Fees?

There was a 0.2% exit fee on the Fixed Rate product.

What Security Did Landbay Use?

Tenanted houses and flats secured all loans. Loan-to-values averaged 70%.

Was There A Secondary Market?

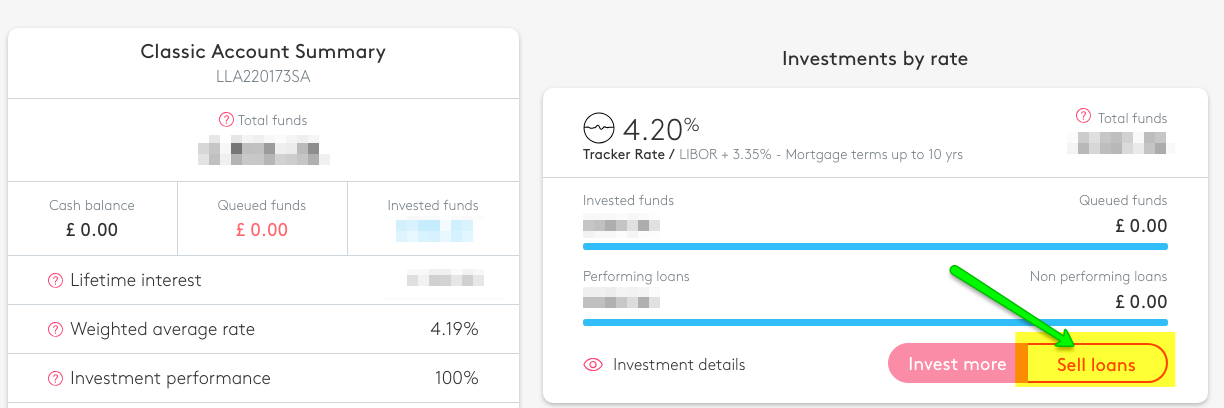

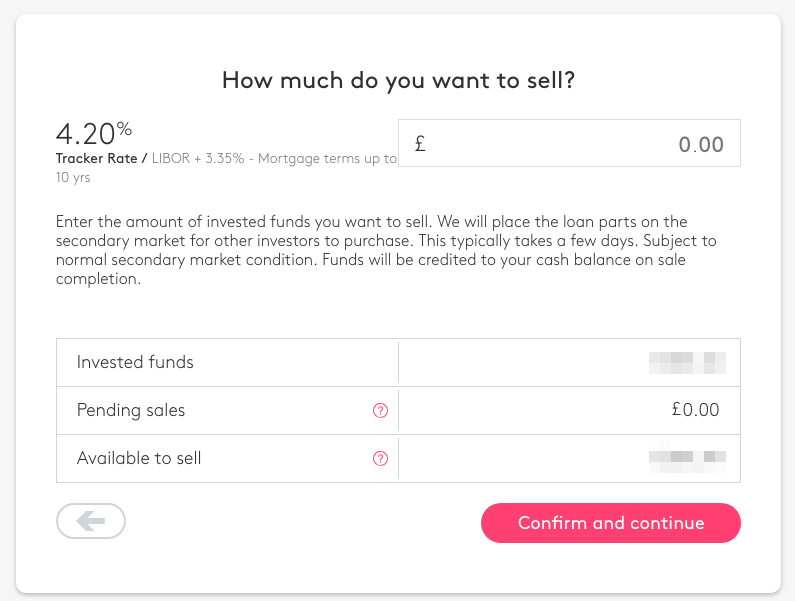

Yes. The Tracker product offered an exit provided there were funds available from other investors to purchase your loans. Just click on the Sell Loans button located in the investor dashboard:

Was There A Provision Fund?

Yes. As of December 2019, it was 0.6% of the total outstanding loans.

Was I Lending To Landbay The Platform Or To Borrowers?

Borrowers

What Would Have Happened If Landbay Went Out Of Business?

Landbay was required by the FCA (Financial Conduct Authority) to have a sufficient wind-down plan in place. Any uninvested lender funds were held in separately protected bank accounts.

Landbay didn’t provide detailed wind-up information other than stating that a Security Trustee and third-party loan Administrator exist to manage the loan book should Landbay cease trading.

Winding down a loan book involves fees taken from any recovered money so lenders would likely see a loss of capital if Landbay were to close its doors. This is part of the risk of peer to peer lending.

In 2019 Landbay hired a third party company, MIAC analytics, to perform a loan book stress test to see how it would fare during a severe property downturn. The report showed Landbay would survive with flying colours.

THUMBS UP FOR LANDBAY:

Safety / Loans Secured By Property Owned By Experienced Landlords

Landbay focused their business model on reducing investors’ risk to a minimum. They accomplished this in several ways:

High-quality loan underwriting and stringent application criteria. Landlords must have no adverse credit events within the last 3 years, usually not be first time buyers and already own residential property, had a minimum of 125% rental coverage, meaning £125 of rent brought in on every £100 owed on mortgage (current average was 165%). Landbay states it does sometimes lend to first-time buyers subject to the rental coverage being 135% and the landlord having a strong local area knowledge. The landlord must had a minimum income of £30,000.

The property must be located in England or Wales in areas with strong rental demand. Each property receives an RCIS Chartered Surveyors valuation.

Mortgages must be less than 80% of the property’s value. Currently, the average was 70%.

Landbay received a large portion of its lent funds from financial institutions. Institutional money tends to indicate lower risk. tend to invest in lo

Instant Lender Returns

Lenders interest accumulated upon investment whether money was allocated to loans or sitting in the queue. This was important since Landbay sometimes experiences a slowdown in borrower loans and lending demand can be greater than loan supply. All queued funds received monthly “cashback” rather than interest since the funds weren’t lent against loans

£1 Billion Institutional Credit Line

In July 2019, Landbay signed an agreement to receive a £1 billion institutionally funded credit line to grow its mortgage loan book. While I don’t know who funded the credit line, I’ll surmise that this funding pledge shows immense confidence from the funder towards Landbay’s business model.

This was a contributing facotr to why Landbay closed its retail peer to peer lending to focus on the much larger institutional side of their business.

ISA

Landbay offered an ISA and the minimum investment was £5,000.

Zero Defaults

As of December 2019, default rates were 0%. Landbay offers landlords up to 30 year fixed-rate mortgages at very reasonable interest rates (4-5.5%). Unlike other peer to peer lenders offering high-interest rate loans, sometimes up to 20%, Landbay’s low-interest rates kept defaults to a minimum.

Reserve Fund

Landbay had a reserve fund funded from borrower fees that was 0.6% of outstanding peer to peer loans. Reserve funds provided an extra layer of security to cover shortfalls in case of any defaults.

Capital And Interest Repayments Could Be Automatically Reinvested

In the past, when a loan matured or repaid early Landbay didn’t offer a way to reinvest capital. Landbay introduced investors the ability to reinvest both repaid capital and interest.

Payments

Interest payments were credited promptly on the last day of each month.

The Website

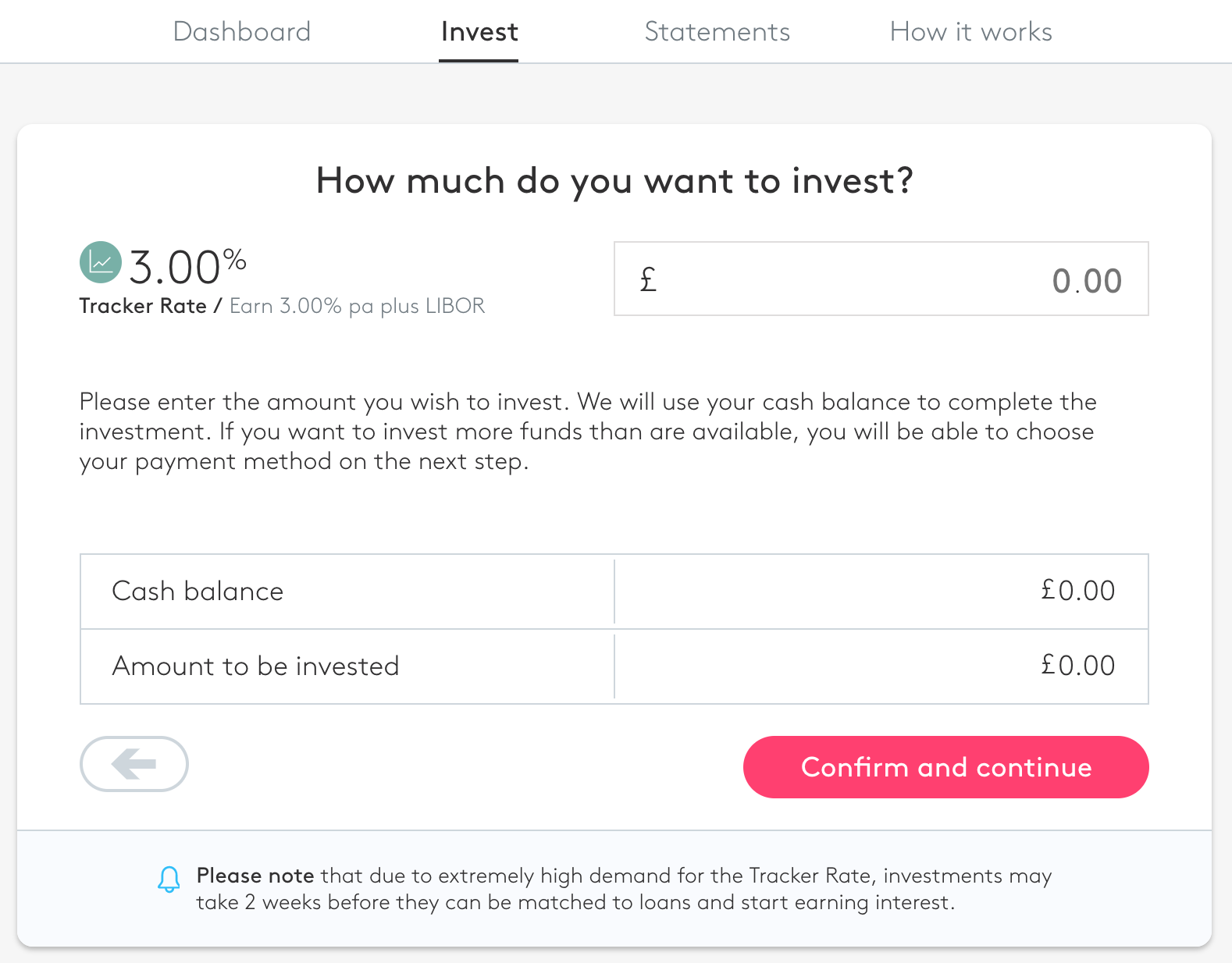

Landbay offered one of the easiest websites to use in peer to peer lending. Here was the Portfolio dashboard that showed you how much of your money was invested and how much was in the queue:

And the page where you selected your investment product and amount:

THUMBS DOWN FOR LANDBAY:

Lower Risk = Lower Return Rates

Rates had been consistently falling from the 4.15% rate I was able to obtain when I began investing through Landbay. Landbay’s rates ended in the mid to low 3% range which was lower than all other peer to peer companies but better than savings accounts.

In fairness, you did had to factor in safety and I considered Landbay to be a fairly safe place to park your money.

No Information To Show Which Loans Your Money Was Invested Into

Landbay’s loan book contained several hundred mortgages (including institutional) and while it states that investors funds were invested in “multiple mortgages”, the website didn’t show how many or which loans your money was invested in.

Slower Exit Via The Secondary Market

When I began investing in Landbay, exiting an investing happened in a matter of minutes. As interest return rates fell, it took more time for loans to sell on the secondary market. My last sale in April 2019 took 13 days, better than the 48 days in October 2018

Exiting was never guaranteed and was always based on supply and demand.

Reserve Fund

Landbay’s Reserve Fund was used to cover shortfalls in default recoveries (which never occurred). This meant if Landbay recovered a defaulted property and sold it and the amount recovered was less than the loan value, the Fund could have been used to cover the shortfall. The Reserve Fund was discretionary meaning Landbay decides whether or not to use the fund.

Having a fund like this reduced lender returns because the provision fund money was stored rather than paid out to lenders in the form of increased returns. The reserve fund was only 0.6% of the total loan book equating to just over £1m on a loan book of £170m. This Fund could have been easily wiped out by a few bad loans, especially considering Landbay has several £1 million+ single loans on its books. Thankfully none of Landbay’s loans defaulted so it wasn’t an issue.

Landbay’s Reserve Fund was once used to pay some of my monthly interest while zero properties were being shown as being in default. For those who had noticed similar occurrences, I reached out to Landbay who sent a prompt explanation:

“We recently updated our Tracker Rate on the 1st of October 2018, in line with the new LIBOR rate and therefore interest rates had gone up. The confusion took place because some of our borrowers had set up standing orders for their monthly repayments and because they haven’t updated the amount they were due to pay, some of them had partial repayments as they were missing £10-200 of their payment.

We considered this to be an isolated event and decided to cover the missing amounts of borrowers from the reserve fund such that all investors can receive their interest payments on time and at the right amount. The borrowers with partial repayments had already been informed about their repayment status and the majority had already covered the difference and updated their standing orders for future repayments.

Please extend our apologies to your readers for the confusion created and please assure them that everything was going well at Landbay and there was nothing for them to worry about. Our loans were as strong as always!”

My Strategy

Landbay was a set-and-forget investment platform so there wasn’t any investment strategy needed. The only decisions to make were whether you wanted the access Tracker Rate or the Fixed Rate, and whether to reinvest interest. I chose the Tracker Rate with reinvestment for easy access. Despite a drop in interest rates, I continued to leave money in Landbay as I consider it a part of my overall diversification.

Landbay Conclusion

When Landbay announced it was closing its doors to retail investors so it could focus on lending using it institutional money, I was disappointed. Investors’ weren’t given any notice and all funds were returned to the holding account ready for withdrawing.

Landbay was easy to use, relatively safe and stable. I consider it to be one the safer peer to peer platforms as it receives large institutional money investments. Landbay was backed by an experienced management team and offers landlords low fixed interest rate loans for up to 10 years.

Landbay delivered exactly as promised, a decent return rate for low risk. I’m sad to see them exit the peer to peer lending market.

As of December 5th, 2019, Landbay will no longer offer retail peer to peer lending. New investors will no longer be accepted and existing investors will see their funds returned to their accounts.

If you enjoyed my Landbay review and want to learn more about peer to peer lending, click here and receive my complimentary Top 5 Peer to Peer Lending Sites Report.

I love feedback, so if you find any errors or omissions or had any improvement suggestions, I invite you to contact me and be a part of contributing to this website.

Disclaimers: I had not paid to write my reviews and I’m not employed by any of the companies I write about. In most cases, I had invested or continue to invest my own money through these companies. In order to keep the website financially viable, the sign-up links on this website were referral links and I do accept advertising in the form of banner ads. This advertising in no way influences my reviews and opinions. When you sign up for an account through my website, in some cases I receive a referral fee directly from the companies, at no cost to you. Your support enables me to continue to operate the Financial Thing website. You can read more about my referral links and banner advertising here.

** This Landbay review was for information purposes only. This information was not financial advice and has been prepared without taking your objectives, financial situation or needs into account. You should consider its appropriateness for your circumstances. All investing carries risks. Opinions expressed in this review were opinions based on my own personal experiences. The FSCS does not cover peer to peer lending and your capital was at risk. Please don’t invest more than you can afford to lose. **