As we bid farewell to 2018 and the stock market continues to move up and down, I continue to read news story after story about how actively managed Unit Trusts and Mutual Funds are the best bet during volatility. I believe these claims are unfounded and purely financial market panic rhetoric designed to have you running to your financial advisor.

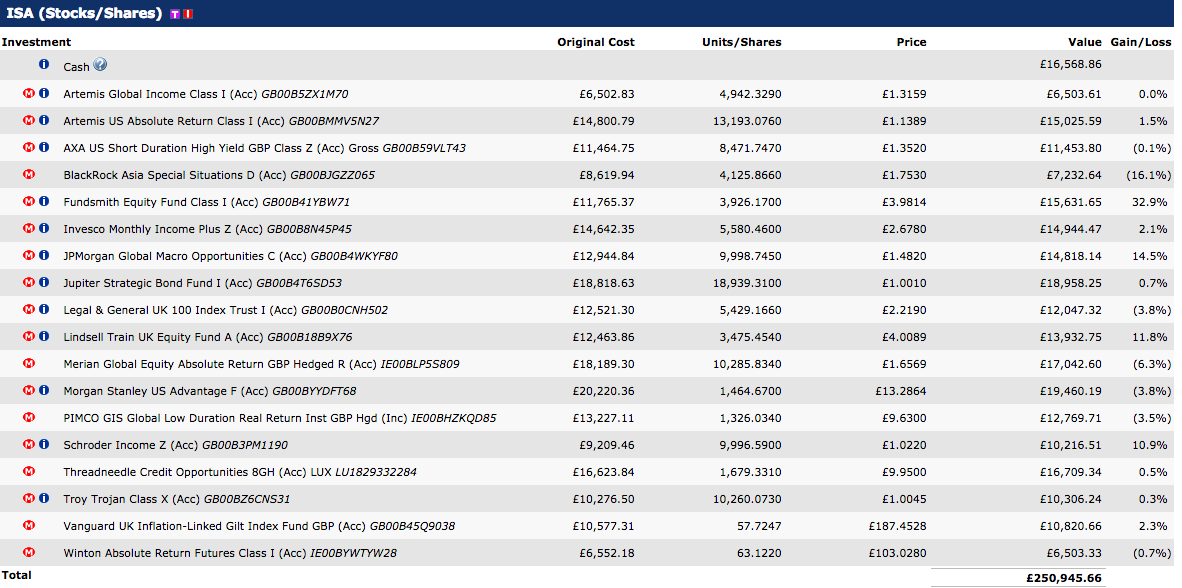

A Financial Thing reader recently sent me their actively managed ISA portfolio which had been strategically constructed by an experienced local financial advising company. The portfolio is set for medium risk. The reader asked my thoughts and generously agreed to let me post his portfolio:

The reader opened their account in July 2016 with a starting balance of £244,645.00. On November 20th, 2018, the fund was valued at £250,945.00. The total return on the portfolio represents 2.57%. Funnily enough, this is about the same return a cash ISA would have produced with almost no risk.

The reader was confused about why the portfolio had performed so poorly. Firstly the advisor’s fees (1% per year), the platform fee (0.35% per year) and the managed fund fees (0.10% – 2% per year) are dragging the returns down. Secondly, a portfolio made up of so many funds has little chance of succeeding because financial advisors don’t know which funds are going to do well and which will underperform. If they did, the advisor could have plonked all the money into Fundsmith, steered clear of the Blackrock fund, bought a government bond fund and called it a day. Of course, this didn’t happen.

This portfolio example is exactly why I fired my financial advisor years ago and put all my funds into the Vanguard US Equity Tracker Fund. More and more funds are being poured into index trackers as people learn they don’t need a financial advisor to invest. Index trackers increase your returns due to their lower fees and lower fund holding turnover, resulting in lower taxes. Plus a DIY investors can save at least 0.5% in fees from your financial advisor. I estimate that most people can save between 1.5 – 2.5% in fees annually.

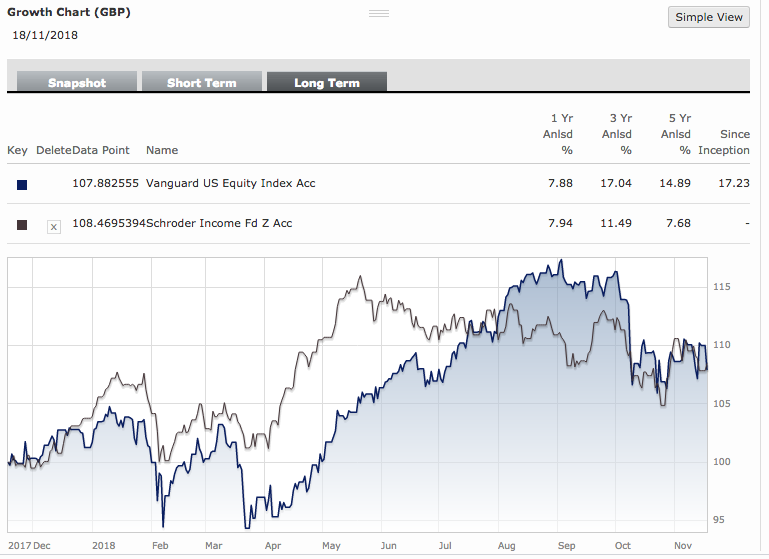

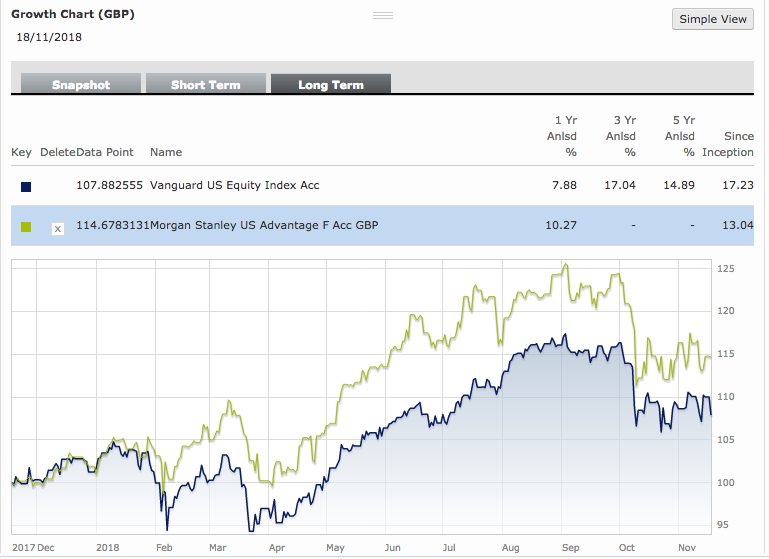

Just so you understand how hit and miss actively managed funds can be, I wanted to compare a few of the active equity or stock funds from my reader’s portfolio against my Vanguard US Equity Tracker. The charts mostly show years one, three and five year results and since inception returns.

In my comparisons, I put five active equity funds up against my Vanguard Tracker assuming a £25,000 stake over 10 years where all funds return 8% annually. I list the actively managed funds’ showing the loss of returns because of the added actively managed fund fees.

I also list the active funds’ fee and the advisor and platform fee as a Total Annual Fee. (When you invest yourself, you remove these advising fees adding to your total returns).

Schroder Fund Annual Fee: 0.91%, Advisor Fee: 1.35%. TOTAL ANNUAL FEE: 2.26%

Vanguard US Equity Tracker Fee: 0.25%

Vanguard Annual Fee Savings: 2.01%

Schroder return: £45,439 (8% – 2.01% fee = 5.99% annual return)

Vanguard return: £55,491 (8% annual return)

Lost returns: -£10,022

2. BlackRock Asia Special Situations D (Acc)

Blackrock Fund Annual Fee: 0.96%, Advisor Fee: 1.35%. TOTAL ANNUAL FEE: 2.31%

Vanguard US Equity Tracker Fee: 0.25%

Vanguard Annual Fee Savings: 2.06%

Blackrock return: £44,103 (8% – 2.06% fee = 5.94% annual return)

Vanguard return: £55,491 (8% annual return)

Lost returns: -£11,388

3. Morgan Stanley US Advantage F (Acc)

Morgan Stanley Fund Annual Fee: 0.55%, Advisor Fee: 1.35%. TOTAL ANNUAL FEE: 1.90%

Vanguard US Equity Tracker Fee: 0.25%

Vanguard Annual Fee Savings: 1.65%

Morgan Stanley return: £47,096 (8% – 1.65% fee = 6.35% annual return)

Vanguard return: £55,491 (8% annual return)

Lost returns: -£8,395

4. Artemis Global Income Fund I (Acc)

Artemis Fund Annual Fee: 0.80%, Advisor Fee: 1.35%. TOTAL ANNUAL FEE: 2.15%

Vanguard US Equity Tracker Fee: 0.25%

Vanguard Annual Fee Savings: 1.90%

Artemis return: £45,939 (8% – 1.9% fee = 6.1% annual return)

Vanguard return: £55,491 (8% annual return)

Lost returns: -£9,552

5. Fundsmith Equity Fund Class I (Acc)

Fundsmith Fund Annual Fee: 0.95%, Advisor Fee: 1.35%. TOTAL ANNUAL FEE: 2.30%

Vanguard US Equity Tracker Fee: 0.25%

Vanguard Annual Fee Savings: 2.05%

Fundsmith return: £45,259 (8% – 2.05% fee = 5.95% annual return)

Vanguard return: £55,491 (8% annual return)

Lost returns: -£10,232

Conclusion

The reader’s portfolio suffers from the same issues every financial advisor’s portfolio suffers from, high fees and a lack of being able to predict the future. Out of 8 equity funds in the reader’s portfolio, only four funds produced good results over a 1 one year period while four funds lost money.

From the above charts, Fundsmith is the only fund that has managed to outperform the Vanguard US Equity tracker, and only by 1.19% since inception. Since the Fundsmith fund has only existed since 2010, it’s very long-term results are undetermined but I would expect it to underperform the tracker over a longer time period.

High fees and fund charges can cripple returns long-term. The Invesco and Troy funds have a 5% initial charge entry charge while the Merian fund has a whopping 2% annual management fee. Oh, and the Merian fund lost the reader 6.8% over the year.

Being able to know which of the actively managed funds will produce consistently positive returns through the decades is an impossible task. This is why I believe actively managed fund portfolios are outdated and flawed concepts, hence the investor exodus to low fee passive tracker funds.

The argument that actively managed funds are the place to put your money in times of stock market volatility is mainly rubbish. If you truly believe that, look at how actively managed equity funds performed during the stock market correction of 2008.

After reading this enlightening book and researching the low-cost power of passive investing, I moved all of my investments into passive index trackers and the results have been as expected. If you would like to learn more about why I like index trackers, click here.

I love feedback, so if you find any errors or omissions or have any website improvement suggestions, I invite you to contact me and be a part of contributing to this website.

Disclaimer: This article is for information purposes only and should not be regarded as investment advice. Opinions expressed are my opinions based on my own personal experiences, investing my own money. Never invest in anything you don’t understand. It’s your money and you worked hard for it.