Lendy Enters Administration – My Thoughts

** Updated August 2nd, 2021 **

On May 24th, 2019, Lendy’s administration was announced. It was widely known that Lendy was experiencing issues so I wasn’t too shocked by this news. I was, however, disappointed to learn of Lendy’s questionable actions. I never like to see businesses fail and it’s an unfortunate incident that highlights the importance of investment diversification. Lendy’s failure is also a black mark on the FCA regulatory process.

I highly recommend all Lendy investors join the Lendy Action Group.

- Investors can join the Lendy Action Group here. and the Facebook group here. This group is not affiliated with Financial Thing or Lendy but will be helpful in providing information and support during Lendy’s administration. The Group is being legally represented to fight for investors’ rights against the waterfall clause that was included in Lendy’s Terms & Conditions.

Here is the administrator’s information:

Administrators: RSM Restructuring Advisory LLP

Contact: Damian Webb / Phillip Sykes

Tel: 020 3858 9653

Email: lendy.restructuring@rsmuk.com

https://rsm.insolvencypoint.com/?case_code=1084885

Latest Administration updates:

July 30th, 2021

July 16th, 2021

June 18th, 2021

May 26th, 2021

Feb 1st, 2021

January 26th, 2021

January 19th, 2021

December 9th, 2020

August 18th, 2020

June 19th, 2020

June 12th, 2020

June 5th, 2020

March 21st, 2020

February 28th, 2020

February 4th, 2020

November 29th, 2019

October 25th, 2019

August 16th, 2019

July 27th, 2019

- The damaging nature of Lendy’s “waterfall clause” Term & Condition can be seen in the February and March 2020 updates where Lendy is due over £1.2m in payments before investors are paid.

- I received my first distribution on one defaulted loan. The recovery amount was 45% of the amount owed with the possibility of future distributions. No further explanation was given. I’m receiving reports of investors receiving up to 98% of returned capital on certain loans.

- Investors must have completed the anti-money laundering process to receive any financial distributions.

- Investors should log into their accounts and make sure all personal contact information is up to date as the administrators will be validating all investors to comply with Anti Money Laundering laws.

Lendy Administration Quick Facts

Lendy’s loan book had a book value of £152m split between bridging (£36m) and development (£116m) loans.

54 total loans are live of which, 35 are either in or entering administration.

25 of the 54 loans are development loans with £116m owed and have a gross value of £265m. 14 of the 25 loans have formal insolvency proceedings against them. It is estimated investor gross recovery will be 57p out of each £ before costs.

29 of the 54 loans are bridging loans with an outstanding value of £36m secured against written gross assets of £81m. Current reported values are much lower than £81m. 22 of the 29 loans have formal insolvency proceedings against them. It is estimated investor gross recovery will be 58p out of each £ before costs.

At the date of Lendy’s administration appointment, Lendy held eight bank accounts with Barclays. A total of £904,384 was held in seven accounts. Lendy’s eighth account was its client account which totaled £2.6m in held cash.

The most damaging fact in the administration process is Lendy’s cunning Waterfall clause that was inserted into Lendy’s Terms & Conditions prior to the companies failure. The clause allows Lendy’s owner to be paid out a portion of certain recovered funds, prior to investors being paid.

For example in two recovered loans (DFL 20 & 31), out of £4.2m recovered, £1.2m is being held to pay Lendy prior to investors being paid.

This waterfall clause is being fought by legal representation via the Lendy Action Group. The administrator is holding Lendy’s proposed funds while the waterfall clause is being challenged.

What Happened To Lendy??

When I began investing through Lendy in 2015, things initially went well. But as the years passed and the loan book matured, the problems and default issues became apparent.

Investing in property development and bridging loans can be extremely high risk, but I believe Lendy’s lending practices and ownership caused its downfall through high fee generation and poor quality loan offerings. Lendy’s loans were given to the borrower at high-interest rates with high front end fees.

Before administration, Lendy was put under restrictions by the Financial Conduct Authority on its regulated activities. Lendy could not “in any way dispose of, deal with or diminish the value of any of its assets and must not in any way release client money without in either case the prior written consent of the authority.” This was the sign of Lendy’s unraveling.

I have some other feelings regarding gross mismanagement by ownership but I can’t go into details at this time. We will never know how much money Lendy withdrew from their accounts prior to entering administration.

Lendy’s failure highlights the importance of knowing who you are lending money to. FCA regulation reliance simply isn’t a good measure of a companies reliability.

I will still use peer to peer lending a place in my investment portfolio. I’m far more diligent about diversifying through different companies and loans and I never invest more than I can afford to lose.

As far as Lendy’s administrators recovering investors’ money, capital losses are inevitable for most investors who diversified across many loans. The administrator is also likely to withhold a portion of recovered funds for future claim issues and unforeseen circumstances.

My biggest concern is the legal fees that will be incurred due to a large number of defaulted loans and RSM’s administration fee which is expected to be over £1m.

Property Development Loans

Property development loans present three major issues to a peer to peer lending company.

Firstly, development building has many factors that can delay development schedules and increase costs.

Secondly, in reference to property developing, there’s no exact science to valuing something that doesn’t yet exist. Once development is completed, the value may have fallen or risen. It’s especially hard to value land. Lendy misvalued many of their loans.

Thirdly, if a development loan falls into arrears midway, going through the legal administration process can be completed. Borrowers’ can cause issues, delaying the court process which can take months or years, Once the lender takes over the property, they must either take over the development or find a buyer.

Despite a development loan being asset secured, defaults are a major pain and costly to recover.

Lendy’s loans were large in nature indicating the company took on more risk than needed and their lack of satisfactory due diligence failed investors.

Lendy: My experiences …

I have been investing through Lendy since June 2015. I knew Lendy offered higher risk loans but I was prepared to accept the extra risk for the higher return possibilities. I invested in various loans but as time passed the defaults mounted, my return rate dropped significantly. Ultimately I still had invested funds within some of Lendy’s loans when the company failed.

Let’s Address The Defaults

If you are Lendy investor, you will know about the defaulted loans. Most lenders’ are feeling disgruntled and rightfully so.

Property defaults are always concerning for peer to peer lenders’ as recovery can be complicated, expensive and lengthy and can sometimes result in a loss of capital and interest. Was I concerned about the defaults? Yes. I’ve been watching the Lendy situation for a long time and I was told by Lendy insiders these defaults were being appropriately handled. This was obviously untrue.

After one of the largest loans on Lendy ran into difficulties, my faith in Lendy began to diminish. I realised that Lendy had offered some low-quality loans in an effort to maintain its advertised 12% per year return rates to continue to please its customer base who were hungry for more loan offerings.

The way security charges were written Lendy and Saving Stream were beneficiaries giving them partial financial benefit in the event of default recovery. This is problematic during the wind-down procedure as Lendy will still receive financial compensation leaving lenders with even fewer recovery compensation.

I have read the many negative online comments written by some of Lendy’s lenders. Some lenders were unhappy with certain loan offerings and the RICS valuations provided while others had miscalculated the risk and built up unreasonable expectations of peer to peer property bridging loans as a whole. The golden early days of 12% annual returns have passed as loan books mature and the true risks of high-interest bridging financing come to light.

When I began investing property-backed bridging loans, I knew the risk. High-interest borrowers usually can’t qualify for standard bank loans so peer to peer lending is a good alternative for them. I always remember that high-risk borrowers are high-risk for a reason. Usually, it is either they have no credible development history or have a black market on their previous credit history.

As a peer to peer lender, I have to take personal responsibility where I place my money and I always have a choice where to invest. While I hope all the information presented to me is true, I know there’s a possibility of misinformation and poor management and due diligence.

I am disappointed that Lendy underwrote so many nonperforming loans, many of Lendy’s loans I purchased were early in my peer to peer lending experience and I was wrong about some of the loans I invested in and about Lendy itself. I expected Lendy to do its due diligence in order to protect my interests but they failed investors’ in that respect.

Sometimes it isn’t possible to know whether the RICS valuations are accurate so it’s important to invest through companies that have good track records offering loans with sensible valuations.

I was also disappointed to learn that Lendy used their Provision Fund as security to obtain working capital. Basically, this means Lendy borrowed money against their Provision Fund to keep the company running. Provision Funds, while discretionary, are usually free-standing funds used to cover late payments or defaulted interest. I found the practice of borrowing against this asset troubling.

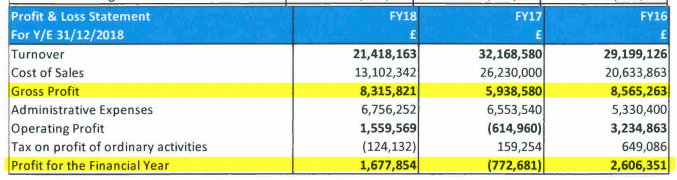

What’s amazing is the huge amount of profit Lendy was able to generate in the years 2016 and 2018.

Where did all of this money go? I believe we will find out through the administration and possible FCA investigation.

What I missed as a lender was the securitisation of some of the loans giving Lendy recovery compensation, a legal loophole that will be costly to lenders.

The most sickening part of the Lendy debacle is the Waterfall clause buried inside Lendy’s Terms & Conditions. This clause allows Lendy to be paid a portion of any recovered funds prior to investors. If investors knew about this clause, I’m sure none would have remained invested through Lendy. I certainly wouldn’t. The Lendy Action Group is legally challenging RSM (Lendy’s administrator) regarding this clause. I expect this administration to drag on and become more costly.

Prior to Lendy’s administration, many of the executive staff and board members left the company including COO’s Robert Kelly and David Gammon, Communications Office Paul Riddell and CFO Paul Thompson.

Lendy became a victim of their own accelerated growth. Lendy’s large profits were unusual for a startup peer to peer company. This profit came from high fees paid by high-risk borrowers. Lendy also selfishly protected the owners through company failure.

Successful Repayments And Default Recoveries

Loan DFL008: 100% of the £9,857,594 loan amount was repaid on December 13th, 2018 after the loan was two months past due.

DFL027: 100% of the £3,448,289 loan was repaid on December 6th, 2018 after the loan was two months past due.

PBL120: 100% of the £651,886 loan was repaid on May 24th, 2018 after the loan became late in 2017.

Less Successful Default And Repayment Recoveries

Loan PBL001: This £5.98m loan became past due in July 2017 and receivers were appointed in September 2017. As of December 2018, the loan remains unrecovered.

DFL004: This £14.3m defaulted loan ran into issues in mid-2018. The loan remains unrecovered but is now in administration.

PBL017: This £7.45m loan ran into trouble in September 2017 and was appointed a receiver. As of December 2018, the loan remains unrecovered.

Laon DFL020: £2.65m was recovered in administration but only £1.75m was paid out to investors. The rest went to fees and Lendy’s waterfall clause.

Loan DFL031: £1.65m was recovered in administration but only £1.05m was paid out to investors. The rest went to fees and Lendy’s waterfall clause.

In case you missed it, I interviewed Lendy’s founder CEO Liam Brooke and Paul Riddell. You can watch the interview here.

What Was Lendy?

Lendy was a peer to peer lending company that offers secured property bridging and development loans. A bridging loan is a short-term loan given to a property developer while they attempt to refinance while development loans are longer given to complete work whilst refinancing is sought.

Bridging and development loans are common in the real estate investment world. All Lendy loans were secured by the property or land being loaned against, In the event of a loan default, Lendy attempted to sell the security in order to cover lenders’ capital and interest.

When Did Lendy Launch?

January 2013

Were They Regulated?

Yes, by the Financial Conduct Authority #622666 under full permissions. Investments made through Lendy are not covered under the FSCS (Financial Services Compensation Scheme). FCA regulation is nothing like the FSCS, which covers consumers when they deposit money in banks. The FCA reports to the UK government and has the ability to pursue criminal action against companies which violate its standards and codes of conduct.

Lendy was placed under an FCA activity restriction. This restriction states Lendy wasn’t allowed to dispose of, deal with or dimish the value of any of its assets, or release any client money without the written consent of the FCA.

What Investment Products Did Lendy Offer?

Lendy offered one peer to peer lending product. Lending on bridging and development loans. Lendy Wealth was a sister company that I did not invest through.

How Much Interest Did Lendy Pay Lenders?

Most current loans paid 1% per month but return rates ranged from 9-12% per year. Lendy also paid some bonuses on loans that were past their term date or in default but most people were never paid those bonuses as the company failed. When the defaults increased, many investors found themselves receiving very little in monthly interest.

How Long Were The Loans?

3-12 months but loans were often extended.

What Security Did Lendy Loan Against?

All loans were secured against property or land. Lendy used to loan against boats and other items but they veered away from these types of loans in favor of property developments. The loan-to-value ratios on the properties and land ranged from 11-70%.

It turned out that some of the assets securing the loans were much poorer than advertised and that some valuations were inaccurate.

Wasn’t There A Provision Fund?

Yes. The discretionary fund was advertised to hold a balance equal to 2% of the entire Lendy loan book total. There were rumors that Lendy used this Fund as collateral to secure extra capital.

The provision fund was held by Lendy Provision Reserve Ltd which also entered administration. The status of the fund won’t be clear until the administration is further along.

What Happens Now That Lendy Has Gone Out of Business?

All of Lendy’s affairs have been taken over by the administrators, RSM Restructuring Advisory LLP, who are winding down Lendy’s loan book and overseeing all of the defaulted loans. The administrator is attempting to recover investor capital by taking ownership of outstanding properties and liquidating where possible. RSM is also consolidating all company bank accounts.

It’s still early days in the wind-up process but the first repayment distributions from property liquidations sales are being paid to lenders’.

As An Investor, Should I Expect To Receive My Money Back?

Many factors will dictate the recovery results and at this stage, that’s an impossible question to answer because only the administrators know the financial health of Lendy.

The administration process will include consolidation of Lendy’s financial accounts, communication with loan borrowers, legal action to recover defaulted loans, collection of current loan payments and more.

The losses you might take will depend on the loans you were invested in. I personally expect to take a capital loss in the region of 50% of my capital investment.

I’ve received one distribution so far and was paid back 45% of my capital.

So Does This Mean All Property Development Lending Is Bad?

No.

Property developers need financing for projects and peer to peer lending solves this need. As lenders’, we have to find reputable peer to peer lending companies who are experienced and who care about their investors and borrowers.

We need companies that will source sensible loans at sensible valuations and who have a network of loan brokers who bring deals. We need companies who have underwriting experience and who know how to separate the good loans from the bad in order to protect investors’ interests. We need companies who charge sensible fees and operate in transparency.

If you want high returns as an investor, you will need to take risk. This risk will invariably come with defaults so if you invest in property development loans, you must be comfortable with the risk.

Conclusion

Lendy used to be an extremely popular higher risk investment for anyone looking to lend money within the property bridging sector. As Lendy’s loan book matured, it was apparent that many of the underwritten loans were troublesome. Property development financing is a competitive field and Lendy underwrote many loans they should have passed on in order to generate high fees.

Lendy was under pressure to keep their loan pipeline full. Investor demand was high and the more loans Lendy filled, the more fees they generated.

12%+ interest-paying bridging and development loans are prone to defaults so don’t be surprised by this, especially during unstable economic times.

It’s now apparent that Lendy’s questionable actions were not in investors’ best interests, especially the Waterfall Clause inside the Terms & Conditions which allowed Lendy to paid considerable sums upon company failure.

Lendy’s failure is another wake-up call for all investors to properly diversify through several peer to peer companies and many loans and not to exclusively chase high returns.

Despite Lendy’s failure, I plan to continue investing through peer to peer and expect some companies to thrive and others to fail. I’m paying much closer attention to the experience and background of the founders of the companies I invest through.

A reader asked me if I were a new investor, would I continue to invest in property bridging and development loans? My answer would be to limit property development exposure by lending through reputable companies with experience, who lend to experienced borrowers, tread carefully and diversify across many companies and loans at varying risk levels. Also, understand that property development bridging and lending can be risky so don’t invest more than you can afford to lose.

If you want to learn more about peer to peer lending, click here and receive my complimentary Top 5 Peer to Peer Lending Companies Report.

I love feedback, so if you find any errors or omissions or have any improvement suggestions, I invite you to contact me and be a part of contributing to this website.

Disclaimers: I am not paid to write my reviews and I’m not employed by any of the companies I write about. In most cases, I have invested or continue to invest my own money through these companies. In order to keep the website financially viable, the sign-up links on this website are referral links and I do accept advertising in the form of banner ads.

This advertising in no way influences my reviews and opinions. When you sign up for an account through my website, in some cases I receive a referral fee directly from the companies, at no cost to you. Your support enables me to continue to operate the Financial Thing website. You can read more about my referral links and banner advertising here.

** This page is for information purposes only. This information is not financial advice and has been prepared without taking your objectives, financial situation or needs into account. You should consider its appropriateness for your circumstances. All investing carries risks. Opinions expressed in this review are opinions based on my own personal experiences. The FSCS does not cover peer to peer lending, crowdlending or crowdfunding and your capital is at risk. Please don’t invest more than you can afford to lose. **