Fruitful Review

** Fruitful review updated February, 22nd 2018 **

News: Fruitful has relaunched as Fruitful Homes and will focus on crowdfunding in-house property development projects based on modular eco-friendly homes. Interesting.

Fruitful announced that it will be closing it’s door to further peer to peer lender investing after a soft launch spanning only 10 months. They will be returning lenders capital and interest in sections. My email stated I would receive 81.5% of my investment in early November, with the remainder being paid (including earned interest) over within the next 12 months.

** I can now report that 100% of my original Fruitful capital and interest was repaid.**

My current annual rate of return: 0% (I no longer invest)

Receiving an email stating a peer to peer business is shutting down triggers a wave of anxiety. Well it’s more of a “shit, have I lost my money??” panic reaction. Truthfully I have faith in Fruitful that they will handle the wind down of their loan book appropriately. According to Fruitful, they aren’t going out of business but shifting their focus. Fruitful found that their peer to peer lending ambitions collided with the reality that business model wasn’t working. Now they will focus on their main lending only model.

My hat goes off to the company for recognizing the warning signs and pulling the plug. Fruitful’s departure is a reminder of the risks all peer to peer lenders face.

Fruitful: My experiences so far….

I have been investing in Fruitful for only two months but so far my experiences have been extremely positive.

What is a Fruitful?

It’s a peer to peer lending company that lends money directly to business mortgage borrowers. Fruitful is the new kid on the peer to peer block and is looking to rough up the competition. I remain cautiously hopefully about Fruitful because of its tiny track record and simplicity. Personally I have had nothing but good experiences with the Fruity crew but it’s simply too early to come to any long term conclusions whether or Fruitful will be a viable long term investment platform.

When Did Fruitful Launch?

January 2015

How Do I Sign Up?

Fruitful is still in beta release so from time to time, they close the platform to new lenders. I imagine as time marches forward they will open the platform up to new lenders. Click here to request an invite.

What’s the Signup Process Like?

Easy. They run the usual i.d. check, no additional identification needed.

Are They Regulated?

Yes, by the UK Government’s Financial Conduct Authority.

How Much Interest Are Lenders Paid?

5% above the Bank of England Base Rate. This interest rate is variable but currently pays 6%. As interest rates rise, the rate of return will rise. (All numbers were of September 2015.)

What Are the Fees?

None to the lenders.

How Long Are the Loans?

Not certain. No information listed currently.

What Security Does Fruitful Loan Against?

All loans are secured by brick and mortar businesses that the mortgages are lent against. No information regarding the loan-to-value ratios of the securities so some blind trust is required here. Loans are also backed by a personal guarantee for added security. Read more here.

What Happens if Fruitful Goes Bust?

Your un-lent money is held in a separate Trustee bank account through Santander. Your loan parts are directly held between lenders and borrowers so if Fruitful fails, they claim they would work to sell loan parts to asset managers and payments would be made as scheduled.

Fruitful doesn’t go into further detail regarding the platform failure plan so in reality, no one knows how this would play out and this is all part of the risk of peer to peer lending.

WHAT I LIKE ABOUT FRUITFUL:

It’s So So Simple

I’m really on the fence whether to put simplicity in the like or don’t like list because Fruitful’s website is so simple, it’s scary. You deposit your money ad it’s instantly invested across an unknown amount of loans and that’s all the input you have. For people who don’t like complicated investing, this is as simple as you can get.

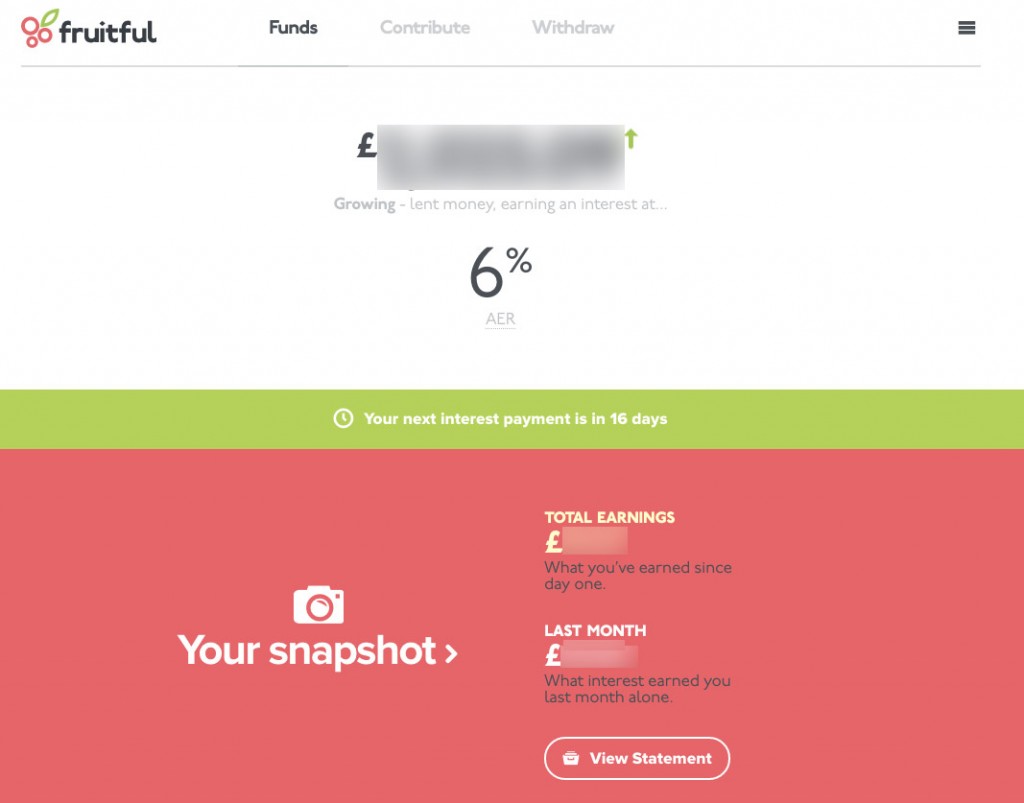

This is the dashboard:

Nothing further to see here. No details of what loans your money is invested into.

It’s Liquid

Amazingly, if you need access to your money and Fruitful can find sell your loan parts, you can withdraw your money. I’ve tested this and it took about 6 days. Pretty good considering the interest rate. It does lead me to wonder what would happen if everyone headed for the exit at the same time but for now, the system is very liquid. The only catch is if you were to withdraw your money a day before your interest payment is due, you wouldn’t receive any of the interest owed.

Loan Security

All loans are backed by the mortgaged properties and a personal guarantee.

The Canopy Fund

This is Fruitful’s version of a provision fund or a safety net which makes payments in the event of a borrower defaulting! The fund is paid into by the borrowers so this added security comes at no cost to you. Currently Fruitful doesn’t list how much is in this fund but hopefully once the company fully launches, this will be transparent information for investors.

Deposits, Payments & Withdrawals

Deposits used to be instant and free via debit cards but this has recently changed. Now if you use a debit card, you’ll be charged a 2.1% fee. Alternatively you can make a bank transfer which is free and takes 2-3 business days. Interest payments are prompt and credited to your account the day they are due. Withdrawing balances isn’t the fastest but it’s easy and takes 2-3 business days.

The Website

It looks great, it’s super easy to use and navigate and it just works. Way to go Fruitful!

Communication

If you need help, the website has a chat feature and the team is quick to respond and super friendly. This makes handing money to strangers far less stomach churning.

Signup Process

This was easy. They run the usual i.d. check, no additional identification needed.

WHAT I DISLIKE ABOUT FRUITFUL:

It’s Too Simple

There’s very little information regarding who or what you are loaning money to. This is a stark contrast to peer to peer sites such as Funding Circle where you know far more about the loans you are investing in.

No Information on Default Rates

Fruitful’s website doesn’t show any default stats so don’t expect any information on default rates. Hopefully this will change in the future?

Track Record

Launched January 2015 so it’s track record is very limited.

My Strategy

Deposit money, hit the invest button and off you go. Your money is instantly invested and earning interest.

Conclusion

My Fruitful experience was good so I was disappointed when they decided to close their peer to peer lending business. They have since reopened offering property development loans but I’ve yet to invest.

If you enjoyed my Fruitful peer to peer lending review and want to learn more about peer to peer lending, click here and receive my complimentary Top 5 Peer to Peer Lending Sites Report.

Disclaimers: I’m not paid by or employed by any of the companies I write about. In most cases I have invested or continue to invest my own money through these companies. The sign up links on this website are referral links. When you sign up for an account through my website, I receive a referral fee directly from the companies, at no cost to you. Your support enables me to continue to operate the Financial Thing website. You can read more about my referral links here.

This unbiased review is for information purposes only and should not be considered investment advice. Opinions expressed in this review are based upon my investing experiences. All information was deemed to be correct at the time of writing. Peer to peer lending contains risks so never invest more than you can afford to lose.