Despite some peer to peer lending sites offering mediocre return rates, here’s why investors continue to love peer to peer lending.

In 2014 I stumbled upon peer to peer lending by accident. I was interested in buying an investment property so my dad suggested looking at peer to peer lending as a way to borrow funds to complete a purchase. I brushed off his suggestion because the idea of taking on debt put me off. One year later my dad sadly became very ill and was diagnosed with terminal cancer so I was asked to help my mother handle his affairs. This forced me to learn how to DIY invest and once I was comfortable, peer to peer lending looked more and more interesting. After copious hours of research, I began dipping my toes into the peer to peer lending waters.

Since then, peer to peer lending has become a bit of an obsession for me.

When you begin peer to peer lending, trying to decipher which platforms and investments to choose can be particularly time consuming. But if you stick to your allocated game-plan, there will be a point where the investing becomes more hands off because you should hit your investing ceiling. A smart investor will only allocate a certain percentage of his total available investments to peer to peer lending and never exceed that amount.

Most peer to peer lending platforms don’t offer particularly high investment returns when you factor in risk and idle money periods. Take for example Ratesetter, one of my favourite peer to peer options. If you were to choose the Ratesetter 5 year option, you’d hopefully secure a rate of 6.4%. When you receive monthly principle and interest payments, there are times when interest rates drop and setting a target interest rate manually is the only way to avoid being reinvested at rates in the mid 5% range. When you manually set rates, it can take a few days for your order to be matched. If this happens each month (which it tends to), you can expect to lose a small percentage of returns due to idle money. Let’s say this loss in returns is 0.5%. now your 6.4% annual return could easily become 5.9%. Factor in taxes and risk and this percentage return doesn’t look so favourable. If banks were paying 4% on 1 year bonds, people might not consider Ratesetter at 6.4%. You can read my full Ratesetter review here.

Let’s take this step further and gaze into our crystal ball. Imagine that you could buy a low fee index stock fund that historically returned 10-12% annually. Other than for diversification purposes, it wouldn’t make much sense to invest in Ratesetter at all. Such index funds do exist.

Since index funds exist that pay 10-12% annually, why do people still like peer to peer lending (myself included)?

Here are a few reasons.

Most people don’t understand how to invest in the stock market

In the UK there are over 29,000 managed stock funds or unit trusts. With so many choices, it’s no wonder the average investor is overwhelmed and feels the need to consult a financial advisor for investment advice. Investing through a financial advisor can be really boring and for most people, it’s hands-off.

In a 2015 interview, Chris Macdonald Brooks Macdonald Investments said:

“There are too many funds in most sectors, and [the asset management market] could do with a shakeout. We are still seeing fund launches the whole time, and in the vast majority of cases, unless they are niche, they are not needed. Too many funds do the same thing.”

Having full control over investing make peer to peer lenders feel empowered. Where as selecting unit trusts can lead to confusion, deciding whether or not to invest money into a diamond ring offered by a p2p platform can be more clear cut (pun intended).

Peer to Peer lending is exciting

Let’s face it, buying a loan piece of a Ferrari 458 Spyder, Citation jet or a commercial property development is darned exciting. Every time I receive a new email touting an upcoming peer to peer investment opportunity, I feel a bit giddy. Owning exotic toys and property investments are unaffordable for the majority of us, so owning a cyber piece is the next best thing. Property peer to peer lending platforms allow you to buy property pieces with an appreciate upside potential. Just like some people love to buy and sell stocks, the thrill of the future property outcome is appealing.

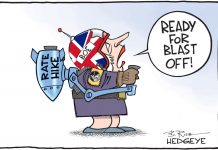

Stick it to the banks

Personally, I dislike the behemoth banks. Anytime a smaller lending company can step in and make the big banks a bit less obsolete, I’m all for it. I’ve known many a small business to be turned down for financing through the big banks. these same businesses were able to obtain peer to peer financing in order to grow. On the opposite side, investors have a chance to experience returns that they could once only obtain through the help of a financial advisor or stock fund manager. Peer to peer lending levels the playing field.

The Returns

Bank saving rates are atrocious at the moment. Sure there are a few savings accounts that pay up to 5%, but they have capped deposit limits, direct debit requirements and quite frankly for me, they’re a pain in the rumpus. If you’re willing to take some risk, peer to lending can offer some enticing returns. The once popular European site Bondora saw people achieving returns in the 20% range; unsustainable long term of course. There are some peer to peer lending sies which offer 12% annual returns but I estimate over the long run, a return of 7% is realistic for peer to peer lending if you diversify in both high and low risk investments. For people who don’t like or understand the stock market, 7% returns are reasonable.

It’s safer than trading single stocks

Some might disagree with me but for the average person, I believe this to be true. People who dabble in amateur stock trading are usually victims of poor market timing; ie. buying and selling at the wrong times. This is usually a result of their emotions. How on earth can the average investor know the correct times to buy and sell shares when even Wall Street traders can’t get it right? Yes of course people get lucky from time to time, but over the long run, stock trading is highly risky and mistiming can lead to heavy losses. For example, I have a friend who bought Royal Dutch Shell B’s in May 2014 for £25.76 a share. He then watched the stock fall and hit the sell button in Jan 2016 for £13.71, netting himself a 46% loss. He read all the bad oil news and genuinely believed Shell’s stock was heading below £10. If my friend would have stopped reading the news and sat on his shares for 10 years, I’m sure Shell would have rebounded. But his emotions caved into logic because when stocks are tanking, the urge to sell becomes high which is the opposite of a good long term strategy.

Those are a few examples why peer to peer lending continues to grow in popularity, and once the IFISA is more available to the mainstream, will continue to grow.