Property Partner Review

** Property Partner review updated September 5th, 2020 **

Property Partner is an online property crowdfunding platform that funds property purchases and loan development bonds on commercial buildings and residential houses and apartment blocks. Investors can own shares in each property through an SPV Company or invest in development loan bonds that hold second charges. Property shares can be bought and sold on the secondary market.

Some properties are purchased with mortgages of up to 60% of the purchase. This increases dividend returns but increases risk. Read more below for my unbiased exclusive Property Partner review and my experiences as an actual investor.

In July 2019, Property Partner recently replaced its CEO and introduced new fee structures. Please read my fee section below for details.

My Current Investment Amount: Click here for my latest Where I Invest page

My annual dividend rate: 3.9% (Net return before I pay tax)

| Est. Annual Returns: | Yields up to 5.8%, loans up to 12% |

| My Risk Rating *: | |

| Launched: | 2013 |

| Early Exit: | ✓ |

| Autoinvest: | ✓ |

| ISA Available: | ✓ |

| Investment Types: | Apartment buildings, houses, commerical. Development loan bonds |

| Loan Security: | Property |

| Provision Fund: | Property repair fund |

| Investor Fees: | See fee section in review |

| Min Investment: | 1 property share. Bond min varies |

| Time to Become Invested: | Fast |

| Time Needed Managing: | Low |

| FCA Regulation: | Full |

| Cashback Offer: | Up to £1,500 bonus, scales on investment amount |

| Cashback Sign Up: | Cashback Signup |

* This opinion risk grade factors in types of loans offered, interest rates, platform history, default numbers, and my own investing experience. My risk rating explained.

The Property Partner Review: What You Need To Know

Pros

- Investors can buy shares in UK residential, commercial and student housing properties

- Secondary market to buy shares

- Extensive research performed on property purchases

- Property usually secured at a discount

- Pre-fund investing for upcoming properties

- Auto reinvest of monthly dividends

- Auto invest option

- Possible tax benefits for some

- Easy to use website

Cons

- No dividends paid since Covid-19

- Normal dividend yields can be low

- Some properties are leveraged with mortgages, increasing risk

- Annual Management and monthly account fees which reduce returns

- Risk if Property Partner stops paying on the mortgages

- Need to take a discount to sell shares

- Development bond loans are risky / pay interest at end of term

- Fine print in terms gives company final control over the properties

- 5-year investment term means many unknown outcomes

Equivalent Competitors

Property Partner Review: My experiences so far….

I have been investing through Property Partner since early 2015. As time passes, I’m concerned about Property Partner’s business model. I’m unconvinced the business can make a profit and have long term sustainability using its current model. As with all property equity sites, the unknown outcome factors make for an interesting but risky investment.

When I started investing, Property Partner only offered deals in London but have since expanded to other parts of the UK such as Eastbourne and Lincoln.

Yields on deals outside of London tend to be more attractive. I invested in properties outside of London because of the inflated London prices. Monthly dividend payments have always been received on time. So far two of the properties I have invested in have been sold for a nice profit. I withdraw proceeds from the sale as I didn’t want to invest further. For me, Property Partner has always been a long-term play on rising property prices.

As time has passed I have become less comfortable with my Property Partner investment. When Marshall King was replaced as CEO my gut feeling was the company is having issues over long term sustainability. The lack of new offerings is concerning.

Exiting shares would require potential losses so I decided to stay put for now.

I won’t invest in Property Partner’s property development bonds as they are second charge positions and don’t pay any interest until the end of the bond term.

I haven’t received any dividends for several months due to the Covid-19 economic conditions.

What Is Property Partner?

Property Partner offers a wide range of investments ranging from property shares to development loan bonds. Property Partner acquires property (often with mortgages) then offers the property shares to investors. It’s important to think of Property Partner as an equity site rather than a peer to peer lending company. The properties are held inside individual SPV companies registered at Companies House.

Property Partner manages the rental collection and pays monthly dividends. They also handle any needed maintenance. Properties are held for a period of five years at which time, shareholders vote on holding or selling. Sometimes property exit strategies are evaluated prior to five years.

Development loan bonds are loans given to property developers that offer an annual fixed net interest return paid at the end of the bond term.

How Can I Contact Property Partner?

Email: hello@propertypartner.co

UK Tel: 020 3696 5600

When Did Property Partner Launch?

January 2015

Are They Regulated?

Yes, by the UK Government’s Financial Conduct Authority #613499 under full permission granted September 2nd, 2014. FCA regulation is nothing like the FSCS (Financial Services Compensation Scheme) that covers consumers from bank failures.

The FCA does have the ability to pursue criminal action against companies it finds are in violation of its standards, but it’s not a government entity and is funded by the very companies it regulates.

Who Can Open An Account?

Anyone who can pass the security verification checks. No accounts for U.S. residents.

What’s The Signup Process Like?

They run the usual i.d. verification checks to make sure you aren’t a money laundering pilferer.

How Are Deposits Made?

Debit card deposits (recommended and free) or bank transfers.

What’s The Minimum Deposit / Investment?

Deposits: £50 minimum

Pre-orders on new property share offerings: 1 share minimum (price varies)

Secondary market shares: 1 share minimum (price varies)

Development Bonds: £1,000+ minimum

Does Property Partner Offer An Innovative Finance ISA?

Yes, Property Partner now offers an IFISA.

What Is The Difference Between Property Shares And Development Bond Loans

Property Shares

When you purchase property shares, you own a piece of that property that is held in a segregated SPV company where details are filed at Companies House. Here’s a quick overview:

- You own a part of the property

- Low £ minimum investments

- Pays monthly dividends

- You profit or loss on property resale at the end of term

- Property is generally mortgaged to increase dividend yield

- Professionally managed

- Shares can be bought and sold on the secondary market

Development

When you invest in development bond loans, you are essentially lending money to a property developer to build. Here’s a quick overview:

- Fixed rate interest return

- Higher £ entry cost (usually £1,000 – £5,000 minimum)

- You don’t own any part of the development

- Second charges and personal guarantees are the security

- Interest paid at the end of the bond term

- Illiquid / cannot sell

I only invested in the property shares. Development bond loans are too risky.

Is There Auto-Investing?

Property Partner offers automatic investment plans for those who want a hands-off investing experience. Investors can choose from Income, Balance and Growth plans. Each pay different interest based on the portfolio.

Money is invested in the plans two to three times a week. How long it will take your money to be deployed varies depending on the size of your investment and property share supply. I’ve never used to auto-invest and can’t comment on its effectiveness.

How Much Interest Return Does Property Partner Pay Investors?

For property shares, Property Partner doesn’t pay an interest rate since investors actually own the properties. Monthly rental income is usually paid instead in the form of dividend yields. Net dividend yields range from 2-5.8% but can be affected by rental occupancy and delinquent rent payments.

Property development bonds pay interest on a per deal basis and are usually in the 9-12% range which I think is too low for a second charge position. Interest is paid at the end of the loan term.

My monthly dividend returns prior to the new fee structure: 4.56% per year

My monthly dividend returns after the new fee structure: 3.36% per year

** During the Covid-19 economic downturn, Property Partner has paused all dividends on all properties.**

Are Property Share Dividends Paid Immediately Or When The Investment Starts?

Property share dividends start to accrue immediately upon share purchases.Again these dividends have been paused until further notice.

When Are Property Share Dividends Paid?

Fifth of every month or the following business day on bank holidays.

Who Exactly Am I Lending Money To?

Property Partner isn’t a peer to peer lending company so you aren’t lending money. You either own shares of each property or invest in development loans via a bond. Each property with shares is held inside a separate SPV Company which is registered at Companies House.

What Are the Fees?

Property Partner has some fees to pay attention to.

Investor fees

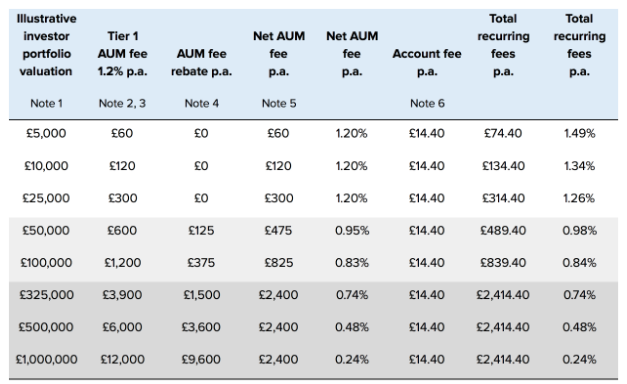

In July 2019, Property Partner announced new Annual Assets Under Management fees based on the equity value of each properties independent valuation. The annual fee will be 1.2% on accounts valued up to £25,000 and 0.7% on accounts valued over £25,000.

Property Partner also introduced account fees of £1 + VAT per month. This fee is deducted from monthly dividends and only applies to clients with active investments and deposits

You can see how these new fees would affect you based on your account balance:

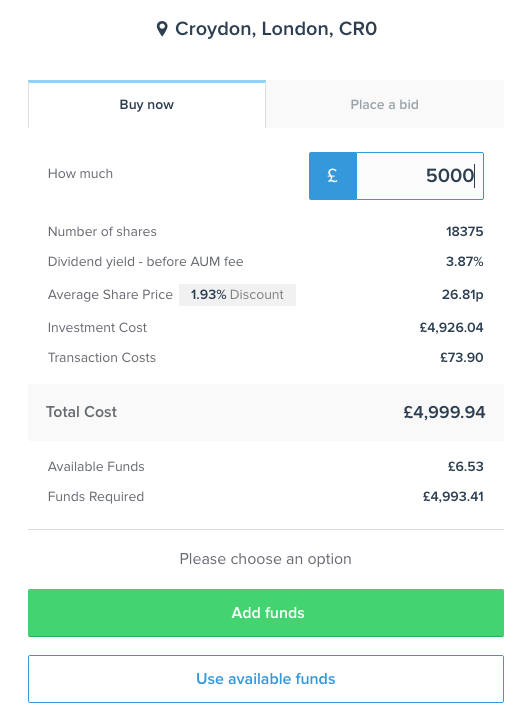

Property Partner charges up to a 2% fee for property shares purchased on new property investments. This fee is reduced to 1% during the first week of live funding on a new property.

Premium Clients can invest during early access on properties and won’t be charged a fee.

2% upfront fee on development bond purchases.

There is a 1% fee for shares bought and sold on the secondary market. This 1% fee has been set until October 7th, 2019 at which point it will be reviewed.

Property Partner charges a 3% + VAT Sourcing fee on the purchase price of each property. So if a property costs £1m, Property Partner’s Sourcing fee would be £30,000 + VAT. Not strictly an investor fee but important to know as it adds to the acquisition cost.

Property Partner charges 10.5% + VAT (total of 12.6%) of gross rent for management and rent collection. Other fees are added to the property acquisition including mortgage origination fees.

And finally, Property Partner holds 0.5% of any investors share purchase to pay Stamp Duty Tax

After the first month of the new fee structure (July 2019), I lost 27% of my dividend payment to fees. The less your account value, the more the fees will hurt your dividends.

You can read the fine details of the fee schedules here.

What Are The Length Of The Investments?

Investment terms are five years on property shares but sometimes properties are evaluated prior to term end to see if an early sale is beneficial.

Development bonds are 12-18 months with interest paid at the end.

Is There A Secondary Market?

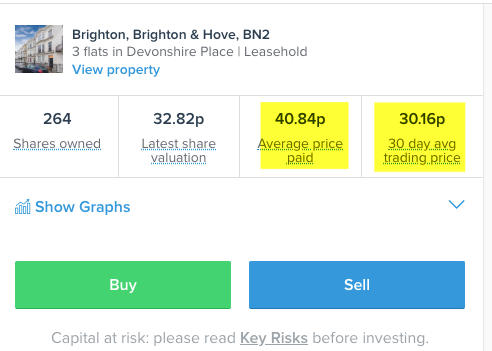

Yes. Investors can buy and sell shares at a price of their choosing, including at premiums or discounts. You will find if you try to sell shares, you will likely receive less money than what you paid for the shares as shar buyers are looking for deep discounts.

There’s no charge to sell shares on the secondary market. Share prices are determined by independent monthly valuations and buyers are always offered the cheapest shares first. The secondary market for selling can be somewhat stagnant at times, so don’t rely on being able to quickly offload shares, even at a discount as there’s never a guarantee.

Property Partner also has a bid / offer option on the secondary market. This is where you can bid a price you are willing to pay as a buyer, or offer a selling price you are willing to accept as a seller. It’s an interesting concept but it does complicate the once simple secondary market.

What Are The Main Risks?

Platform failure: This is the biggest risk as if Property Partner fails, there are many unknowns as to how investors would really fare. Property Partner states each investment is individually ring-fenced inside an SPV company outside the platforms assets and liabilities, and uninvested funds are held in a segregated bank account. The issue is the cost and of administration due to a company failure. Liquidating a large property portfolio would be time consuming and expensive.

Tenant defaults: If tenants don’t pay rent, then investor returns would suffer. You rely on Property Partner’s ability to implement quality property management and attract quality tenants. So far I’ve had no issues in the properties I’ve invested in.

Mortgages: Property Partner sometimes acquires properties using mortgages. Mortgages increase investment risk because if Property Partner doesn’t make the payments, the banks could foreclose.

Loan Default: If a developer defaults on their loan obligations, then investors could lose money.

Calculation errors and unpredictable events: There are so many unknowns that go along with landlording. If Property Partner miscalculates expenses or valuations are incorrect, investors may lose money. Tenant property damage could also reduce returns.

Property market downturn: Property values could decrease and be worth less than they were purchased for. Property Partner is heavily invested in London, a market considered to be on the verge of a bubble. Having mortgages on properties also increases risk during a downturn.

Sector specific: Being 100% in the real estate sector is risky should a property downturn occur, for example, because of Brexit.

Is There A Provision Fund?

Property Partner withholds a repair fund for each property for future use.

What Happens If Property Partner Goes Bust?

Investors property shares are ring-fenced and held separately within SPV’s. Any uninvested funds are in a segregated Barclays account. In the event of platform failure, third party liquidators would be appointed to manage the properties “in accordance with terms of the investments”. All uninvested funds would be returned to investors. as we’ve seen in the past, administration is slow going and expensive.

How Is The Deal Flow?

Property Partner’s deal flow has been very quiet since the previous CEO was replaced. This is concerning.

THUMBS UP FOR PROPERTY PARTNER:

Investing In Property Located Throughout The UK

UK Property has always been somewhat of a secure investment in certain locations in the UK. Property Partner has a very experienced team who are able to locate quality investments. I believe this is a relatively secure investment and in the worst-case scenario, rental dividend payments should partially offset any potential property price declines.

Property Partner now focuses on areas outside of London which is a good move in my opinion.

Secondary Market

The market is great for buyers trying to diversify their holdings or new investors who are building a portfolio from scratch. Selling, on the other hand, can be slow going and will likely result in a loss, so plan on holding any shares you buy long term unless you are willing to sell at a deep discount.

Low Minimums On Property Shares

It is possible to buy a single share of a property which helps when reinvesting dividends. Property Partner’s low minimum makes it easy to diversify across many properties.

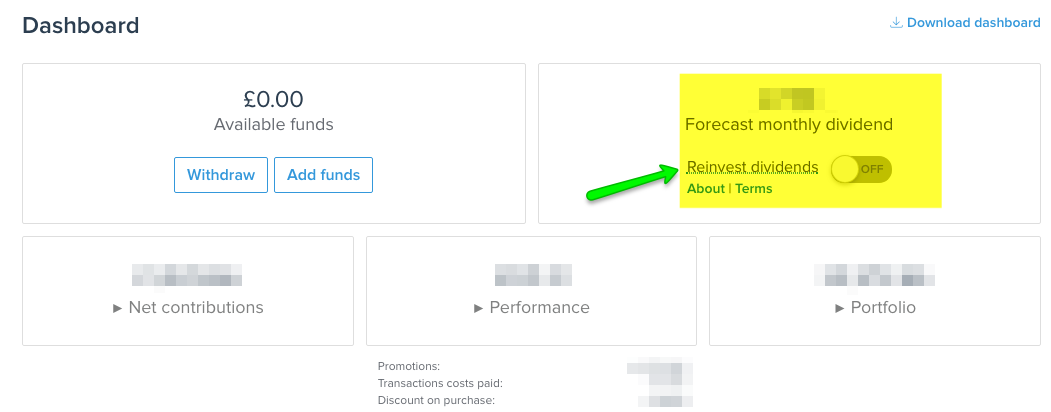

Auto Monthly Dividend Reinvestment

This new feature allows you to automatically reinvest your monthly dividends into the property which the dividend was paid from. This saves some time having to manually reinvest the dividend:

Auto Investing

For those of you that don’t have the time or patience to manually choose properties, Property Partner offers investment plans that act as an automatic investment tool. You can choose from Income, Balance and Growth. Each pay different interest returns based on what’s in the portfolio.

Each plan automatically invests into properties based on the plan criteria. You can read more about this here.

Property Is Owned

The properties are the security when investing in property shares so there’s no defualt recovery like peer to peer lending companies face. All properties are owned by an SPV which can be viewed on Companies House. Some properties do have partial mortgages on them which Property Partner acquires.

For development bonds, security is usually a charge and a personal guarantee.

The Website

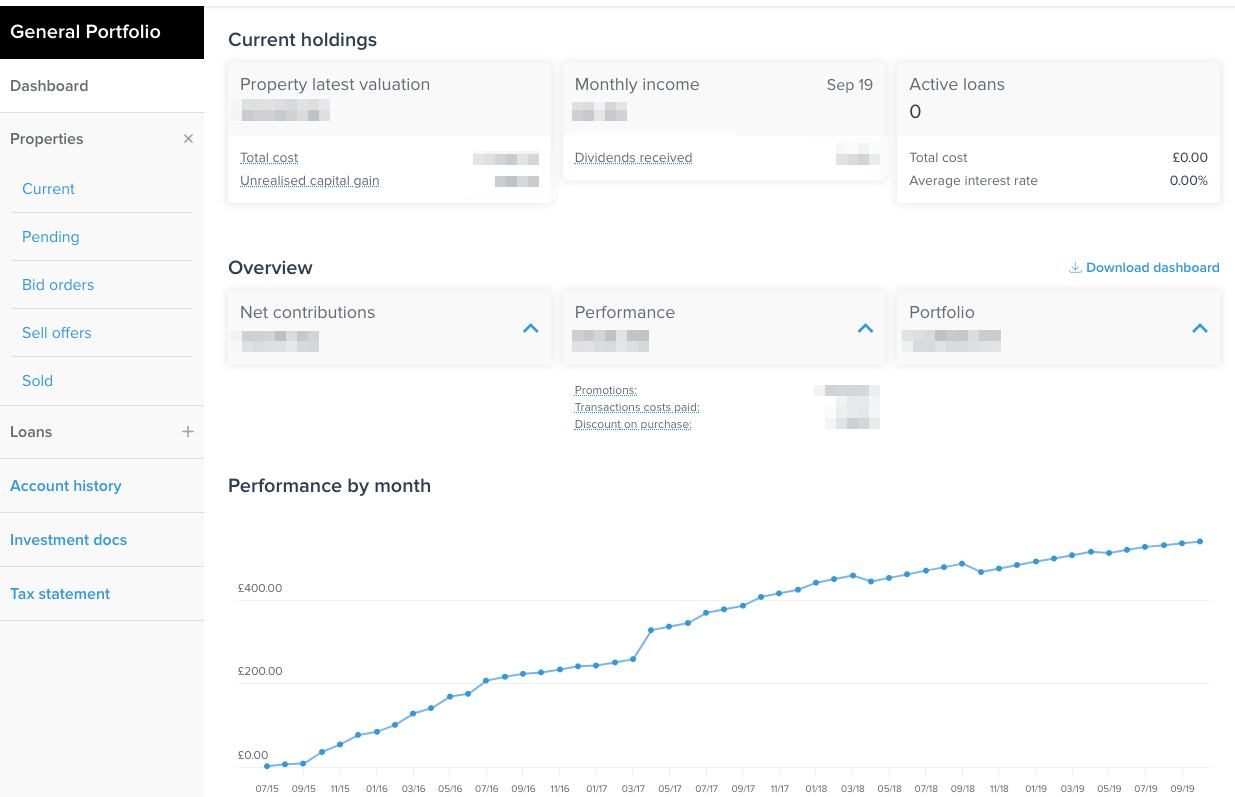

The website is clean but it’s become more complicated as features are added. Here is the dashboard:

Want to buy some shares in a property? Click on the property and then…

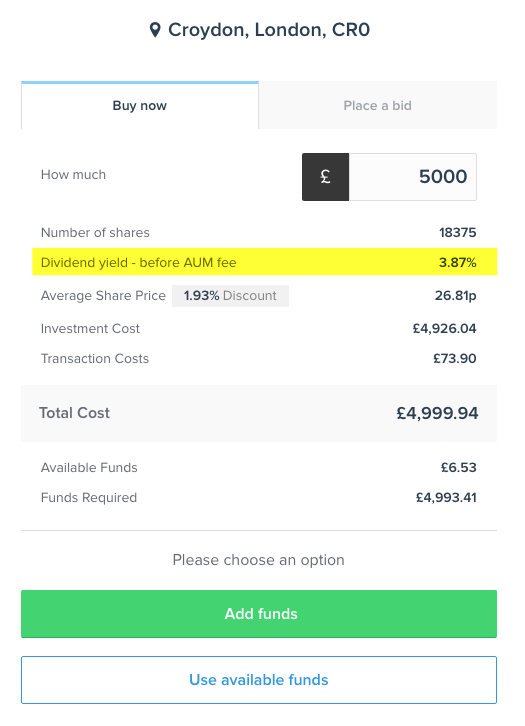

Decide how many shares you want to buy or sell and the information is laid out in a concise manner, including any fees:

Deal Flow

With 150+ properties offered since launching, the deal flow used to be good but has now ground to a halt.

Rental Yield

Every property you invest in will pays a rental dividend each month, as long as rent is collected.

Possible Tax Advantages

I usually don’t discuss tax in the reviews as everyone’s tax situation is different but Property Partner may offer some of you certain tax advantages using the HRMC’s Capital Gains Tax allowances. Also, dividends are taxed at a different rate than regular peer to peer loan interest. Please consult your tax professional for more advice on this.

THUMBS DOWN FOR PROPERTY PARTNER:

Lack Of New Deals

Since Marshal King was replaced as CEO and additional fees were put in place, Property Partner’s new deal flow has ground to a halt. This is concerning as new offerings are how Property Partner generates new income and growth. Without this growth, I question Property Partner’s financial health.

No / Low Dividend Yields

Compared to competing peer to peer lending sites, Property Partner’s estimated returns are on the low side. Property Partner estimates returns will be in the 13% per year range but I can only base returns on dividend yields as future valuations are speculative. Current dividend yields range from 2% to 5.8%. Any capital appreciation will be a bonus but isn’t guaranteed. Investments may offer tax advantages for some people.

The increased fee structure has lowered dividend yields further, especially for investors with smaller balances.

Also, no dividends are currently being paid out due to the Covid-19 economic conditions that have caused some property sector issues.

Gearing / Mortgages

Property Partner often uses mortgages to purchase properties on behalf of investors. Loan to values are up to 60% and mortgages result in lower dividend yields since a mortgage payment must be added to the expenses.

One of the greatest risks to investors is reliance on Property Partner to make the mortgage payments. If they don’t pay, the bank could foreclose on the property and investors could lose everything.

Mortgages always increase risk. With future interest rate rises a certainty, it remains to be seen how Property Partner will address the mortgage situation. Personally, I think Property Partner should stick to allowing investors to fully fund properties with 100% cash. You can read more about how Property Partner addresses leveraging here.

The Fine Print

One very important terms that you should be aware of (taken directly from Property Partners website):

“It is possible that a cost is incurred that is larger than Gross Rent, and may be unexpected and also uninsured. In such a scenario Property Partner reserves the right to take out a loan which is secured against the property, to fund the expenditure. That loan is repaid from Gross Rent, and this impacts the investors’ returns accordingly. If this situation were to occur, the matter would be communicated clearly to existing and prospective investors alike in a clear, fair and transparent manner.”

Basically, Property Partner can take out a loan on any property it chooses without investors consent. This term isn’t ideal but I assume Property Partner has to include such a term to cover their bums in worst case scenarios.

Development Bond Loans

I’m not a fan of Property Partner’s development bond loans for several reasons.

Most companies that offer development loan investments have a first charge on the development. Property Partner charges are second. Personally, I won’t invest in second charges because if the developer defaults, chances of recovering money on a second charge are slim.

Second charges mean the investors are in second position for any recovery efforts. Second charge position investors often lose capital during default recovery.

The other issue is the interest rates Property Partner offers investors are far too low for a second charge position. Most developers also offer a personal guarantee but once a developer runs into financial issues, personal guarantees can become worthless.

Development Bond Interest Paid At End Of Term

I’m not a fan of investments that payout at the end of the loan term. Firstly you lose compounding interest (the ability to reinvest loan repayments). Secondly, since the loan amount isn’t reducing through the loan term, the risk increases. It’s far better when development loans are paid down monthly as when the loan principle reduces, less risk is prevalent and less money needs to be recovered should the borrower default.

Fees

Property Partner does have several fees that are important to know about. These include a share purchase fee, Sourcing fee and property management fees. All these will contribute to acquisition costs and returns. (see fee section in this review).

Five Year Investments

Five years in crowdfunding / peer to peer lending can feel like a lifetime. No-one knows how these property investments will pan out after five years so there is some obvious speculative risk that accompanies investing through Property Partner.

Selling Shares On Secondary Market

There is a secondary market for selling shares but you’ll probably need to deeply discount your shares in order to exit. Remember exiting any investment is never guaranteed.

Auto Investing Diversification Can Leave You Exposed

Property Partner has certain criteria that rule it’s auto investment plans. One such rule is that no more than 20% of your money can be invested into a single property. This means, in theory, your entire portfolio could be made up of just 5 properties.

I’d prefer Property Partner offer the investor a setting whereby they can set maximum per property exposure in order for the investor to have better diversification.

Strategy

I used to be a fan of Property Partner but as often happens, one learns more about an investment, opinions change. As time has progressed, I’ve become less enthusiastic I like Property Partner but some property valuations have fallen. This could be due to pre-Brexit jitters. The experienced property team appears to run a tight ship and I particularly like the analysis they provide on each property highlighting why one should invest.

Currently, I own shares in over 30 properties as I believe diversification is key. I first invested in a few centrally located London properties, later branching out into other locations such as Lincoln and Brighton. I don’t invest in development bonds.

I used to view Property Partner as a long-term investment and planned on holding my shares until the end of the five year investment period in order to benefit from appreciation.

Recent developments have me yearning to exiting the platform but I am less inclined to take a loss by needing to discount shares to possibly exit.

Property Partner Review Conclusion

I used to think Property Partner was a good concept but many pros and cons emerged. Pros include being able to get obtain a diverse property portfolio without the high expense as the low minimum share purchase amounts will suit investors of all budgets.

Cons are that while you own property shares, you really don’t have any control over what happens to the property. Most properties have mortgages and leverage creates extra risk. If Property Partner stopped paying mortgages, then the lending bank could foreclose. Also, platform failure risk is apparent with Property Partner’s lack of new deal flow and the apparent economic situations being faced due to the Covid-19 downturn.

Another con is that development bonds are secured by second charges which can be problematic if the borrower defaults. Finally, there are monthly account and Annual Assets Under Management fees which will reduce your dividend returns.

I hope my Property Partner review will make your investment decision easier.

Click Here and receive up to £1,500 cashback (scales depending on how much you invest). (Property Partner pays me a small referral fee when you open an account through one of my links. This fee comes at no expense to you and when you sign up for an account through my website, it allows me to continue to operate Financial Thing. Thanks for the support).

If you enjoyed my Property Partner review and want to learn more about peer to peer lending and crowdlending, click here and receive my complimentary Top 5 Peer to Peer Lending Sites Report.

I love feedback, so if you find any errors or omissions or have any improvement suggestions, I invite you to contact me and be a part of contributing to this website.

Disclaimers: I’m not employed by any of the companies I write about. In most cases, I have invested or continue to invest my own money through these companies. The sign-up links on this website are referral links. When you sign up for an account through my website, I receive a referral fee directly from the companies, at no cost to you. Your support enables me to continue to operate the Financial Thing website. You can read more about my referral links here.

** This Property Partner review is for information purposes only and should not be regarded as investment advice. Opinions expressed in this Property Partner review are current opinions based on my own personal experiences. Property share equity investing contains risks so never invest more than you can afford to lose. **