Ratesetter Review (UK)

** Ratesetter review updated March 30th, 2022 **

Read my comprehensive unbiased Ratesetter review highlighting my investing experiences after 5+ years as a lender. Many things changed at Ratesetter in 2020 including the Metro Bank purchase and interest rate return cuts due to economic conditions caused by the Covid-19 pandemic. Ratesetter proceeded to close their peer-to-peer lending and repaid all investors in April 2021.

Read on for more information.

The Ratesetter Review: What You Need(ed) To Know

Thumbs Up

- Repaid all investors in April 2021 following Metro Bank’s acquisition

- Established in 2010 / £4bn+ lent

- Purchased by Metro Bank giving financial security

- Loans given to creditworthy, lower risk borrowers / Lower default rates

- Provision fund with interest buffer to cover lenders equally

Thumbs Down

- Offered low return rates

- Retail peer to peer lending loan book will decrease and cash drag could be an issue

- Exit fees on 3, 5 year, Plus and Max products (there’s a hack to bypass fees)

- Larger lump sums of your money can be invested into single loans

- Company operated at a loss (£8.6m in 2020)

Read more below in my exclusive Ratesetter review.

Equivalent Companies

Ratesetter’s Company Financials

Ratesetter posted a 2020 loss of £8.6m. Company accounts can be seen here.

Ratesetter Review: My experiences so far

I invested in Ratesetter’s loans since early 2015. I have a special love for Ratesetter as it took my peer to peer lending virginity without buying me dinner. Ratesetter was the perfect entry point into peer to peer lending as it provided simplicity, relative safety (for peer to peer lending), a provision fund and a possible exit strategy. The December 2019 and July 2020 rate cuts made Ratesetter far less attractive.

The highest return I saw investors obtaining post-Covid was 4% not including the 1.5% early exit fee on accounts aside from the Access account.

I switched my strategy from manual lending in early 2019 to using the auto-invest feature simply because I didn’t have the time to monitor my account daily. My returns fell slightly but it was worth the time saved. Incidentally, Ratesetter told me only 7% of all investors set their own rates. I was surprised by this low number.

The Access, Plus and Max products were introduced on October 3rd 2019. What did I think of these products? I was fine with them until the rates were cut down to 2% per year which was below what I’m willing to accept for a longer-term investment. I decided to let my loans mature and withdraw funds as they are repaid.

Eventually, I received 100% of my investment from Ratesetter which I was more than happy with.

What Is Ratesetter?

Ratesetter began as a peer to peer lending company where lenders loan money directly to borrowers via lending terms of either instant access (Access rate), one year or up to five years. The Access account invested in a mix of one-year and five-year loans.

Most borrowing types were unsecured personal and asset-backed property loans. Property loans made up a small percentage of loans.

Lenders could choose the current market return rates or set their own return rates. This was a profitablet strategy during Ratesetter’s early years.

Diversification was achieved by all lenders sharing in bad debts equally through the Provision Fund.

Ratesetter had excellent online reviews from borrowers which means Ratesetter cares about taking good care of its customers.

In September 2020, Ratesetter announced it had been purchased by Metro Bank and later closed its peer to peer lending business in order to focus on retail lending through Metro Bank.

How Can I Contact Ratesetter?

Email:invest@ratesetter.com

UK Tel: 0203 1426226

When Did Ratesetter Launch?

October 2010

Is Ratesetter Regulated?

Yes, by the Financial Conduct Authority #722768 under full permissions granted October 16th, 2017. Investments made through Ratesetter are not covered under the FSCS (Financial Services Compensation Scheme).

FCA regulation is nothing like the FSCS, which covers consumers when they deposit money in banks. The FCA reports to the UK government and has the ability to pursue criminal action against companies which violate its standards and codes of conduct.

What Was The Minimum Deposit / Investment?

Debit card deposit: £10 min

Bank transfer deposit: No min

Investment into loans: £10 minimum

Did Ratesetter Offer An Innovative Finance ISA?

Ratesetter’s IFISA was released late February 2018

How Much Interest Were Lenders’ Paid?

Average market rates were as follows:

Legacy Products

Access / Access: Ranges from 2.5% to 4% with a historical average of 3.1%

1 Year: Ranges from 3.7% to 5% with a historical average of 3.7%

5 Year: Ranges from 5.1% to 6.4% with a historical average of 5.8%

Current Products Under Normal Market Conditions:

Access: 3%

Plus: 3.5%

Max: 4%

Temporary Covid-19 Conditions:

During my early Ratesetter investing days, I was able to achieve return rates of 8% per year but rates dropped as competition increased and due to Covid.

Coronavirus Update

When Covid-19 became an issue, Ratesetter experienced a severe liquidity issue resulting in slow exit times. Ratesetter reported they have processed £4.3m of exit requests in one week but have seen a large drop in exit requests to pre-Coronavirus levels demonstrating customer confidence. I was able to exit from the 5 year product within six weeks but I requested an exit from my Access account on March 13th, 2020 and I am still in the queue. I will explain why later in the review.

On May 4th, 2020 Ratesetter announced a dramatic temporary decrease in investor return rates:

This decrease was to divert money into the Provision Fund which covers all investors equally in case of borrower late payments or defaults.

Metro Bank Purchase

In September 2020, Metro Bank completed the purchase of Ratesetter UK for between £2.5m and £12.5m depending on performance and pending regulatory approval.

What Did The Metro Bank Acquisition Mean For Lenders?

The acquisition plans weren’t clear but I thought Ratesetter would close its peer to peer lending business when it was announced Metro Bank would use its customer cash deposits to fund new Ratesetter unsecured loans. In April 2021 all retail investors were 100% repaid and Ratesetter’s peer to peer lending business was terminated.

Will Retail Peer To Peer Lenders Still Be Able To Invest Through Ratesetter?

No

What About My Existing Investments?

All peer to peer lenders have been repaid.

What Products Did Ratesetter Offer?

October 2019 – April 2021

On October 3rd, 2019, Ratesetter rolled out three new products called Access (previously known as Rolling), Plus (previously known as one year) and Max (previously known as five year).

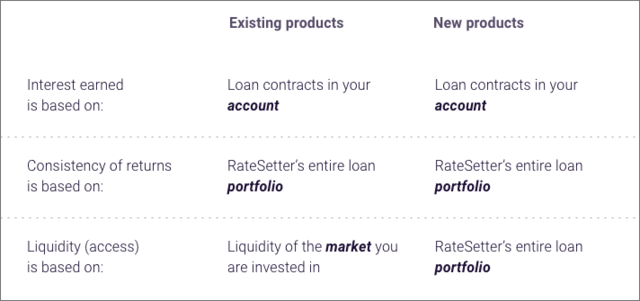

During my September 2019 visit to Ratesetter, ex-Chief Investment Officer Mario Lupori and Head of Communications, John Battersby explained that Ratesetter’s new products were designed to provide stability and liquidity in the event of a change in the economic landscape. The new products are also expected to deliver more consistent returns for lenders.

The main difference with the new products was that liquidity was pooled together across three markets versus individually. For example, if your money was currently invested through the one-year market and you wanted to exit, you could only exit based on the liquidity of the one-year market. With the new products, exiting the Plus market was theortically easier since money could come from wherever it was available across all three markets.

The challenges of Covid-19 really highlighted the importance of liquidity within the peer to peer lending industry.

Here is a comparison of the old products (prior to Ocotber 2019) versus the new:

And the standard market condition “Going Rates” and exit fees:

So what were these “Going Rates”? The new products had a market rate based on demand and supply versus the existing trailing average rate.

Ratesetter claimed the Going Rates allowed them to remain competitive in the low-risk lending sector and that rates would be more stable than the existing trailing average rates. Lenders were still be able to manually set their own rates under the new products.

One gripe I had about the new products was the reinvestment process. It’s fine for the Access account which had zero exit fees but for those invested in the Plus and Max products, investors were automatically reinvested in the same product and forced to pay fees to exit, even if they wanted to switch products.

There was no option to have Plus & Max repayments funnelled into your holding account but there was a workaround. You could manually set reinvestment rates much higher than the Going Rate to prevent money from being reinvested and then cancel the reinvestment order which would return funds to your Holding Account.

The lack of repayment options affected people who wanted to withdraw income payments. Ratesetter said this was challenging since capital repayments weren’t consistent.

Legacy products

Access: This account was designed to be an easy access account and pre-Covid accessing money was fast, but due to Covid, exiting has been reduced to months of waiting. Access always depends on demand and supply and is never guaranteed.

This account funds many different types of loans including consumer, business and property. There was no exit fee. This product was renamed Access on October 3rd, 2019.

One Year: The one year account only funded property loans. Investors could exit early for a fee if availability existed.

Five Year: The five-year account funded many different types of loans including consumer, business and property, investors could exit early for a fee if liquidity existed.

Was Interest Paid Immediately Or When the Loan Starts?

Interest accrued as soon as money was matched to a loan.

When Was Interest Paid?

Access, Plus & Max: Capital and interest were paid monthly or when you sold out / withdraw.

1 Year: Capital and interest were paid at the end of the term.

5 year: Capital and interest were paid monthly.

What Were The Fees?

Ratesetter charged an exit fee on their 1, 3, 5 year, Plus and Max products. The fees were as follows:

Access: No fee

1 year: 0.3%

3 year: 1% (for those invested in the now-defunct 3 yr product)

5 year: 1.5%

Plus: 30 days interest based on Going Rate at the time of investment release

Max: 90 days interest based on Going Rate at the time of investment release

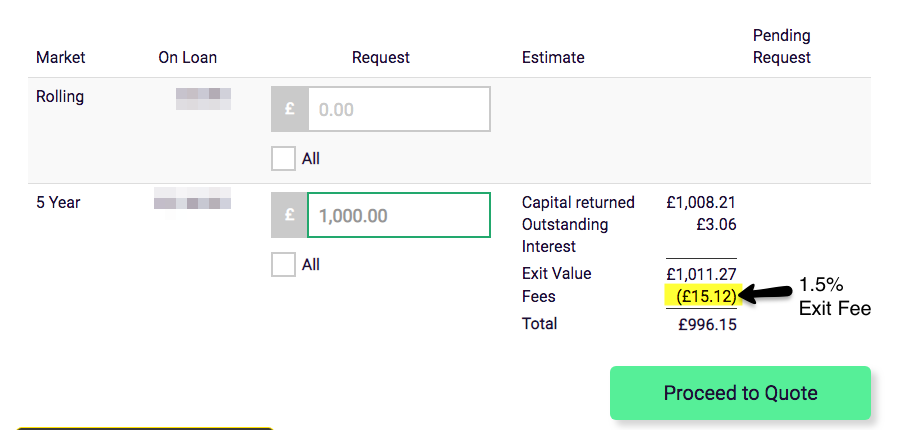

If you wanted to estimate the sale fees, you could do the following:

Step 1: Click on the Withdraw link inside your account:

Step 2: Click on Sellout at the bottom of the screen:

Step 3: Enter the desired sellout amount and the fees will be shown:

Step 3: Enter the desired sellout amount and the fees will be shown:

You can see from my example that the exit fees were 1.50% on the five-year product.

On a positive note, the Access account had no exit fee.

How Much Time Was Needed Managing Investments?

I used to spend approximately 30 minutes per week using Ratesetter. To earn the best rates, I had to log on and make sure my reinvestment target rate settings were realistic otherwise money idly sat by in my Holding Account earning zero interest.

When I switched to Ratesetter’s auto-invest to free up some time so I spent almost no time managing my account.

How Were The Loan Investment Terms?

Access (easy access/ no minimum time frame), one year or five years. The Access account invested your money across loans ranging from six months to five years. Any loan could be repaid early by the borrower.

What Security Did Ratesetter Lend Against?

Ratesetter listed its borrowers’ types as individuals, business / commercial loans, and property. Ratesetter stated that “Commercial loans include unsecured loans to sole traders and small businesses and secured loans to larger businesses.” All business and property loans were secured by an asset while personal loans are unsecured.

What Were The Loan Loss Rates?

Loss rates on the Provision Fund covered loans were:

2020: 0.5% (year-to-date)

2019: 2.2%

2018: 4.5%

2017: 3.3%

You can view Ratesetter’s current statistics here.

What Were The Main Risks?

Company Failure: This is a risk with every peer to peer lending company. If the business model fails, investors could lose all of their investments though it’s more likely they would lose some of their investment. I considered Ratesetter one of the safer peer to peer lending companies however Covid-19 has changed this. Ratesetter’s provision fund does protect the company somewhat and its pending aquisition by Metro Bank may provide added financial stability.

Economic downturn: Ratesetter is now experiencing a downturn in the economy caused by the Covid-19 pandemic. Ratesetter might experience higher borrower default rates since most loans are unsecured. Ratesetter states it is positioned to handle such a downturn.

Lowering of underwriting quality: One of Ratesetter’s draws is they lend to high-quality borrowers who they consider low risk. There is always a risk that Ratesetter will lower their underwriting standards to attract new borrowers resulting in higher defaults.

Ratesetter Conclusion

Ratesetter was one of the big three peer to peer lenders so it was unfortunate to see them close their doors to retail peer to peer lending in April 2021. Ratesetter repaid all investors so that was a victory. Ratesetter offered peer to peer loans since 2010 so they had a great track record and great liquidity history (pre-Covid-19) for those needing to exit early (some fees may apply).

With £4bn+ lent, Ratesetter’s low default rates and £800m loan book made them a good peer to peer lending option since daily borrower repayments provided constant liquidity pre-Covid.

As a lender, I expected to receive a max 4% annual interest during normal market conditions, and somewhere between 2-3% during Covid-19 conditions. Exit fees reduced returns further.

Most loans were unsecured and appeared to perform adequately during the Covid-19 pandemic. Ratesetter proactively stress tested their loan book in order to make provisions for an economic downturn.

Metro Bank’s purchase of Ratesetter left many questions unanswered as to the peer to peer lending side of the business. These questions were answered in early 2021 when Ratesetter announced the planned closure of its peer to peer lending business with repayment to all investors in April 2021. Metro Bank began funding loans with its customers’ deposits and focusing on lending through its retails locations.

RIP to Ratesetter”s peer to peer lending, you shall be missed.

If you enjoyed this review and want to know more, click here and receive my complimentary Top 5 Peer to Peer Lending Sites Report.

I love feedback, so if you find any errors or omissions or have any improvement suggestions, I invite you to contact me and be a part of contributing to this website.

Disclaimers: I am not paid to write my reviews and I’m not employed by any of the companies I write about. In most cases, I have invested or continue to invest my own money through these companies. In order to keep the website financially viable, the sign-up links on this website are referral links and I do accept advertising in the form of banner ads.

This advertising in no way influences my reviews and opinions. When you sign up for an account through my website, in some cases I receive a referral fee directly from the companies, at no cost to you. Your support enables me to continue to operate the Financial Thing website. You can read more about my referral links and banner advertising here.

** This Ratesetter review is for information purposes only. This information is not financial advice and has been prepared without taking your objectives, financial situation, or needs into account. You should consider its appropriateness for your circumstances. All investing carries risks. Opinions expressed in this review are opinions based on my own personal experiences. The FSCS and FDIC does not cover peer to peer lending and your capital is at risk. Please don’t invest more than you can afford to lose. **