Lending Works Review

** Lending Works review updated August 9th, 2022 **

After almost eight years after entering the retail peer-to-peer lending business in 2014, Lending Works announced it would be closing its doors to retail investors.

Lending Works offered peer to peer investment options that pre-Covid, were a good choice, but things changed.

I made my first deposit in Lending Works on July 16th, 2015. For the first three years, I was very happy with learning works but then interest rate drops and the companies actions during the pandemic led me to begin the withdrawal process.

When Did Lending Works Launch?

Lending Works was founded in 2012 and started offering peer to peer lending in January 2014.

In July 2020, an announcement was made that Lending Works is to be acquired by Antriva Capital with Nicholas Harding remaining as Lending Work’s CEO:

“The deal sees Intriva acquire 100% of the equity in Lending Works, subject to regulatory approval. Intriva has further committed to providing significant additional funding and capital to support the growth of the business following completion.”

This acquisition was completed in 2021 and subsequently, Lending Works closed their doors to retail peer to peer lending in December of 2021.

What Is Lending Works?

Lending Works is a UK based peer to peer lending company where retail investors lend money to personal unsecured loans to individuals. Investors are then paid interest returns based on two products, a three-year (Flexible) and five-year (Growth) product.

What made Lending Works different from other peer to peer lending companies was their approach to risk management. Lending Works attempted to reduce risk using their Shield fund which dedicated a portion of uses a reserve fund to cover borrower late payments and protect against some forms of borrower default such as loss of employment, accident and sickness and death.

Lending Works was acquired by Intriva Capital in July 2020. Intriva is expected to provide Lending Works with a capital injection and brings operational experience growing a consumer lending business. Lending Work’s CEO, Nicholas Harding will continue to run the business.

Why Did Lending Works Close Their Doors To Retail Lenders

Like some of the other peer to peer lending companies, Lending Works realised that their existing business model serving retail peer to peer lending was not going to be sustainable in the long term. This likely had much to do with the pandemic economic pressures but also due to the fact they were acquired by another company who were more interested in institutional funding.

Institutional funding can be a lot easier than retail funding due to the smaller amount of red tape needed to acquire lending funds. It is certainly much easier to offer customer service to one institutional lender than it is to thousands of retail peer to peer lenders.

What Does The Closure Mean For Lenders?

Lending works has stated they will be returning all funds to retail lenders as it will run off all loans. This means lenders will collect interest and capital repayment as normal until all loans are completed.

You can read more about this process here

Can I Continue To Lend?

Yes if you leave the autolend option selected in your account your money will be used to buy loans other lenders are selling via the quick exit option. Just be aware there are no new loans being added for retail investors, so your money could sit idle.

Personally, I have been withdrawing all capital and interest payments as I can invest this money elsewhere.

Can I Access My Money Early?

If you don’t want to wait for the loans to complete, you can still use the quick withdrawal feature as long as there are sufficient funds in the lending queue. Beware if you do this, the fees can be high.

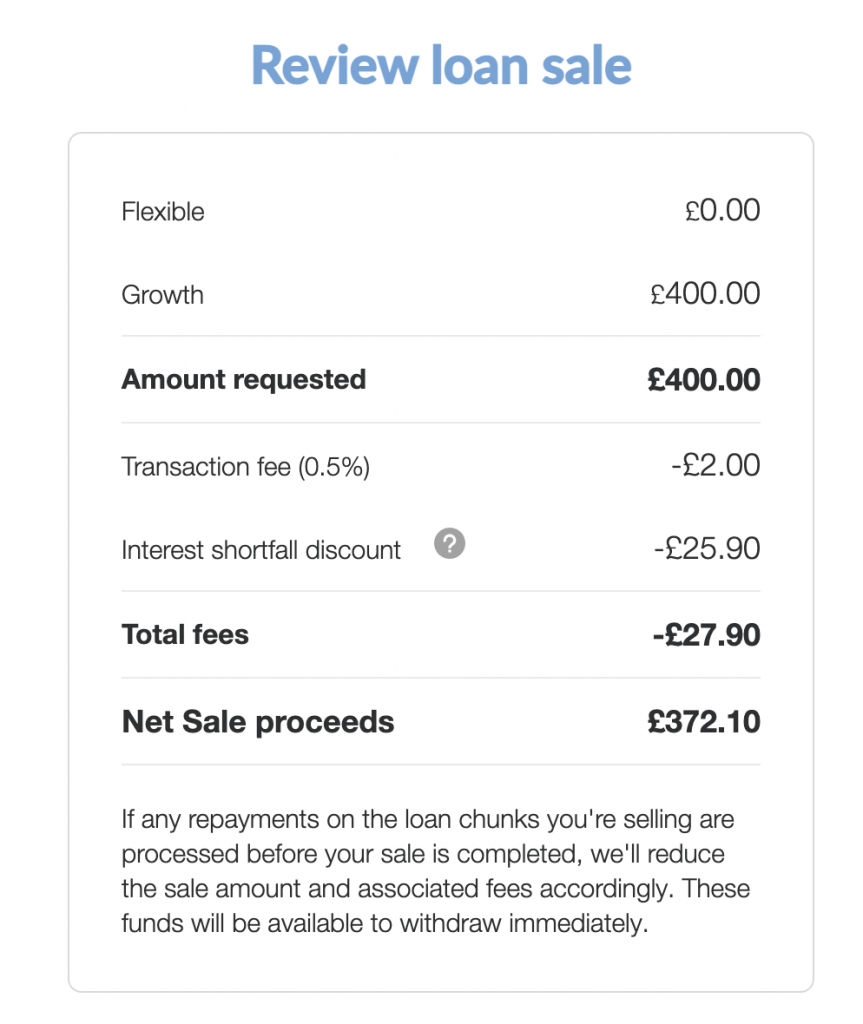

I did a test withdrawal on January 18th, 2022 and the fees for withdrawing were £400 pounds were £27.90 which is about 7% or 18 months worth of interest:

What Happens To ISA’s?

ISAs will need to be transferred to another ISA provider.

What Investing Products Did Lending Works Offer?

Lending Works offers two simple investing products. New customers saw the new products take effect on July 23rd, 2019 while existing customers saw the changes on August 6th, 2019.

Existing money within the three-year product will remain as is while all five-year product investments will be moved to the updated Growth product.

Growth (five-year product)

- Ideal for longer-term investors

- Money is invested across personal consumer loans from 2 to 60 months in length

- 0.5% fee for early exit (exit never guaranteed)

- All existing five-year investments will be moved to the updated product

The Growth product is the same as the current five-year product except the selling fee is being reduced from 0.6% to 0.5%. It’s important to understand exit is based on demand and supply and not guaranteed.

Flexible

- Ideal for shorter-term investors

- Money is invested across personal consumer loans from 2 to 60 months in length

- Zero fees for early exit (exit never guaranteed)

- All existing three-year investments will NOT be moved to the updated product but all new investments and repayments will be updated to new product

The Flexible product is similar to the existing three-year product but the biggest welcome change is the removal of exit fees should you want to access your money early. Lending Works is predicting investors will be able to exit in 48 hours providing there is demand for the loans. The exit time will always depend on demand and supply and is not guaranteed.

Important to note that existing investment in the three-year product prior to July 23rd will stay as is and the exit fee of 0.6% will remain. Any new investments or reinvestments will fall under the updated product.

Investors can set their account to automatically withdraw repayments to their bank accounts for income or automatically reinvest repayments and interest.

Both updated products are available in ISA and regular variants.

Is Lending Works Regulated?

Yes, by the Financial Conduct Authority #722801 under full permissions granted December 10th, 2016. Investments made through Lending Works are not covered under the FSCS (Financial Services Compensation Scheme).

FCA regulation is nothing like the FSCS, which covers consumers when they deposit money in banks. The FCA reports to the UK government and has the ability to pursue criminal action against companies that violate its standards and codes of conduct.

What’s The Minimum Investment?

£100 on regular or ISA accounts

Does Lending Works Offer An Innovative Finance ISA?

Yes. The ISA includes the same two products as the standard accounts.

How Much Interest Does Lending Works Pay Lenders?

During normal market conditions, lender return rates are variable and will update weekly. Normal annual rates are projected to be 4% (Growth product) and 4.5% (Flexible product) but that doesn’t account for the negative interest rate period you might have experienced due to Covid economic conditions.

How Does The Negative Interest Rate Work?

Lending Works subtracts negative interest payments monthly from all lenders’ accounts but the actual amount of lost interest isn’t easy to understand. Lending Works has stated that they expect to charge each lender an amount that is reviewed every three months.

Currently, loans from 2017 are seeing a -7% drop in returns and loans from 2018, a -3% drop.

This interest rate charge then contributes towards to Shield Provision Fund in order to make sure there is sufficient coverage for the increasing levels of defaults.

Lending Works told me that the first three months will likely be the worst in regards to how much money is withdrawn from your lending account. In November 2020, I saw a reduction of 0.4% of my capital.

Lending Works told me this negative interest period is temporary but they couldn’t tell me when it would end.

When Is Interest Paid?

During normal market conditions, interest payments are made to you when the borrower makes payments so therefore payments are staggered throughout the month.

What Are the Lending Works’ Bad Debt Rates?

You can view the loan statistics here.

What Are The Fees?

Negative Interest Rates: Lending Works subtracts negative interest payments monthly from all lenders’ accounts. Lending Works has stated that they expect to charge 2% to each lender with this amount being reviewed every three months.

Flexible Product: No fee

Growth Product: 0.5% exit fee. You may be charged an interest rate differential fee if current lender rates are higher than the lender rates of your portfolio of loans. Lending Works doesn’t explain how this fee is calculated. Here is an example of an exit fee:

How Long Are The Investment Terms?

Money is invested in loans from 2 to 60 months in length. Both the Flexible (free exit) and Growth (0.5% access fee minimum) products allow sale if buyer demand exists.

Loans are currently being run off and investors will receive capital and interest as loans are repaid.

What Security Does Lending Works Require From Borrowers?

None because currently, all loans are unsecured. You can read how Lending Works screens its borrowers to manage risk here.

Is There A Secondary Exit Market?

Yes but only during normal market conditions where Lending Works will try to sell your loan pieces to other investors. The Flexible product has a fee-free exit and the Growth product has a 0.5% exit fee of the amount you are selling.

Exiting is never guaranteed and can only occur if there is demand from other lenders wanting to buy loans.

Because of the Covid-19 situation, Lending Works froze all loan exits for several months to prevent a run on money which could have caused the company to fail. Now, this freeze has been lifted.

Be aware that if you have money invested in both the Growth and the Flexible account, you cannot place more than one loan amount up for sale at one time. I’m currently testing the exit times and will report back once complete.

What Happens If Lending Works Goes Out Of Business?

The FCA (Financial Conduct Authority) requires Lending Works to have a sufficient wind-down plan in place should it cease to operate. Lending Works has an agreement with Link Financial which would manage all loan payments to maturity.

The biggest issue with company failure is that the expense of the trustee and administration could significantly reduce the amount of recovered money paid to peer to peer lenders.

If Lending Works were to go out of business, there is an agreement with a third-party service provider to manage all loan agreements so interest payments are maintained. In addition to this, an administration company would work on behalf of the creditors (people owed money by Lending Works) and customers (borrowers) to recover as much money as possible. It’s important to know that we (lenders) are not considered creditors.

All monies in investor Cash accounts are ringfenced inside a Barclays UK account.

Be aware that the administration process involved in a company wind-down is expensive and lengthy and there’s no guarantee you would get your money back.

Though an unlikely occurrence, there are many unknowns that can occur when a peer to peer company goes out of business.

You can read about Lending Works’s wind-up plan here.

My General Experience

I have been withdrawing my funds from Lending works for several months. I have been receiving timely payments into my holding account which I have withdrawn into my bank account. Payments are received promptly so no issues as of yet.

I expect to receive most if not all of my investment balance as loans are repaid. I don’t plan on using the early exit feature as the fees are too high.

The Lending Works Conclusion

Lending Works used to be one of my favourite peer to peer lending companies but as with anything investing, things change. I believe the takeover by Intriva was a positive move for a company that might have been traveling in the wrong direction business-wise.

Now the hope is that all loans run off efficiently and investors receive their money back. From there, Lending Works can proceed to closing their retail peer to peer business and focusing on institutional money lines.

Thanks Lending Works, it was a fun ride.

If you enjoyed my Lending Works review and want to learn more about peer to peer lending, click here and receive my complimentary Top 5 Peer to Peer Lending Sites Report.

Disclaimers: I am not paid to write my reviews and I’m not employed by any of the companies I write about. In most cases, I have invested or continue to invest my own money through these companies. In order to keep the website financially viable, the sign-up links on this website are referral links and I do accept advertising in the form of banner ads. This advertising in no way influences my reviews and opinions. When you sign up for an account through my website, in some cases I receive a referral fee directly from the companies, at no cost to you. Your support enables me to continue to operate the Financial Thing website. You can read more about my referral links and banner advertising here.

** This page is for information purposes only. This information is not financial advice and has been prepared without taking your objectives, financial situation or needs into account. You should consider its appropriateness for your circumstances. All investing carries risks. Opinions expressed in this review are opinions based on my own personal experiences. The FSCS does not cover peer to peer lending and your capital is at risk. Please don’t invest more than you can afford to lose. **