** Updated January 17th, 2023 **

(This article is for information purposes only, I have no idea what will happen to the cryptocurrency prices in the future, I can only give my best opinion of what I believe will happen based upon my research and convictions. Do your own research, be informed, and make the best decision possible).

Cryptocurrency is a hot investment topic so I’m here to demystify this exciting opportunity and address all the common questions and concerns.

Article Summary

- What is Bitcoin, the oldest cryptocurrency, and why does it do

- What is blockchain and why I believe it’s the future of technology

- What are Altcoins and which one’s to consider

- What are the upsides and risks of cryptocurrency investing

- What the cryptocurrency myths are; are they true?

- Where to buy cryptocurrency and what are the fees

- What are NFT’s and are they good investments

- What is staking

- How to protect your cryptocurrency

If you have been watching my weekly YouTube live stream, you will know that I’m a big fan of Bitcoin as the asset grabbed my interest back in 2013 when it was merely a few dollars in price. Unfortunately, I didn’t understand what Bitcoin’s place was in the macroeconomic environment and I didn’t begin buying until 2017.

In 2022, the crypto market experienced another boom / bust cycle as it has in the past many times over. Several high profile companies went out of business due to various reasons and coins prices got trampled in the process.

But the fundamentals of cryptocurrency haven’t changed which is why I remain optimistic.

In this article, I’m going to explain what Bitcoin, cryptocurrency, altcoins and blockchain are, how you can invest and what the cryptocurrency investment upsides and downsides are plus more.

This article will explain the importance of this once-in-a-generation technology and asset class. If you’re not paying attention to cryptocurrency, the time to start is now.

Cryptocurrency certainly isn’t for everyone and is mostly misunderstood because it’s such a new asset class. If you take some time to understand cryptocurrency and basic macroeconomics highlighted in this article, you can decide if cryptocurrency fits your investment profile.

In this guide, I have also linked to other terrific cryptocurrency resources where you can learn more.

Where To Buy / Sell or Swap Cryptocurrency

There are many options to buy, sell and transfer your cryptocurrency to. Be aware that fees differ vastly between one crypto platform and another, and can change depending on cryptocurrency network fees, especially when you are withdrawing your coins.

For example, I tested a $100 Bitcoin withdrawal from Coinbase to Binance.us and the fee was 0.19%. I did the same withdrawal test from Binance.us to Coinbase and the fee was a whopping 50%! Some platforms also have a minimum withdrawal amount, for example, Binance has a Bitcoin minimum withdrawal amount of 0.001 Bitcoins (around $50 at a $48,000 Bitcoin price point).

My preferred platforms to buy and sell are:

Coinbase Advanced (Recommended)

** I highly recommend using Coinbase Advanced rather than Coinbase Simple to purchase your cryptocurrency **

Buy / Sell fee: Up to 0.6%

Debit card fee: Can only use bank transfer or wire transfer

Recommendation: Use bank transfer

Coinbase fees are complicated whereas Coinbase Pro fees are far more straightforward. I also recommend using bank transfer versus debit or credit cards as this will save you money in fees.

Fees are the same for £’s and $’s. The more you buy, the lower the fees. No fees to transfer regular FIAT currency into your bank account:

|

Amount |

Buy fee |

Sell fee |

|---|---|---|

|

Up to $10K |

0.50% |

0.50% |

|

$10K – $50K |

0.35% |

0.35% |

|

$50K – $100K |

0.25% |

0.15% |

|

$100K – $1M |

0.20% |

0.10% |

|

$1M – $10M |

0.18% |

0.08% |

|

$10M – $50M |

0.15% |

0.05% |

|

$50M – $100M |

0.10% |

0.00% |

|

$100M – $300M |

0.07% |

0.00% |

|

$300M – $500M |

0.06% |

0.00% |

|

$500M – $1B |

0.05% |

0.00% |

|

$1B+ |

0.04% |

0.00% |

Coinbase (UK or USA)

Coinbase fees: Coinbase has some of the highest fees in the industry so I don’t recommend using them to purchase. Use Coinbase Pro instead. When you open a Coinbase account, you automatically receive a Coinbase Pro account for free. No fees to transfer regular FIAT currency into your bank account.

Buy / Sell fee: 2.5%+

Debit card fee: 0.85% on top of buying fee

Recommendation: Use bank transfers and not debit or credit cards

Here are the Coinbase trading fees:

|

Total buy or sell amount |

Fee |

|---|---|

|

£10 or less |

£0.99 |

|

More than £10 and up to £25 |

£1.49 |

|

More than £25 and up to £50 |

£1.99 |

|

More than £50 and up to £200 |

£2.99 |

There are additional fees for paying with debit or credit cards. Sometimes these fees vary, I did a test purchase for £1000 pounds of Bitcoin using a debit card using Coinbase Advanced and the estimated fee was 0.6%:

If you use Coinbase Simple you’ll pay a much higher fee: of 3.8%

The fee to sell is 2.99% on Coinbase:

Coinbase also charges a 0.5% spread fee so you could end up paying more than 3.5% in fees when you buy or sell.

There are no fees to convert from one cryptocurrency to another.

Coinbase Advanced isn’t hard to use. Just look for the option in the trading screen:

Coinbase’s customer service is poor and they use a ticket system versus Binance’s live chat. Some people have difficulties with the identification verification checks but if you follow the instructions carefully, you will be fine.

Click here open a Coinbase account and receive £7 ($10) in free cryptocurrency when you invest £70 ($100). (Terms and conditions apply. When you open an account through my website, it helps me to continue to fund operational costs).

Binance

Buy / Sell fee: Up to 0.1%

Debit card fee: Up to 4.5%

Recommendation: Use bank transfer

Binance (Non-USA): New customers can receive 5% of their purchase fees back. Sign up here.

Binance (USA): Sign up for a free account here.

Binance does not charge spread fees. Binance’s website and phone app are not as user-friendly as Coinbases’s. Also in the UK, many banks are blocking deposits to Binance as they go through regulatory probing.

Binance’s online chat customer service is effective.

There are other platforms but those are the ones I prefer.

Alternative Platform Options

Again there are many different platforms that sell cryptocurrency so here are some alternatives and the fees.

Kucoin

Kucoin is a platform that sells a wide array of cryptocurrencies that other platforms don’t always sell. Kucoin’s buy and sell fees are some of the lowest in the industry but the withdrawal fees can be hefty.

Buy / Sell fee: 0.072% and lower (the more you trade the lower the fees)

Withdraw fee: Check here

Revolut

UK: Buy / Sell fee: from 1.5% to 2.5%, debit card fee: Up to 2.5%

USA: Various monthly subscription plans with buy / sell fee: from 1.5% to 2.5%

Revolut is an easy option to buy and sell cryptocurrency especially if you already have an account. I do like the fact you can withdraw your coins from Revolut to an external wallet. Currently, Revolut offers Bitcoin, Bitcoin Cash (not recommended), Ethereum, and Litecoin.

You can view Revolut’s latest fee schedule here

eToro:

Buy / Sell fee: Up to 4.9%

Debit card fee: None

eToro charges spread fees for trades which vary depending on which coin you want to buy. Bitcoin’s spread fee is 0.75%, Ethereum 1.9%, and other coin spread fees are as high as 4.9%.

You can vie Etoro’s trading fees here

Crypto.com:

Buy / Sell fee: Starts at 0.4% per trade and drops the more you purchase

Debit card fee: 2.99%

Recommendation: Use bank transfer

Kraken:

Buy / Sell fee: 1.5%

Debit card fee: 3.75% of the total purchase

Recommendation: Use bank transfer

0.5% online bank transfer fee

Paypal:

Buy / Sell fee: Up to 2.3%

Debit card fee: None

PayPal charges a spread fee based on the trading prices. Currently, you cannot withdraw your coins to an external wallet.

Cashapp (USA only):

Buy / Sell fee: Up to 2.5%

Debit card fee: None

Only Bitcoin is available

Venmo (USA only):

Buy / Sell fee: 2.3%

Debit card fee: None

2.3% fee which decreases the more crypto you purchase. $0.50 min fee. Currently, you cannot withdraw your coins to an external wallet.

Robinhood (USA only):

Buy / Sell fee: None

Debit card fee: None

Now that you can transfer your crypto from Robinhood to a hardware wallet, Robinhood is a good purchase platform offer for U.S. customers as there are no trading fees. Robinhood makes money between the spreads of the trading prices but be aware Robinhood sells your trading data to investment institutions.

VERY IMPORTANT!! –> Not your keys, not your crypto!

If you don’t own your cryptocurrency keys, you don’t own the actual cryptocurrency. Nearly all platforms allow cryptocurrencies purchases with the option to transfer to a hardware wallet.

I recommend only using platforms that allow you to withdraw your actual coins.

Be aware that some platforms allow withdrawal of some coins and not others but let’s stick to Bitcoin for now for example.

Major platforms that allow you to withdraw your Bitcoins are Coinbase and Coinbase Advanced, PayPal, Robinhood, Binance and Binance.us, Etoro, Huboi, Kraken, Cashapp, Kucoin, and Bitfinex.

I highly recommend purchasing a hardware wallet and transferring all of your cryptocurrency so it is off the platform you bought it on.

External Wallets

I will cover external wallets later in this article. I think it’s important to know the difference between online (hot storage) and offline (cold storage) wallets, how they work and why you would want to store your cryptocurrency in this manner.

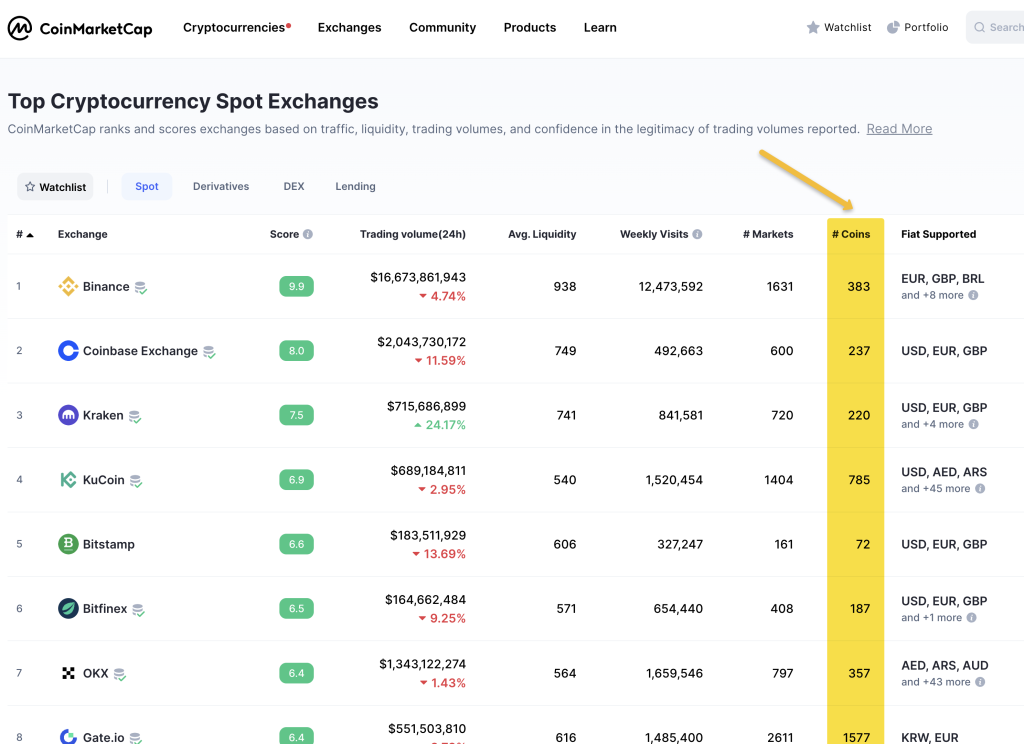

Not all platforms offer all cryptocurrencies

There are hundreds of alternative platforms to purchase on, the largest being Binance, Coinbase and Kucoin. It can get confusing though, for example, Binance.com offers different coins to buy and sell than Binance.us which is essentially the same company operating in different countries. The difference in coin offerings is due to regulatory procedures in differing counties where the platforms operate.

Some smaller market cap coins are not available on any of the standard platforms, you will have to use decentralised exchanges such as Uniswap or Sushiswap to obtain these coins. I do not recommend using swap exchanges for beginning investors, but if you do want to try, use a small amount of crypto to exchange until you become comfortable with the process. There are many YouTube videos explaining the process.

Coinmarketcap lists over 12,000 coins and will show you which exchanges and platforms offer each coin. Just click on the coin you want to buy and scroll down to the Markets section:

Buying and selling on decentralised exchanges

Decentralized exchanges cut out the middle man and provide liquidity from transaction fees and pools. These exchanges only allow you to swap coins, not buy them using fiat currency like £’s or $’s.

Some cryptocurrencies aren’t sold on the major exchanges and can only be obtained through decentralized exchanges. Decentralized exchanges aren’t particularly easy to use because you need to connect external wallets to make a transaction. The good news is there are plenty of YouTube videos walking you through the process.

In order to use these decentralized exchanges, you first need to buy coins such as Ethereum, Binance (BNB) or Tether on platforms such as Coinbase, and then exchange or swap for other coins.

Below is an example of an Ethereum to Chainlink exchange on Uniswap. You can see the fees changing based on price movements and transaction volumes:

The main decentralized exchanges are Uniswap, Pancake Swap, and Sushiswap. Each exchange supports different coins and liquidity is provided by pools funded by transaction fees.

Cryptocurrency 101 – Start Here

What is Cryptocurrency?

Cryptocurrency is a secure, cryptography-based currency that exists within computer networks. When payments are made between two parties, they are made directly between the parties rather than passing through a third party. The transaction is permanently logged on a public ledger for anyone to view and cannot be changed (unless a privacy cryptocurrency like Monero is used).

Cryptocurrency aims to reduce transaction fees and increases transaction speed, especially internationally, while keeping the banks and credit card companies out of the transaction.

What is Blockchain?

Blockchain is a cryptographic open and decentralized database that can store any value transactions such as money, real estate, goods, contracts, or even votes. These transactions can be verified by the entire community and viewed by anyone.

So What is Bitcoin?

Bitcoin is a decentralized open-source software cryptocurrency. Yes, that’s correct. This digital coin that is worth tens of thousands of dollars is just a piece of software. The software is an extremely complex set of numbers, code, and protocols controlled by all Bitcoin users around the world.

Bitcoin can be sent to anyone who owns a Bitcoin wallet address or used as a payment where accepted.

Who Created Bitcoin And Why?

Bitcoin was created by an anonymous person or group named Satoshi Nakamoto. To this day there are many theories about the identity of the creator(s) but still, this remains a mystery. One man, Dan Pena, believes Vladimir Putin created Bitcoin. I think he’s mistaken.

Bitcoin was created to provide borderless decentralised payments between two parties that could be simply verified via cryptography rather than by financial institutions. But Bitcoin has evolved into much more. Read on.

You can read the original Bitcoin whitepaper here.

What Was Bitcoin’s Starting Price

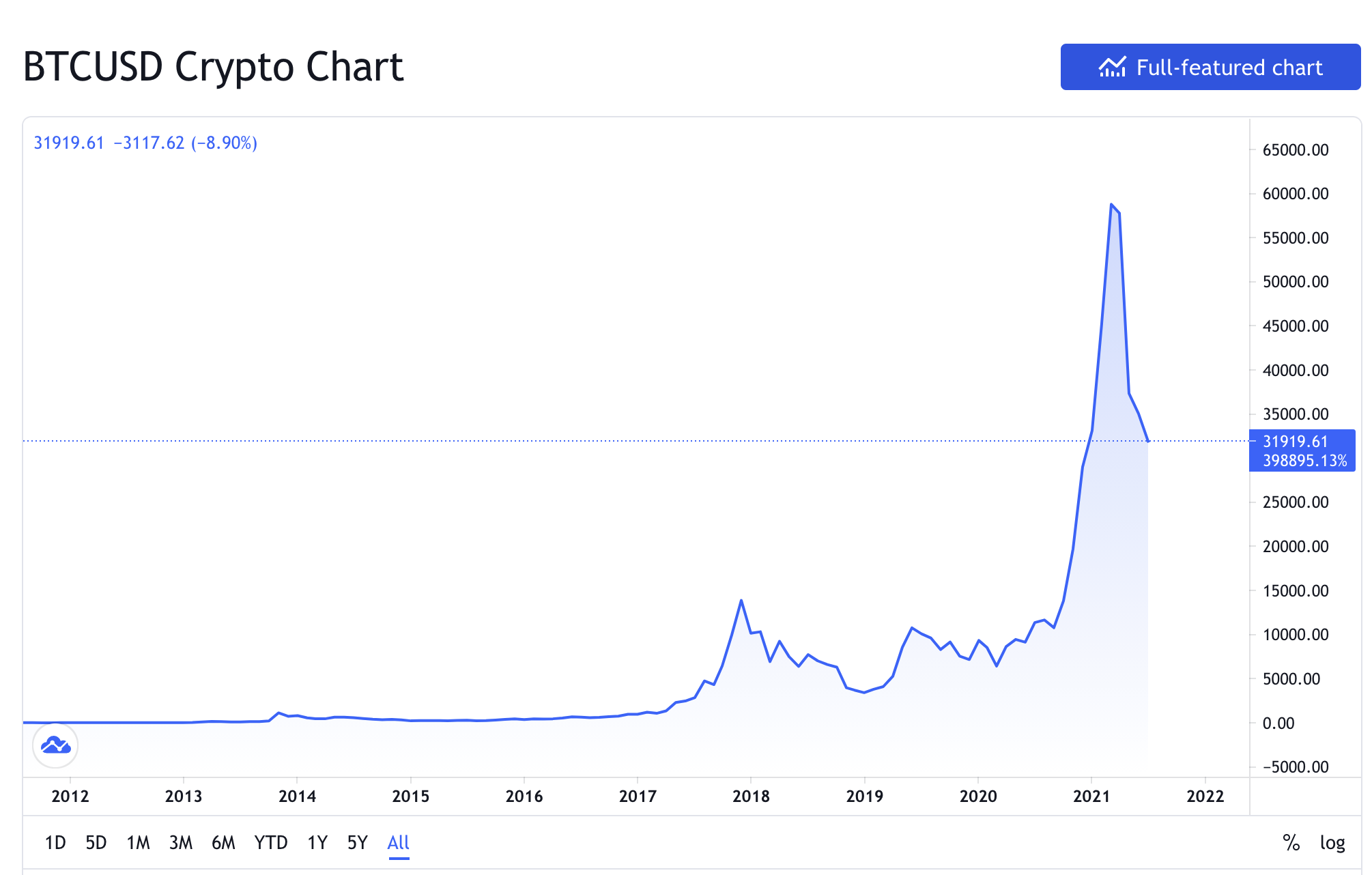

Bitcoin began trading at approximately $0.0008 in mid-2010 but was worth zero at its release in 2009.

What Will Bitcoin’s Price Be In The Future?

No one knows and anyone who claims to know is just guessing. There are many Bitcoin believers who guesstimate the future price will be upwards of $500,000 to $10 million per coin. Bitcoin’s price is based purely on demand and supply, so it’s impossible to estimate what the Bitcoin price will reach or fall to. Bitcoin’s adoption and reducing supply should certainly increase the price but nothing is guaranteed.

Personally, I believe a future Bitcoin price of $500,000 – $1 million is completely reasonable. My opinion is based on future adoption which is growing at over 100% per year and Bitcoin’s market cap.

Is It Too Late To Buy Bitcoin?

Absolutely not. We are in the very early stages of the adoption of cryptocurrency at only 140 million users which is still extraordinary growth for a new asset launched in 2009. But Bitcoin’s adoption rate is growing faster than the Internet adoption rate and it’s estimated to reach 1 billion people by 2025.

It took the internet 7.5 years to grow users from 140m to 1 billion. It will take Bitcoin just 4 years to do the same based on current adoption numbers.

Bitcoin’s adoption rate is increasing by 114% per year versus the internet which increased by 65% per year

You can read more about adoption rates here.

If this adoption rate is accurate, the price of Bitcoin should just keep going up as its price is based purely on demand and supply. Eventually the there will not be enough Bitcoin for everyone to own as the supply is decreasing.

But Isn’t Bitcoin Too Expensive To Buy Now?

Bitcoin isn’t too expensive. I remember thinking that Bitcoin was way too expensive at $3,000. I couldn’t imagine buying any at $12,000 and the thought of buying at $28,000 was ridiculous. I was wrong on every count.

We don’t know what the price of Bitcoin is going to be in the future, but if you believe in what you are buying, the pricing won’t matter. I have purchased Bitcoin at prices of $15,000, all the way up to $59,000. If the price of Bitcoin reaches six or seven figures, I will be wishing that I could’ve bought more at five-figure prices.

Why You Should Cost Average

Since you can buy small amounts of Bitcoin because of its divisibility, cost averaging makes the most amount of sense.

Cost averaging is where you purchase monthly or weekly. This is a strategy that has been used to buy stocks and index trackers for a long time. Most people set up automatic monthly investment purchases so they don’t have to worry about market timing. When you cost average you buy through the high and low prices making price fluctuations less significant.

Here’s an example of how cost averaging $10 per month into Bitcoin over three years would have resulted in $360 of principal being worth $1483 or 312% in gains:

(Source calculator)

Tell Me More About Bitcoin Being Decentralized

The word decentralized is often misunderstood in the cryptocurrency world. Decentralized means the bitcoin is not controlled by any single entity, person, government or company. Bitcoin is controlled by all of the Bitcoin users throughout the world.

Other coins like Euthereum and Litecoin are decentralized to various degrees, but none as much as Bitcoin.

How Many Bitcoins Exist Or Will Exist?

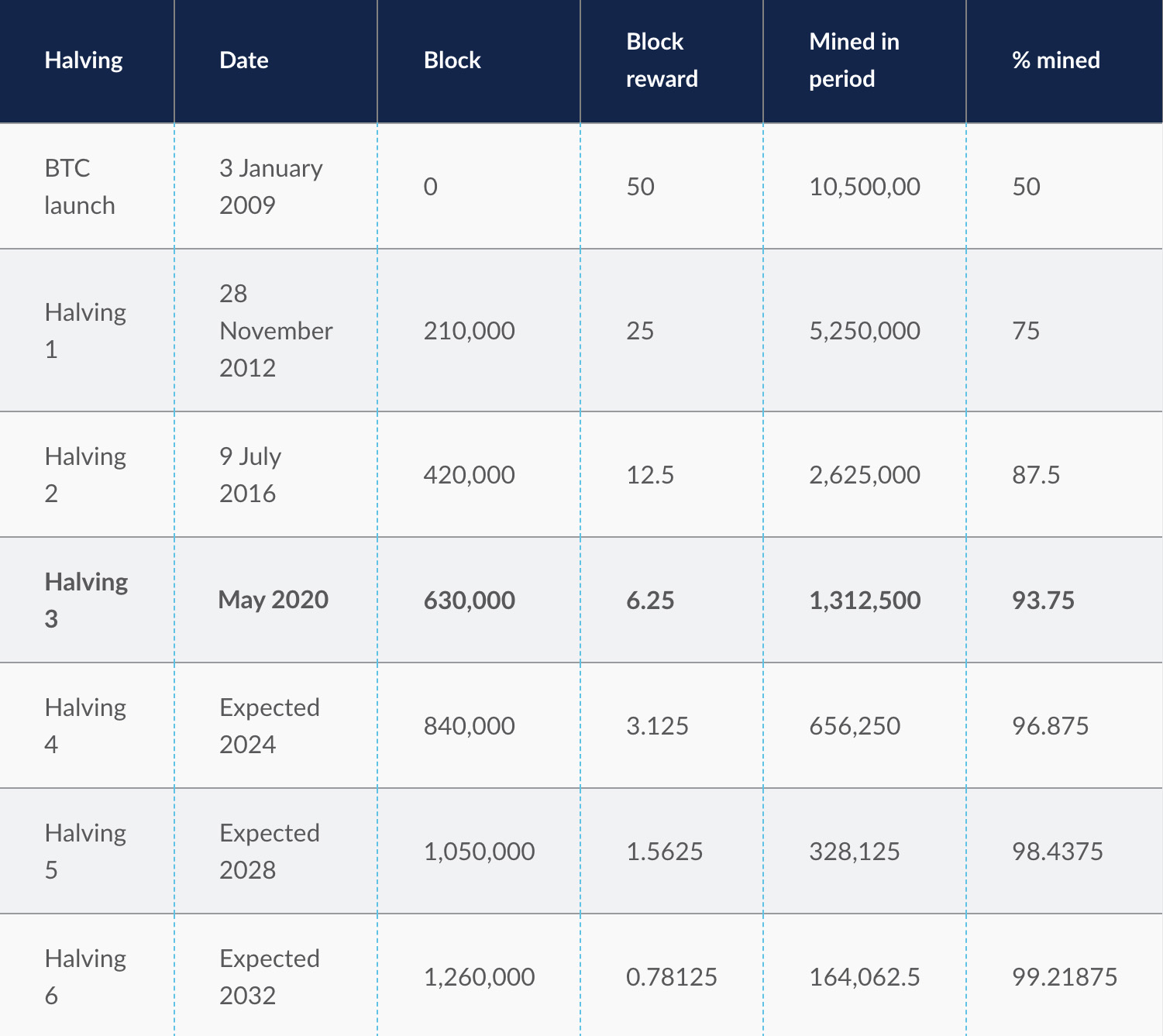

One of the beauties of Bitcoin is the limited supply amount of 21 million. At the time of writing, 19,265,210 Bitcoins have been mined. 6.25 Bitcoins are available to be mined every 10 minutes. In 2024, this amount will halve and halve again every four years until 2032 when the halving will end. The final Bitcoin should be mined in 2140. Once 21 million Bitcoins have been mined, the supply will end.

Can The Total Circulation Amount Of Bitcoins Ever Be Changed?

In theory yes it could, but changing the circulation would require mass adoption and changes to Bitcoins source code adopted by developers and thousands of users. This would be very unliked as changing Bitcoin’s circulation limits would have a negative effect on Bitcoin’s fundamentals, price, and reason for ownership.

What Is Bitcoin Mining?

Mining is how new Bitcoins are created within blocks. Miners use powerful computers to solve a complex math equation to compete for blocks (Bitcoin) which help secure the Bitcoin network. these miners are rewarded with Bitcoin blocks or pieces. Blocks are made up of random 64 characters named “hashes”. Once the hash equation has been solved and the block has been mined, it is locked in the Bitcoin blockchain and cannot be changed.

Think of these blocks as complex passwords that are being solved.

Large companies own thousands of computer mining computers, some are public companies listed on stock exchanges such as Marathon Digital Holding and Riot.

Can Bitcoin Miners Change The Circulation Amounts?

No, because miners do not control the network or Bitcoin’s rules and any major changes to Bitcoin have to be adopted by tens of thousands of users. There have been cases where miners have voted to allow Bitcoin to scale in size but this was denied by users and nodes.

What Is Halving?

Bitcoin’s source code includes algorithms that release half the amount of blocks every four years or 210,000 blocks. A block on the Bitcoin Blockchain is a 1MB file of Bitcoins transaction records.

The final halving is expected to occur in 2032 and from there, the last Bitcoin should be mined in the year 2140.

This halving protocol is written into Bitcoins software code and cannot be altered unless done so by the majority of miners and users running nodes.

Why is Halving Good?

As Bitcoin mining is halved every four years, Bitcoins become more costly to mine because less are being released as mining rewards while mining costs may increase through electricity, computer, and operational costs. Halving in theory makes Bitcoins more valuable as a result of scarcity.

Halving is an action that confirms Bitcoin’s deflationary nature since extra Bitcoins can’t be printed indefinitely as fiat currency can be.

Can You Mine Your Own Bitcoin Or Other Cryptocurrencies?

Any cryptocurrency that is based on proof of work can be mined. Such coins are Bitcoin Ethereum, Litecoin, Monero, Dash, and Dodge coin. You can mine any of these coins but you will need a powerful computer rig that will consume electricity and you need a cool room and access to cheap electricity. Efficiently powerful cryptocurrency mining rigs cost upwards of $3,000 each and have to be optimally configured with good GPU’s. Here is an interesting YouTube video of someone who purchased $34,000’s of Bitcoin mining rigs.

Watch the Malaysian government crush Bitcoin mining computers:

What Happens After Cryptocurrencies Are Mined?

Once Bitcoins are mined, they are either kept by the miners or sold on the open markets for FIAT currency.

What Is The Difference Between Proof Of Work And Proof Of Stake Coins?

Proof of work currencies are coins that can be mined by anyone as mentioned above. Miners are rewarded by solving complex math equations to create new blocks which therefore create new coins. These proof of work miners can also verify transactions and are paid fees to do so.

Proof of stake cryptocurrencies transactions are verified by coin holders who stake their coins for compensation. Think of staking as locking up your collateral, and for doing so, your collateral is used to verify transactions for which you are awarded via an annual percentage interest which is paid in the form of extra coins.

Should I Stake Coins?

Cryptocurrency staking is a way to earn income from coins that you already own. Some staking rewards pay double-digit interest returns that pay you in the form of the cryptocurrency you stake, so it is a form of compounding interest that is very powerful. For example, the cryptocurrency HEX pays up to 40% per year if you are willing to lock away your coins for over five years.

However, there are some things that you need to know before you stake your coins.

Some coins such as Ethereum, require you to lock away your coins for a certain period of time, meaning that your coins are inaccessible should you need to liquidate them. This will change as Ethereum 2.0 is released and now Ethereum has changed from a proof of work to a proof of stake coin.

Other companies such as Binance and Kucoin offer staking of various coins without any lock-in time. The only drawback is if something were to happen to the staking company, then your coins could be at risk. When you stake your coins through platforms, you no longer have ownership of those coins as they are now controlled by the company you stake through.

Investors who held large staking balances in Celsius and FTX and feeling the pain as these companies have gone out of the business taking investors cryptocurrency. Remember, if you don’t have your crypto on your own wallet, it is at risk.

These staking companies are able to pay you an interest rate because they lend your cryptocurrency to traders as loans.

Different coins pay different staking rewards, some rewards are very high but be aware, the more interest you’re being paid, the higher the risk might be.

You can also stake through hardware and browser-based wallets which means you have more control over your coins. Some wallets only offer staking for certain coins so you’ll have to research and be sure not to send coins to a wallet that isn’t supported as you’ll lose the coin. Ledger, Trezor, Algorand, Exodus, Atomic, Trustwallet and Terra Station are some good places to stake.

What Are The Risks Associated With Staking?

Staking is still a relatively new form of investing that comes with risk because staking pays you interest returns. We know any time you are paid interest returns for an investment, there are risks. When you stake a coin it is used by the staking company or pool in various ways but mostly to lend money to other investors who are trading cryptocurrency or for liquidity.

The biggest risk of staking is that the company you give your coins to stake goes out of business and you lose your coins.

Due to the high profile failures of Celsius, Gemnini, Blockfi and FTX, I don’t recommend platform staking.

Personally, I started staking coins through Binance and Celsius in 2021. I took a small percentage of certain coins that I was willing to risk. Unfortunately all of of my Celsius coins were lost due to the company failure.

The other risk is if you have to lock in your coins for a certain amount of time, if the market falls severely you cannot sell your coins. This might not be so much of an issue if you are planning on holding coins long-term.

So If Bitcoin Was Originally Intended As A Payment Currency, Why Is It Now Considered A Store Of Value Or Investment?

After the 2008 financial crash and bank bailouts, people began to wake up to how much control governments and financial institutions have over our economy. The increase of government control and money printing (aka “stimulus”) has made it clear that a decentralized digital currency that cannot be controlled by governments or financial institutions is an essential inflation protection investment.

Bitcoin started as a payment system but is now widely being used as a store of value because it is deflationary….let me explain.

Bitcoin is Deflationary, Standard Currencies Such As $’s and £’s Are Not. Explain?

Inflation is when the costs of products, goods, and services rise. Deflation is the opposite. Bitcoin is deflationary because it has a limited supply of 21 million coins, unlike government currencies that have unlimited supplies due to government money printing.

When governments print money, this causes inflation. The worse cases of this were Germany in the 1920’s and currently in Venezuela where inflation reached 28.5% in May 2021. Cash in those two situations became worthless because of hyperinflation.

We are currently seeing inflation spikes (over 5% annually) in the USA and 2.5% in the UK due to the trillions of $’s of stimulus that is being pumped into economies due to the Pandemic. Governments in the USA and UK attempt to keep inflation around 2% annually. When the government prints a pound or a dollar, due to inflation that currency is worth about 2%+ less a year into the future.

If you hold cash in a regular 2% inflationary environment, in 10 years, that cash will have approximately 20% less buying power. Worse if inflation is higher than 2% annually.

Since Bitcoin is a decentralised currency that isn’t controlled by anyone, it has historically protected against inflation by rising in value 200% annually since inception and has therefore created an increase in buying power.

Bitcoin Is Always Evolving

Bitcoin was first released as a payment solution in 2010 but that’s not what Bitcoin is primarily being used for today. Bitcoin is being used an inflation-fighting savings/investment tool. Bitcoin will evolve into many other things as time passes.

In its current state, Bitcoin cannot handle millions of small payments per second like Visa or Mastercard. Bitcoin relies on its peer network to validate transactions, removing any central authority (like Visa or the government).

But Bitcoin is very useful for sending payments.

Currently, if you want to send an international wire transfer, the transaction is slow, requires various financial checks and can be costly. Companies like Wise have made this process cheaper and faster but the process still isn’t ideal. If I want to send someone a payment in Bitcoin, the transaction can usually be confirmed and received within 10-30 minutes but sometimes as fast as 1 minute depending on the size.

Because Bitcoin is being authenticated by thousands of peer networks (proof of work), 24 hours a day, settlement can occur outside of banking hours without multiple layers of verification.

Bitcoin’s payment system will evolve and become faster as its technology and infrastructure advances but it is not designed to be Visa or Mastercard.

If you are old enough to remember the Internet’s beginnings, you will recall dial-up modems running at 56k speeds, basic ICQ chat functions, and slow email.

In 2023, it’s hard to imagine life with no internet. Shopping, investing, researching, entertainment, travel planning, communication, and navigation are all conducted on the internet in ways we couldn’t have imagined 40 years ago.

Bitcoin is always evolving and 20 years from now, its function and usage may be very different from what it does today. This is very exciting.

Bitcoin Myths And FUD

If you’ve read the news or Elon Musks tweets about Bitcoin, you’ll have seen some arguments such as:

- Bitcoin is terrible for the environment as it uses too much electricity

- Bitcoin is untraceable and used by criminals for money laundering

- Bitcoin will be banned by governments

- Bitcoin is too volatile

- Bitcoins is too expensive to be useable

- Bitcoin has no value

- Bitcoin can be hacked

- Someone can buy all the Bitcoin and control it all

In the cryptocurrency world, there is a saying called FUD. The means Fear Uncertainty and Doubt. FUD is spread by such people as the mainstream media (many articles are paid to be written by financial institutions), Central Banks (they don’t want you owning cryptocurrency for various reasons explained below), and Bitcoin whales (billionaires who want to manipulate the prices to buy more).

Many myths are in fact FUD. Below I will look at each of these myths and link to resources that objectively consider these myths.

FUD: Bitcoin is terrible for the environment as it uses too much electricity

When we consider that Bitcoin is an entire monetary ecosystem produced in the digital age, electricity will be a part of its growth story. Bitcoin is mined using electricity but its actual impact on the environment is debatable.

There are estimates that state 40-70% of all Bitcoin is mined using renewable energy. That number should increase in the future.

Bitcoin’s energy usage is estimated at 110 Terrawatts Hours per year (a number I think is hard to estimate) which is 0.55% of the world’s electricity production. You may view this number differently depending on how you view Bitcoin. For those with a negative view of Bitcoin might see this usage number as outrageous. For those who view Bitcoin as a way to avoid inflation, government, and financial institution control then this electricity usage would be viewed as essential.

Chinese Bitcoin miners have been responsible for up to 50% of the world’s Bitcoin mining. China has now banned Bitcoin mining, not because of environmental issues but because the government wants complete control over its currency through the digital Yuan. Since the ban, Chinese miners are relocating to countries with cheaper green energy mining. This will help lower the carbon Bitcoin mining imprint.

There have been stories stating how Bitcoin uses more electricity than small countries which has been used to spread a negative Bitcoin narrative. Even Elon Musk bought into this narrative and tweeted his thoughts.

While Bitcoin does use energy, its carbon footprint is hard to accurately assess however it’s estimated that Bitcoin usage and mining emits 0.12% of global carbon dioxide levels.

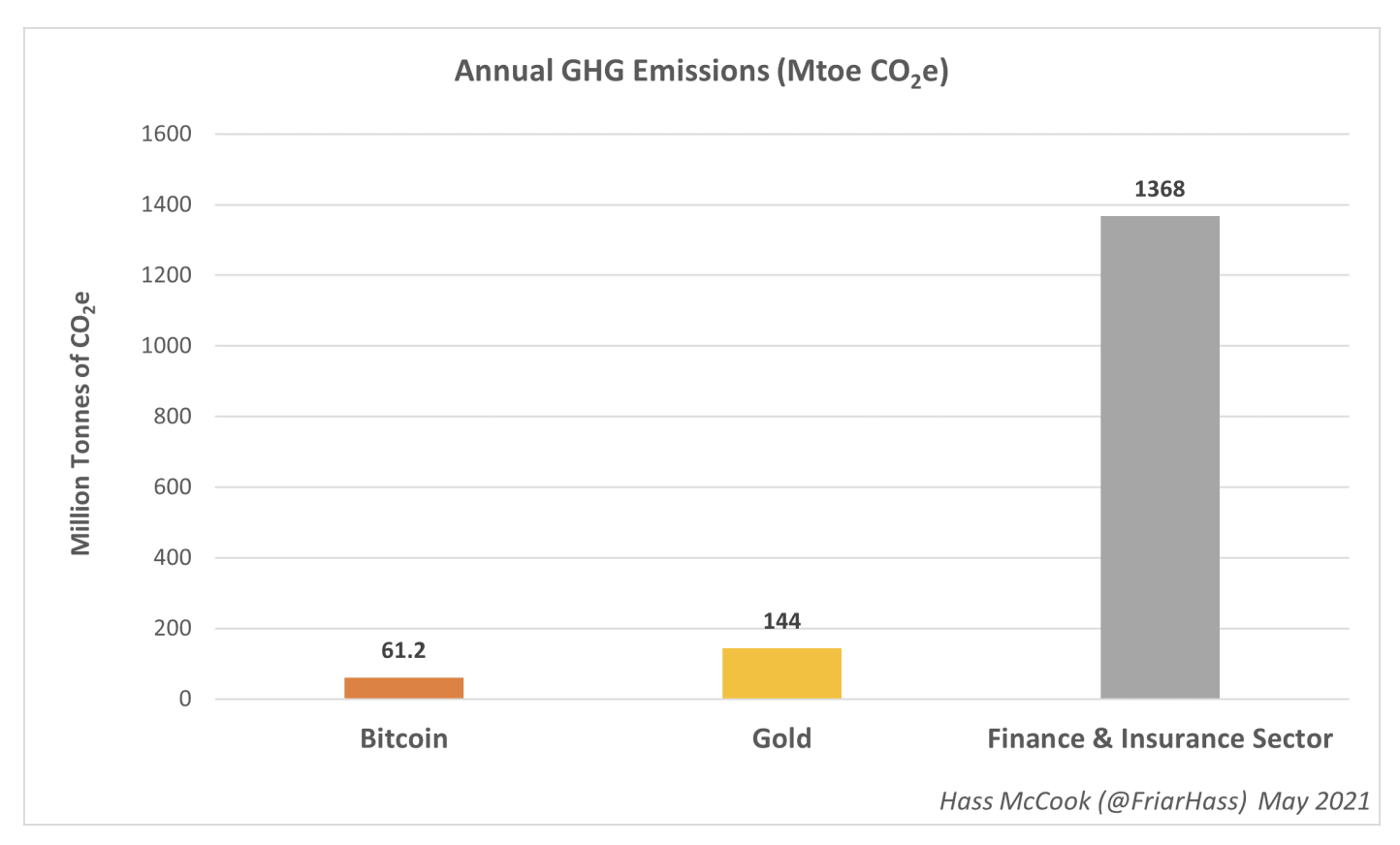

Bitcoin is actually more efficient than both banking and gold mining:

The majority of Bitcoin’s energy usage is because of mining. Bitcoin miners have an incentive to use the cheapest and cleanest energy to reduce mining costs. Many miners are turning to hydroelectric, solar, and other renewable energies.

The consumable items we use daily such as electric / petrol cars, phones, computers, banks, and airlines are far more damaging to the world’s carbon footprint versus Bitcoin.

The resources it takes to manufacture one bank of Tesla car batteries is very harmful to the earth

The news media would rather have you believe otherwise.

The Cambridge Bitcoin Electricity Consumption Index Chart is a live view of estimated Bitcoin network power demand.

FUD: Bitcoin is untraceable and used by criminals for money laundering

Bitcoin was tarnished in its early years when it was used to purchase illicit items on the infamous Silk Road website which was shut down by the FBI in 2013, long before Bitcoin’s mainstream rise. I’ve been hearing this argument ever since I started looking into Bitcoin in late 2012. Yes of course cryptocurrency has and will be used by criminals and saying otherwise would be silly. However criminal usage of cryptocurrency is a fraction when compared to the traditional US$ for example:

According to an in-depth 2021 report by Chain Analysis (read here), the criminal share of all cryptocurrency transactions was just 0.34% in 2020.

Other issues are leading to the negative narrative on Bitcoin’s criminal use. In 2021, we have seen an increase in ransomware use with criminals blackmailing companies asking for payment in cryptocurrency.

While ransomware is certainly an issue, company cybersecurity should be under more scrutiny for allowing their networks to be invaded at all. If the criminals weren’t asking for payment in cryptocurrency, they would still get paid through other means.

There are many myths concerning Bitcoin being untraceable. This isn’t true. Every Bitcoin transaction is entered into a public ledger here.

You can view how many coins were mined, their value, and extra rewards paid as fees for transactions within a block:

Bitcoin transactions are no more hidden than stock trade transactions.

In 2021, the American Colonial Oil Pipeline was infected by ransomware and criminals asked for a payment of 75 Bitcoins to resolve the issue. The payment was made but the FBI was able to retrieve some of the ransom payment by taking over the computer server where the Bitcoin wallet existed.

Here is the actual Bitcoin wallet where the ransom payment was sent.

“You can’t hide behind cryptocurrency,” said Elvis Chan, assistant special agent in charge of the cyber branch of the FBI’s San Francisco field office.

Here’s an interesting Wall Street Journal article about how the FBI is able to trace criminal cryptocurrency transactions more easily than cash transactions.

FUD: Bitcoin will be banned by governments

I hear this statement often and I agree, Bitcoin will be banned by some governments in an attempt to control their currency but I doubt these countries will be in the developed world, and nor will these bans matter short term.

Bitcoin isn’t owned by anyone and can’t be controlled by anyone so even if some governments ban Bitcoin, it will continue to evolve and grow.

Currently, Bitcoin represents a $1.5 trillion market cap, significantly smaller than gold’s market cap. Developed countries don’t see Bitcoin as a threat because its market cap is still relatively small. When Bitcoin’s market cap becomes significant, Bitcoin will have grown and become widely adopted by people and companies throughout the world and at this point, Bitcoin will be too difficult to ban.

But let’s say that a developed world government such as the United States or UK did try to regulate or ban Bitcoin. Would you rather be invested in an asset that has grown so much in value that a government views it as a global economic threat or a nonowner through fear that regulation might happen?

If a Bitcoin ban were to be attempted by a developed countries government, the free choice rights of companies and people would be taken and it would be hard to imagine these bans being accepted without massive opposition.

Some people claim that if Bitcoin is banned, its value will fall to zero. When gold was restricted in the 1930’s, this did not cause an impact on its value, or its extinction as a store of value.

If countries came together to ban Bitcoin, its legitimacy as a global store of value would be shown to the masses. The only reason governments ban something is because of disruption and fear used with “protecting the people” rhetoric.

Governments protect their “people” when it monetarily suits the people in power. If that weren’t true, then gambling, cigarettes, Coke, sugar, sweets, firearms, alcohol, and drugs would all be banned.

The problem with banning something is that it makes people want it more. We have seen countless historical government bannings and reversals:

- In 1920, the U.S. banned the sale and consumption of alcohol

- In 1934, the U.S. government banned citizens from owning more than a limited amount of gold.

- In 1970, cannabis was outlawed in the USA

- In 2018, the UK government allowed medical cannabis

There have been talks of some countries proposing bans on Bitcoins (India for example), and other that have banned cryptocurrencies such as Turkey, Nigeria, Bolivia and Ecuador. Most other countries ban talks never materialize.

Corporate companies such as Tesla, Microstrategy, Square Inc, and Grayscale own large amounts of Bitcoin, and financial companies such as Visa and Mastercard are implementing cryptocurrency on their networks. Fidelity, Blackrock and Vanguard all own large stakes of shares in cryptocurrency mining companies such as Galaxy, Riot and Marathon.

Cryptocurrency funds have already gained Global popularity with over $40 billion invested. Currently, Bitcoin Futures ETF’s exist but many spot EFT applications have been filed in the USA by companies such as Van Eck, Invesco and ProShares. Once the SEC inevitably approves the ETF’s, it is very unlikely the government will ban cryptocurrency.

Some countries continue to hold confiscated Bitcoin in their Treasury, such as Bulgaria. It’s also possible that other countries own Bitcoin in their government treasury but this is hidden because any public news of such an event would cause the Bitcoin price to skyrocket.

Countries such as Australia, Portugal, Switzerland, El Salvador and Germany are crypto-friendly and the UK is a leader in alternative finance.

Many countries will begin to adopt their own digital currencies which will bring Bitcoin further into the mainstream

There is always a chance that bans can happen, but I believe the chances of Bitcoin being banned by developed countries is minuscule.

FUD: Bitcoin is too volatile to be an investment

Bitcoin has seen some volatile movements since its creation, the volatility is and will continue to decrease over time and I believe this volatility is a good thing because volatility can be profitable.

Any investor has to accept for growth to occur on investments, risk must be present. If you don’t like risk, then you must hold cash (which loses value to inflation) or low-yield treasury bonds (which won’t return much and will lose to inflation).

Ask investors how their Amazon stocks have performed over the last 20 years. Amazon stock was once seen as wildly speculative and volatile but smart investors knew the risk involved and were rewarded for long-term holding.

Volatility is a result of Bitcoin’s monetary policy because Bitcoin limits the money supply growth while allowing capital free flow:

(Source: Ark Investments)

Bitcoin’s volatility has rewarded investors with over 200% of annual returns since its release. Most of us didn’t invest in Bitcoin from its birth, but Bitcoin pricing entry opportunities have been presented over and over again because of its volatility.

Imagine if Bitcoin wasn’t volatile and its price just went up. Psychologically, we wouldn’t want to invest because we would always consider it to be too expensive.

Bitcoin’s highs allow current and potential investors to see the price potential while the lows allow entry buy and hold opportunities. For this reason alone, Bitcoin’s volatility is a good thing as long as you buy and hold for the long-term.

FUD: Bitcoin is too expensive to be usable

Since Bitcoin can be divisible by up to 8 decimal places (Satoshis), it is purchasable and sellable in very small increments that will be manageable no matter how high the value of Bitcoin reaches.

FUD: Bitcoin has no value

Parker Lewis’s brilliant article explains why Bitcoin has value:

“Contrary to popular belief, bitcoin is in fact backed by something. It is backed by the only thing that backs any form of money: the credibility of its monetary properties.”

(All of Parker’s articles are recommended reading).

When FIAT currencies like the £ and $ were created, they were systems based on trust. For example, the $ was accepted based on the trust that it could be exchanged back to gold at a value in the future. Gold ultimately failed as a monetary system as fiat currency became widely adopted and used.

Bitcoin is a new type of investment that is still very young. Despite that, countries such as El Salvador are adopting Bitcoin as legal tender. More countries will follow.

Bitcoin contains properties that make it valuable including:

- Limited Supply: Only 21 million Bitcoins will ever exist and more cannot be created for financial gains as FIAT currency can. It is estimated that out of the close to 19 million Bitcoins mined, three to four mllion have been lost and only 2.5 million Bitcoins are on exchanges for purchase like Coinbase and Binance.

- Exchangeable: Bitcoin can be exchanged with others for things of value. Many individuals now accept Bitcoin as a form of payment and Bitcoin can be used to purchase other coins.

- Divisibility: Bitcoin can be divided by up to eight decimal places (or one Satoshi) so this allows anyone to purchase Bitcoin in smaller amounts. As Bitcoin becomes more valuable and adopted, it will continue to be useable for small transactions.

- Portability: This point deserves special attention. People who live in countries where their currencies are collapsing due to hyper-inflation and government control are watching their life savings become worthless and less and are leaving. Bitcoin allows someone in a country like this to take their savings and move them with them. Imagine if the same person had to go to the bank and remove the balance, this is inefficient and not always safe. We have seen times in history where governments have shut down banks or confiscated monetary funds. It would be difficult to bring a suitcase full of FIAT money into another country without hassle and interrogation. On top of this, you would have currency exchange costs and issues, and other problems. Since technology allows the Bitcoin user to hold their assets on a wallet, this ensures complete portability should that user need to move or even escape. This type of scenario may seem extreme but it can happen to any country. Venezuelan, Argentinian, African, and German residents have seen this disastrous reality first hand and know the benefits of portable assets.

- Durability: Digital currency is durable and can’t wear out, unlike physical money which is dirty, non-durable, and sometimes costly (the American 1 cent coin costs 1.76 cents to make and distribute to banks).

Bitcoin also has value because of the resources needed to create or mine blocks. It is quite expensive to mine a block as electricity is used to run the mining computers. These computers are stored in warehouses that have to be cooled and maintained by people. Computers have to be upgraded and repaired.

Ultimately Bitcoin’s value is determined by demand and supply just like any other tradeable asset. Since Bitcoin’s release and especially more recently due to the creation of Cryptocurrency exchanges like Coinbase and Binance, there has always been demand liquidity even though Bitcoin’s price has risen and fallen.

FUD: Bitcoin can be hacked

Since Bitcoin’s code is open source and is not stored on any single server, hacking its code, the blockchain or the ECC base cryptography would be very difficult. In fact, I would go so far as to say if Bitcoin’s blockchain could be hacked, it would have already have been hacked. Especially when Bitcoin’s value was over $60,000.

In order to hack Bitcoin’s blockchain, 51% of the total mining power would need to be controlled, and given Bitcoin’s size, this would be extremely difficult. And in order to permanently alter Bitcoin’s source code, hundreds of thousands of secured nodes would have to be altered.

There have been instances of Bitcoin exchanges (Binance) and wallets being hacked but these have nothing to do with Bitcoin itself. The hacks were a result of either weak platform exchange security or individual account private passwords and seed keys being accessed to control private wallets.

This isn’t to say other cryptocurrencies with lesser security features haven’t been hacked. Here’s an example.

There are others who believe quantum computing could be used to hack Bitcoin but since this technology doesn’t exist yet, that is just an opinion. Once quantum computing becomes a reality, I’m sure Bitcoin’s code will be upgraded for protection.

FUD: Someone can buy all the Bitcoin for ultimate control

In order for someone to control all of Bitcoin, they would have to own most if not all the Bitcoin. This is illogical for a few different reasons.

Firstly, only about 2.5 million bitcoins are available for purchase on exchanges such as Coinbase and Binance. This means there are upwards of 15.5 million Bitcoins that are stored in offline wallets or that have been lost. It would be impossible for someone to own all of the Bitcoin that existed because they simply aren’t all available.

The second reason why it would make no sense for someone to control all of the Bitcoin would be that it would have no value at that point. Bitcoin’s value is based on demand and supply, just like stocks. If one person controls all of the Bitcoin it would be very difficult to value it and there would be low liquidity.

There are millions of people who own Bitcoin who will likely never sell due to their belief in a decentralised asset.

As more Bitcoin is mined each day, ownership is spread out negating the chance that a single person or entity could own all of the Bitcoin. On top of that, Bitcoin is expensive so someone would need hundreds of billions of dollars to purchase all of the Bitcoin in existence.

The largest holder of Bitcoin, Microstrategy owns about 105,000 Bitcoins worth $4bn which is only 0.5% of the circulating supply.

As you can see it would be almost impossible for a single entity or person to obtain all of the Bitcoin in existence.

What About Coins Other Than Bitcoin AKA Altcoins?

Bitcoin is the oldest cryptocurrency in existence but it isn’t the only coin. There are more than 14,500 altcoins available via exchanges like Coinbase and Binance and via decentralised exchanges such as Uniswap so you may be tempted to dive deep into the rabbit hole and buy other altcoins.

During the 2021 crypto boom, altcoins gained favour as prices skyrocketed in short periods of time.

While some of these coins are great prospective projects, be aware that some altcoins are nothing more than valueless speculations created by startup businesses.

Some joke “meme” coins have rocketed in value in days and busted in hours. Coins such as Dogecoin have sparked the imagination of young investors but have also landed people in financial trouble. Many investors experienced FOMO (fear of missing out) during the height of the cryptocurrency price explosion and invested money at the high points, only to panic sell when prices crashed.

Think of most legitimate altcoins as startup businesses. These companies are utilizing blockchain technology for everything from payment systems, smart contracts, real-time data access, storage, video, virtual real estate, and much more. Such businesses are Chainlink, Polkadot, Polygon, Vechain, and Solana.

These companies are paving the way for new blockchain technology and payment systems.

Startup companies such as the ones mentioned offer coins as a way to raise capital. These coins can be purchased and traded by investors. Think of altcoins like IPO shares when companies go public. Some companies offer an unlimited supply of coins while other companies offer a limited amount of coins. You can view this information at Coinmarketcap:

Altcoins offer equality to all. If you want to invest in company stock IPOs before they are released on the general market, you have to be an accredited investor with access to large amounts of money or have insider connections. Wall Street intentionally prevents normal investors from accessing company stock opportunities before they are released on the markets. Usually, when IPOs are released on the stock market, the price moves drastically on release.

Altcoins offer a way for any investor to buy equity in new start-up companies. Some of these start-up companies might do well and their coin prices will rise.

Of course with any investment upside, there is a downside risk. The problem with Altcoins is we don’t know which companies will thrive and which will fail. You have to do your research and understand what you are buying and what these companies actually do.

Altcoins are highly speculative and should be purchased with caution as most likely won’t exist in the future and your investment could go to zero. As with all investments, be sure to diversify.

Some altcoin projects, Cardano for example, which is the fifth-largest market cap coin worth $59 billion, aren’t being currently utilized but have big expectations. Some expect Cardano to be the payment system of the future while others say it is nothing more than an unproven speculative project.

Most altcoins have no use case and some such as Dogecoin and Shiba Inu were even created as a joke.

Having said that there are some legitimate altcoins including Ethereum which is the second-largest market cap coin. Many other altcoin projects have built their applications on Ethereum making for a strong use case.

While I do hold some altcoins, I think some will be worthless in the future so I would recommend being cautious when investing in them. There are a few coins that I FOMO’ed into that I’d rather not own today. Thankfully I bought them when they were cheap.

Which Coins Should I Buy?

You can see which coins I own here.

I am not here to advise you which coins to buy. What I can tell you is about 75% of my cryptocurrency portfolio is in Bitcoin and Ethereum and the rest is invested in other altcoins listed in the link above.

I would be most comfortable holding a portfolio containing only Bitcoin and possibly Ethereum for the rest of my life. The other coins are purely speculative.

Altcoins can make you rich but they can also kill your returns during a market downturn so buyer beware and do your research into what you’re actually buying.

Tax Implications

Every country’s tax laws are different so please check your applicable country.

This is not intended to be tax advice but in the UK and USA, you will have to pay capital gains tax on profits from cryptocurrency. Taxes are payable whenever you profit from a sale, exchange into another coin, or transfer a cryptocurrency to a person or business. You will also be responsible for paying tax on mined coins, airdrops (free coins given), and income earned from interest paid on staked coins.

You can offset losses from cryptocurrency just like you would any other investment.

UK Tax

Capital gains tax is owed on any profits from the sale or transfer of cryptocurrency, even on cryptocurrency received from airdrops (free giveaways). Income tax and National Insurance contributions are owed on cryptocurrency earnings received from an employer, mining, transaction confirmations, and staking.

You will pay tax anytime you transfer cryptocurrency to anyone other than a spouse or a civil partner

You can view more on this at the UK government’s website where there is a Cryptoassets Manual.

USA Tax

In the USA, you will pay capital gains tax from any profits in the sale or transfer of cryptocurrency.

For 2021, there are two types of capital gains, short-term and long-term. Short-term capital gains tax is the same rate as your income tax bracket and any losses can be used to offset up to $3,000. Long-term capital gains tax is applied after holding your assets for longer than 365 days and the rate is anywhere from 0% to 20% depending on your tax bracket.

Most people in the know try to hold their cryptocurrency assets for at least one year in order to qualify for long-term capital gains tax which is lower than short-term capital gains tax.

Any losses as a result of theft or hacking can be completely written off.

You can read more on the IRS’s website here.

How To Protect Yourself Against Scammers An Keep Your Cryptocurrency Safe!

Just like any asset that has value, there are always going to be people out there who want to steal it from you. In order to keep your cryptocurrency safe, there are things you can do to protect yourself.

- Beware of online scammers using social media and email phishing

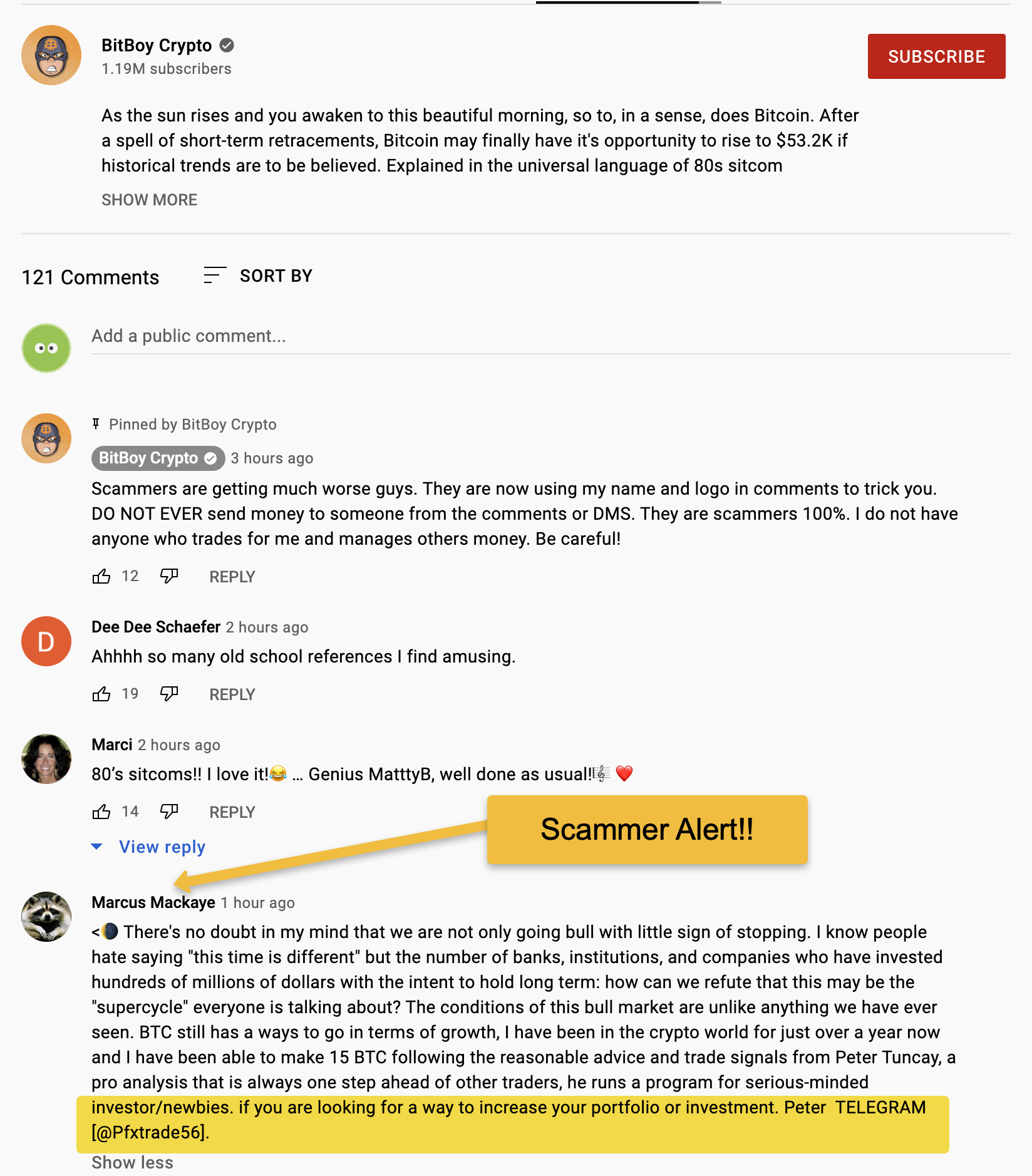

If you watch content on places like YouTube, you’ll see many scammers posting a phone number or social media username. Be aware that these accounts are fraudulent so do not contact these people:

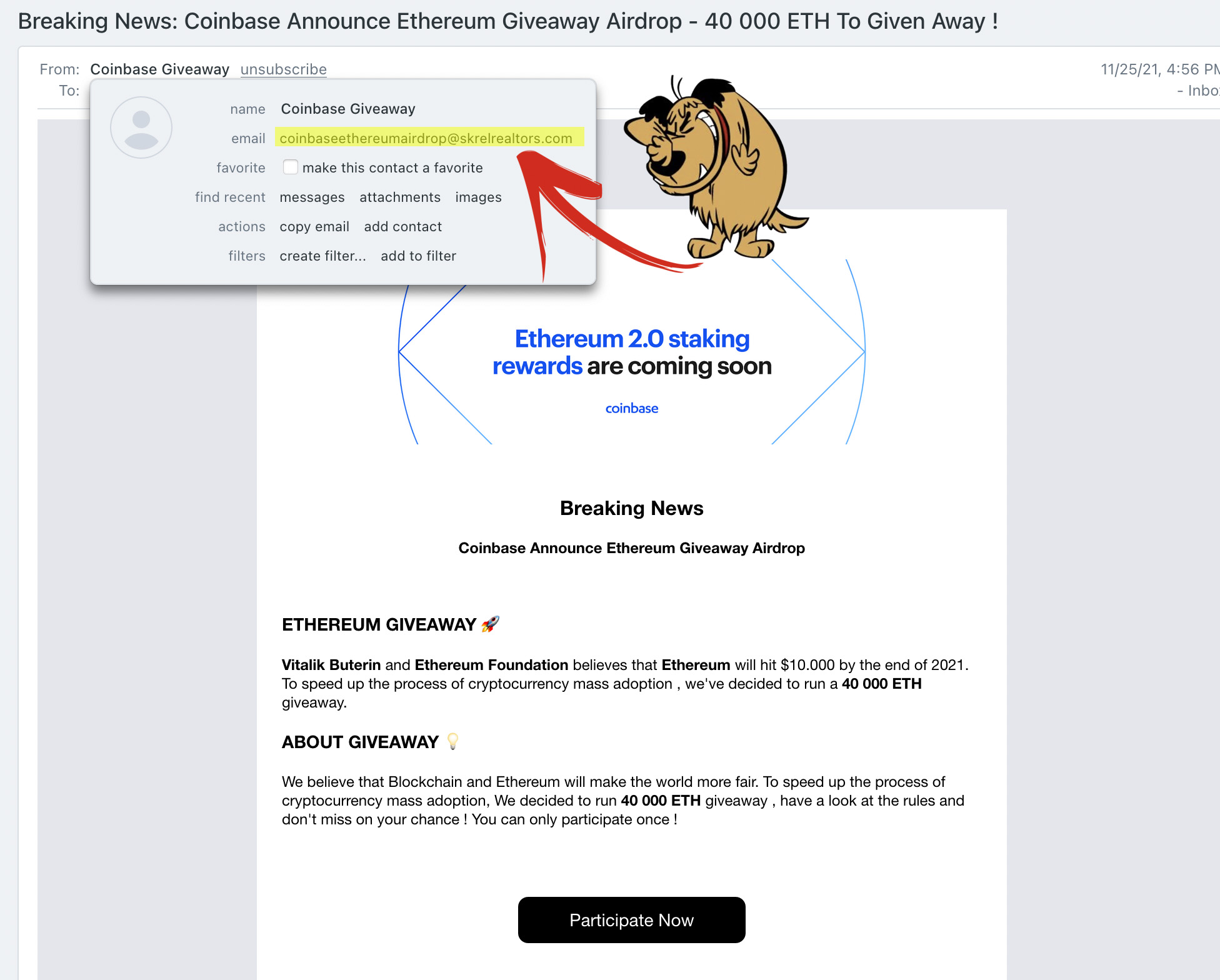

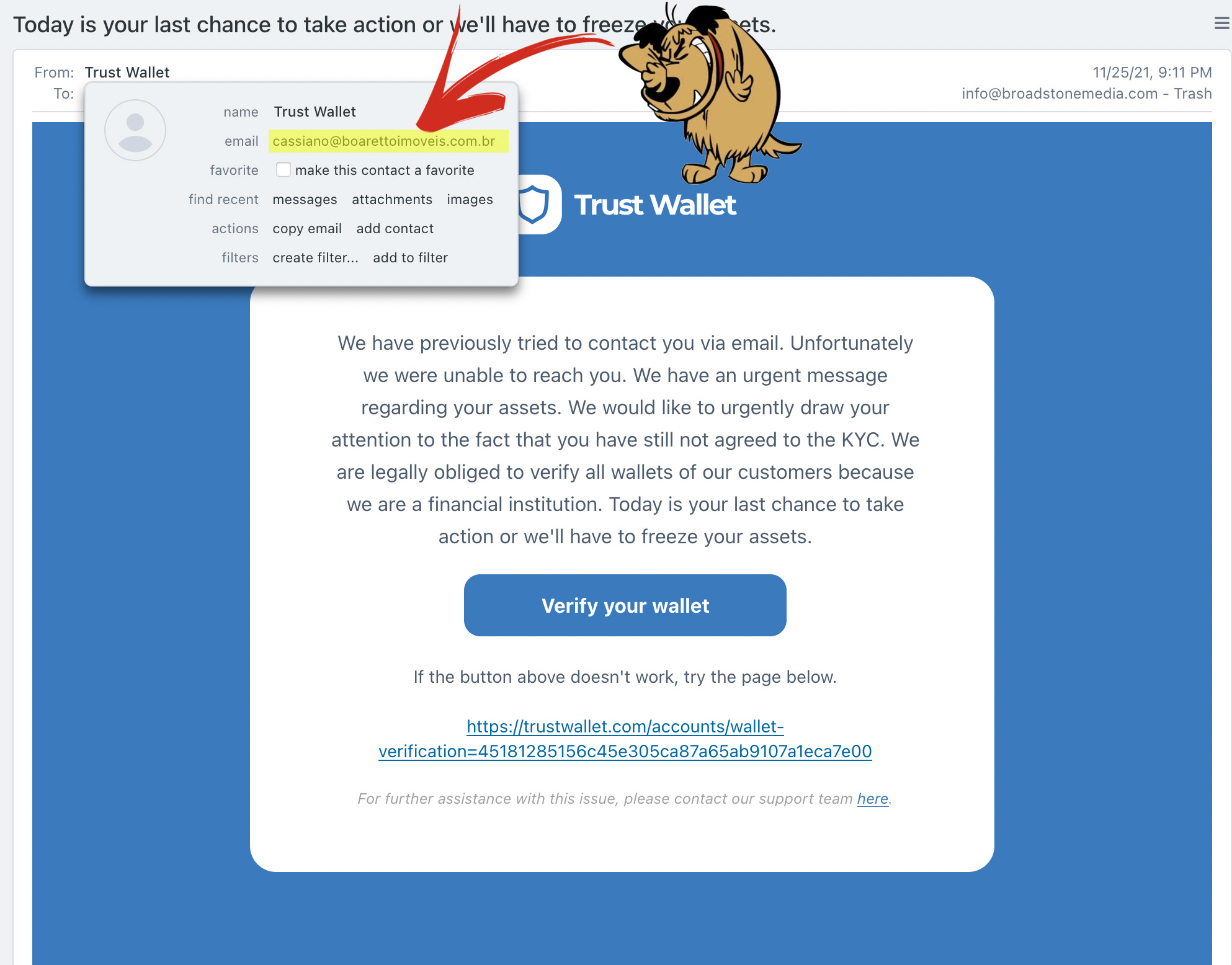

Many scammers also use emails in an attempt to steal login information. Here is an example of one such email I’ve been receiving recently:

These emails look identical to emails that are sent out from the original companies. Be very careful to check who the email is being sent from before you click on any links inside of emails, especially when the emails have a call to action that seems unusual.

2. Use very strong passwords

Password cracking programs can run billions of guesses per second. Always use very long, strong passwords with numbers, special characters, and combinations of capitalised and lower case letters. Never use the same password on two different platforms and never use an online password generator; make up your own passwords.

3. Use 2 Factor Authentication (2FA) wherever possible.

I know that using two-factor authorisation is a pain in the rear, however, it’s a good way to secure your account. Some platforms now force you to login using apps like Google Authenticator which creates a six-digit code that refreshes every 15 seconds. Other 2FA’s like Yubikey is recommended (see below).

4. Do not give your personal information to ANYONE over the phone.

Due to many large corporations having poor cyber security, many data hacks have occurred. Scammers are now able to buy personal and contact information on the dark web. Scammers then call potential victims making up account compromise stories. They then ask for personal information in order to secure your account. Never ever give this type of personal information over the phone.

Another popular phone scam is computer virus cleaning and protection. Scammers will pose as employees from virus protection companies such as McAffee and explain that your computer has a virus. The scammer will ask to remotely control your computer to remove the viruses. Never give anyone remote access to your computer as they can steal your passwords.

5. Don’t log into an investment account on an unsecured public Wi-Fi network. Hackers monitor these Wi-Fi networks for password-stealing opportunities.

6. Use a Yubikey to secure your account.

Scammers often send out fishing emails to get you to click on a password reset link, therefore being able to hack your investment account. There is a nifty item called a Yubikey key that plugs into your device’s USB port in order for you to be able to log in to your accounts or email.

Without this key, your accounts cannot be accessed. This is probably one of the most secure ways to prevent hacking. You also have to be careful not to lose this key however so there is an inconvenience factor. Be sure to buy this key from an authorized seller, or Yubico themselves.

7. Store your cryptocurrencies on both offline and online wallets.

Online or hot storage wallets are the methods platforms used to store your cryptocurrency keys. For example, if you purchase Bitcoin on Coinbase, your Bitcoin will sit inside your personal online hot storage wallet. While this is convenient, you are always at risk of a hack, whether that be a platform compromise or a personal account compromise if someone should ever get your login information.

Offline or cold storage wallets can be purchased from companies such as Trezor and Ledger and can be used to store your cryptocurrency keys. Off-line wallets don’t actually store your cryptocurrency, just the keys. Storing your keys offline is the safest way to secure your cryptocurrency because the keys are in your control. Be sure to purchase these wallets directly from the manufacturer itself because there are unscrupulous sellers that sell hacked wallets that can be accessed remotely.

In order to access your cryptocurrency stored on an offline wallet, you use a secure password. Since your cryptocurrency is stored on the blockchain, if you lose or damage your wallet, a 12, 18 or 24 word recovery seed phrase can be used to recover the cryptocurrencies. Your seed phrase should be written down and stored in several secure places, such as a home safe.

For those who are very paranoid, you could engrave your seed phrases onto a piece of metal and then bury it in the ground for safekeeping.

Both wallet methods have their obvious pros and cons so I recommend using a combination of both.

There are many good YouTube videos that explain how to use offline wallets.

I recommend the Trezor One wallet and be sure to buy from Trezor’s official website.

8. Secure your Wifi Network

Remember to use a strong password to secure your wifi router. Routers can easily be hacked when weak passwords are used.

9. Be careful when transferring your cryptocurrency

Sometimes it’s necessary to transfer coins. Be sure to send a small test amount to make sure you have the correct wallet address. Many stories have been reported of lost coins being sent to the wrong wallet because of a one-digit error.

Other Thoughts

What I’ve Learned About Bitcoin & Why The Banks Hate It

When I first began buying Bitcoin in 2017, I bought into the hype without understanding what the asset really was. Originally I only owned a small amount of Bitcoin and Ethereum and I had no intention of buying more after I watched the Bitcoin price drop from $17,000 to $3,000.

As time passed I purchased more Bitcoin after learning about macroeconomics and how deceitful government debt tactics are being used to plug economic holes. These tactics will harm people and we will have to pay all this debt back, probably through large tax increases in 2026 or 2027.

As debt increases and inflation increases, our money is becoming worth less and less each year as goods and services become more expensive. Because of near-zero interest rates, holding unneeded amounts of money in bank savings accounts is futile.

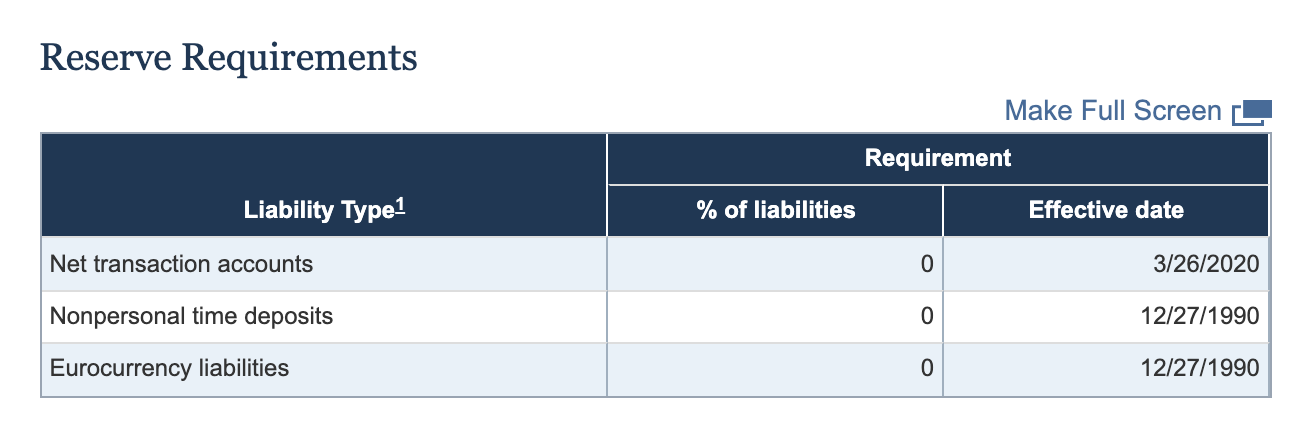

Banks have been taking advantage of the financial system for decades. For example, banks in the USA aren’t obligated to keep a single dollar of your savings deposit in-house. The banks can loan 100% of all the deposits they receive and you receive little to no interest in return.

(Source, U.S. Federal reserve)

The USA isn’t alone in these ridiculous reserve balance requirements:

UK: 0%

Australia: 0%

Iceland: 6%

China: 7%

Russia: 4%

Switzerland: 2.5%

Eurozone: 1%

The truth is most banks are illiquid and wouldn’t be able to pay back all their deposit obligations should a financial disaster strike such as the one in 2008/2009. Another economic fallout would mean more government bailouts and more debt burdens added to citizens.

And so the problem continues.

Bitcoin for me, represents a way to break free of the government and bank control over the financial industry as Bitcoin is decentralised and not controlled by any entity or person.

It’s no surprise that central banks don’t want you to invest in Bitcoin and cryptocurrency. We have seen various UK banks such as Natwest and Starling stop their customers from depositing money into cryptocurrency exchanges, using the veil of “customer protection” as an excuse. My own bank Barclays has blocked nearly all of my Coinbase deposits.

If your bank blocks cryptocurrency payments, I would highly recommend moving to another bank, even if you don’t buy cryptocurrency. Your freedom of choice is being removed by those banks and they shouldn’t be rewarded with your business.

Remember the less money you have in your bank account, the more the bank suffers.

Even the International Monetary Fund (IMF) is trying to dissuade countries and people from cryptocurrency, calling it an “inadvisable shortcut” to financial inclusion.

The largest and most powerful monetary institutions will do everything they can to control the global financial markets and they often flip-flop their opinions on cryptocurrency. One example is JP Morgan in 2017 whose CEO Jamie Dimon called Bitcoin “a fraud and worse than the tulip bubble”. In April of 2021, JP Morgan announced they would offer investors access to a Bitcoin Fund and offer their own JPM digital coin based on blockchain technology.

As much as financial institutions fear the loss of monetary control, some are realizing their customers want cryptocurrency exposure. Companies such as Fidelity, Bank of America, Goldman Sachs, JP Morgan, Bank of America, Wells Fargo, BNY Mellon Bank, and more are all either offering or preparing to offer cryptocurrency investments.

Why Elon Musk Does And Doesn’t Matter To Bitcoin

It was certainly a positive vote for Bitcoin when Tesla announced it would be buying $1.5 billion worth of Bitcoin in April 2021. I’ve received emails from people who believe that someone like Elon Musk can easily manipulate the price of Bitcoin, therefore it cannot be a sensible or stable investment.

Musk recently revealed that he, Tesla and Space X all own Bitcoin. He also stated he doesn’t tweet about Bitcoin to negatively affect the price because he would lose money and that he’d like to see Bitcoin succeed. You can watch the video here.

It’s hard to quantify how much of Bitcoin’s price volatility is really due to Musk’s tweets since Bitcoin has always been volatile and its value is based on demand and supply. We have seen Bitcoin’s price drop dramatically many times since its creation, long before Musk owned it.

Even if Musk were to sell all of his Bitcoin tomorrow, the long-term price impact would be negligible and short term. Bitcoin was around long before Musk’s purchase and it will be around long after if and when he sells.

What About NFT’s And Smart Contracts?

NFT’s or Non Fungible Tokens have been growing in popularity steadily but many people do not understand them.

Nonfungible means unique. If you own a Michael Jordan one-of-a-kind trading card, that is non-fungible.

An NFT is a digitally unique item that can be anything digital such as a piece of art, a video clip, a video game item or music for example. While a digital piece of art can be downloaded onto your computer, only one person owns the original, and this proof of ownership is stored on the blockchain.

Some NFT’s have been sold for millions of dollars, such as a Beeple art piece that sold for close to $70m and a Cryptopunk that sold for $11.75m by Southeby’s. Even Visa purchased a Cryptopunk.

Currently, most NFT’s are stored on the Ethereum blockchain but other coins such as Cardano, Theta and Enjin could become major players in the NFT ecosystem.

Smart contracts are self-executing contracts where the conditions are written into the code by the buyer and seller. I believe smart contracts will be the way of the future as their usage is unlimited.

Why would anybody pay millions of dollars for a block of digital land or an Ape drawing? The answer is perceived value. It’s the same reason someone would pay large amounts of money for a luxury watch or an exotic sports car. Things are valued at what people are willing to pay, NFT’s are no different.

NFT’s have grown in popularity due to celebrities investing in them and some investors buy and sell NFT’s full time and make big profits.

A Smart Contract Example

Smart contracts can be confusing but here is a real-world example.

Bands can lose up to 80% of the revenue they create through the music because so many middleman take a piece of sales, publishing, merchandise rights etc.

Smart contracts could allow a band to self-fund a new album and sell NFT’s to its fans in return for royalties, therefore removing the need for a record label. When the band releases a new album, fans would automatically be paid out a royalty due to the smart contract execution.

This type of smart contract would create immense value in the form of a community.

Are NFT’s Investments?

NFT’s were all the rage during the 2021 / 2022 crypto boom but proceeded to crash in price. Personally, I don’t own NFT’s as I prefer to use my resources to buy cryptocurrency. NFT’s are highly speculative and highly volatile, however I’ve seen some NFT’s increase massively in value.

NFT’s are a risky investment play because it’s hard to know which ones will be valuable in the future. For instance, Cryptopunks, which are a collection of 10,000 unique collectible digital characters, were originally given away for free, and in 2022, the cheapest one you could buy was six figures in price. Since then, prices are cratered and you can buy these NFT’s far cheaper. So in that example, those NFT’s were great investments if you timed the market correctly.

But there are millions of NFT’s that will likely be worthless in the future so knowing which ones to buy is difficult.

The one thing I love about NFT’s is they are making blockchain and cryptocurrency more visible to the masses. For example, rapper Torey Lanez sold $1 million of NFT’s in less than a minute to his fans and Eminem recently became a Bored Ape Yacht Club Owner.

Bitcoin And Cryptocurrency Downsides

As much as I personally believe in Bitcoin there are some downside risks to pay attention to.

- Cryptocurrency is unregulated

As time passes, I expect governments will impose cryptocurrency regulations for tax purposes. Regulation can be positive and negative however more conservative investors might see the lack of regulation as a negative. Personally, I believe the less the government regulates cryptocurrency, the better.

2. A new asset class

Bitcoin is still a new asset class and we can only go off its history to try to predict its future. There is no guarantee that Bitcoin will continue to rise in value, this goes for any type of investment, even real estate. In fact there is always a chance Bitcoin could go to zero although I believe this is highly unlikely. When an asset class is newer and unproven, some perceive the lack of history as a negative despite all of the obvious upsides.

3. Cryptocurrency can be completely lost or stolen

If someone gets access to your cryptocurrency platform or wallet password and seed key or if you lose that information, all of your assets can be lost. Cryptocurrency is not protected by any government programs such as FSCS or FDIC. The bottom line is you have to protect your own cryptocurrency assets because if you lose them they are unlikely to be recovered.

I recommend an offline storage wallet (cold storage) like a Nano Ledger and having multiple backups of your seed key stored in safe places. You can keep your cryptocurrency on exchanges such as Coinbase or Binance however if those platforms were to fail or be hacked, your cryptocurrency is at risk.

4. Cryptocurrency is volatile

Cryptocurrency values are volatile and will likely continue to be for some time. Volatility can be an investor’s best friend and you should be prepared for a long-term buy and hold strategy in coins you believe in. You can smooth out some of this volatility by cost averaging your purchases throughout time.

5. Mass global acceptance of Bitcoin is still in its growth phase.

Cryptocurrency received a lot of attention in 2020-2022 when prices were booming, but it is still a misunderstood asset class. As time goes on, Bitcoin and other cryptocurrencies will become widely accepted and used so while this may be a downside now, I see this as a short-term one. It’s impossible to know exactly how many people own Bitcoin, but just in the USA alone, over 46 million people are estimated to own Bitcoin.

6. Tax treatment of cryptocurrency is inconvenient

You have to keep good records of the prices that you buy and sell in order to accurately pay your taxes. None of the cryptocurrency exchanges provide good tax reports. I think this will change in the future.

7. Too many coin choices

Just like stocks and funds, there are thousands of different cryptocurrencies, most of which should be avoided. You may be tempted to buy some of the cheapest cryptocurrencies available for sale, but remember we have no idea which of these cryptocurrencies will increase in value in the future. Some coins may go to absolute zero so buyer beware. I would recommend sticking to the most well-known projects with the larger market caps, coins such as Bitcoin and Ethereum.

8. Crypto moves fast

The world of cryptocurrency is extremely fast moving, what is hot today may fall out of favor tomorrow. If you are a serious investor, you need to stay informed on the market trends.

For example, meme coins like Dogecoin and Shiba Inu were the belles of the ball but have fallen into the shadow of gaming cryptocurrency. This happened very fast.

Bitcoin And Cryptocurrency Are Here To Stay

Bitcoin and other cryptocurrencies are in an exciting evolution phase and are here to stay. The younger generation is especially interested in blockchain technology because they are growing up in the digital age. As the younger generation matures, they will invest more of their money into digital assets such as cryptocurrency, Bitcoin and NFT’s. There have been studies that show younger people trust Bitcoin more than gold as an investment.

Bitcoin represents freedom and separation from central banks. It’s an asset class that has increased in value by over 200% per year annually since its introduction. Bitcoin represents a way to increase buying power versus FIAT money which decreases its buying power as it loses value to inflation due to money printing and low bank interest rates.

Blockchain technology is revolutionising how data is stored and accessed.

Technological evolution progresses quickly. Remember when we used dial-up internet modems at 56K and big bulky mobile phones? Blockchain technology will progress quickly and the volatility you are seeing in Bitcoin’s value will begin to stabilize as mass adoption occurs.

I believe Bitcoin is a once-in-a-generation asset class, unlike anything we’ve seen before as Bitcoin is only 12 years old and it is almost inconceivable to think that some countries have or are considering adopting Bitcoin as legal tender.

Just remember that Bitcoin is considered a store of value and all other coins are like investing in startup businesses that can boom or fail. Be sure to diversify and do you research before you invest.

Click here open a Coinbase account and receive £7 ($10) in free cryptocurrency when you invest £70 ($100). (Terms and conditions apply. When you open an account through my website, it helps me to continue to fund operational costs).

Click here and receive my complimentary Top 5 Peer to Peer Lending Sites Report.

I love feedback, so if you find any errors or omissions on this page or have any improvement suggestions, I invite you to contact me and be a part of contributing to this website.

Disclaimers: I have not paid to write my content and I’m not employed by any of the companies I write about. In most cases, I have invested or continue to invest my own money through these companies. In order to keep the website financially viable, the sign-up links on this website are referral links and I do accept advertising in the form of banner ads. This advertising in no way influences my reviews and opinions. When you sign up for an account through my website, in some cases I receive a referral fee directly from the companies, at no cost to you. Your support enables me to continue to operate the Financial Thing website. You can read more about my referral links and banner advertising here.

** This page is for information purposes only. This information is not financial advice and has been prepared without taking your objectives, financial situation or needs into account. You should consider its appropriateness for your circumstances. All investing carries risks. Opinions expressed on this page are opinions based on my own personal experiences. The FSCS and FDIC do not cover investments and your capital is at risk. Please don’t invest more than you can afford to lose. **