Best Investments During Turbulent Economic Times

I believe we are living in the one of the most economically unstable times for decades, Interest rates and inflation and the stability of the world banking system is now in question thanks to Credit Suisse and SVN Bank.

World governments continue to hand out bail out money to the powerful banks while the middle class are squeezed by rising interest rates and cost of goods. This type of government intervention is subjectively ineffective but many will argue it is needed.

You are probably hesitant to invest in the volatile stock market and are wondering where you put your money to grow and be safe.

You’re not alone.

Remember in the early 2000’s when you could take a one-year fixed interest bond paying 5%? Those bond rates have been gone for a long time although you can now buy 1 year fixed rate bonds in the 3-4% range.

Inflation (depending where you live) has not been kind to cash savers. It makes little sense to put money into an easy access savings account paying 3% if inflation is 6%. That means your money is losing 3% of its value per year. If you have extra cash, paying off consumer debts is the way to go (credit cards, car loans etc).

If you are debt-free (other than your mortgage), here are some of the best investments to consider during volatile economic times (higher grades mean lower risk and vice versa):

(Ps. Not financial advice, do your own research)

Best Investments: Peer to Peer Lending

Overall Risk: C-F

Risk of Total Capital Loss: D-

Returns: A to D

If you are a reader of this blog, you will know I’ve been involved in peer to peer lending since 2015. As an investor, I’ve had some successes and failures and I’m comfortable putting 10-15% of my liquid savings into peer to peer lending. The main reason I’m hesitant to risk more is bacuase of the companies which have failed causing investor losses.

Peer to peer lending has some downsides which you can read more about here.

In the UK, the FCA (Financial Conduct Authority) regulatory rules have really tightened and only the string companies will survive the expense and scrutiny. I believe the days of poor peer to peer companies (and hopefully fraudulent operation) are behind us.

If you are an investor in peer to peer lending, you will have noticed return rates increasing which is good news.

While inflation is high, we have to be disciplined and not chase returns buy moving too much money from the safer peer to peer lending companies to the higher risk / higher returns companies.

Remember diversification is key because if you put all of your eggs into one high-interest paying site and it collapses (hello Lendy and Funding Secure), you’ll be wishing you had diversified correctly.

Best Investments: Stock Market

Overall Risk: *B

Risk of Total Capital Loss: *A-

Returns: B+

* My risk grades assume you are buying low fee, no-nonsense index trackers and that you won’t touch your investments for at least five years. If you dabble in VCT’s, single shares, trading or other funny investments, my risk grades would be in the C to F range.

I’m still pro stock market as I believe it is one the best and only long term wealth building options for most people. The issue right now is the indexes are reaching record highs so eventually, a correction must occur.

While we can’t predict what stock market returns will be over the long term, it appears as if a 60% equities 40% bond portfolio over a very long period of time, should return approximately 5-7% per year.

Why are stock market levels so high at the moment despite there being so much economically wrong in the world? Demand and my good friend TINA (There Is No Alternative). Basically people have nowhere else to invest so they continue to use the stock markets as a wealth building tool.

Also, lots of foreign money continues to flow into the US and other developed nations stock markets. This investment influx continues to push the markets higher.

Market indexes which seem frothy (or high in value) present a dilemma for many people. Sit in cash and wait for a correction or throw caution to the wind and continue investing with a long term plan. Many people contact me with fears of buying into the stock market because it is so high. It’s a reasonable fear but we don’t know if and when the markets will decline.

By sitting on the sidelines, you could miss out on one the greatest bull runs of all time. Articles dating back to 2011 said a crash was right around the corner. My article on Bob, the world’s worst stock market timer should help ease your fears.

If you are sitting on cash and are 18-50 years old, you could consider pound / dollar cost averaging into index trackers even though the markets are high. Cost averaging means you average your purchases over a period of time rather than buying all your funds at once. For example, investing £10,000 at £1,000 per month over ten months instead of buying £10,000 of index funds at one time. This way you buy through the market highs and the lows, averaging out your fund costs.

I still think it makes sense to be 100% invested but there are advantages and disadvantages to both pound / dollar cost averaging and buying all at once.

Some financial experts recommend buying dividend-paying single stocks. I think this is difficult because stock-picking is difficult. Picking single stocks is risky because companies can be affected by day to events. Think VW’s emission scandal, Credit Suisse’s failure or Boeing’s 737 Max aircraft issues. One piece of bad news can send a company stock tumbling. Also, history has shown most financial advisors aren’t good at stock picking.

The problem with stock picking is the emotional consideration. If you pick 10 stocks, how will you react when a market correction occurs and you see half of your stocks in the red. Will you have the disciple to hold on and not sell?

Read my article here about why I stopped buying single stocks years ago.

There is always a chance that the stock market could fall as no one knows the future, but despite being historically high, I still consider the stock market one of the best long-term investments. Index trackers are great options as long as you don’t need the money for at least five years and you are disciplined enough to buy and hold and ignore the volatility.

Read my article on which index trackers I buy.

Best Investments: Property

Overall Risk: C+

Risk of Total Capital Loss: A

Returns: B+ to C

I love real estate but the downsides are glaringly obvious. The high cost of entry is the main reason people don’t own rental property. Most people have to take on a lot of debt to buy real estate. This is inherently risky especially if your income can’t support the mortgages if disaster strikes (remember the 2008 financial crisis?).

Personally, I like to sleep at night so the horrifying idea that a bank can take my property steers me away from debt financing unless I can keep my debt less than 50% of the property value. Property rentals only make sense when they are cash flow positive, ie. net rents are greater than expenses. If you are negative cash flow on a property, then you are speculating on future property value increases. That’s risky. Smart landlords own rental properties that are positive cash flow.

If you have enough money, buying rental homes for cash can make you wealthy.

Some people will disagree with me on financing rentals and I have friends that have financed many rental houses. These people rarely factor risk into their financing decisions. I know people who fell sick and were unable to work for a year. They fell behind on their rental house mortgages and their properties were repossessed by the bank. My fears also point back to 2008. Millions of people including myself were bankrupted because of property speculation. This could certainly happen again.

Investing in property can be risky. It is possible to overpay, buy a home with unforeseen problems or be cursed with dreaded vacancies. Landlording isn’t easy (I speak from experience) and paying a property manager eats into returns and no property manager will care for your property as you will.

If you are itching to get involved in property investing but don’t have the financial capability, you could look at some of the peer to peer options such as Crowd Property in the UK and Peer Street in the USA.

In the UK, the government’s stamp duty tax increase on buy-to-let properties has drastically reduced rental property returns.

Buying property outright has a high cost of entry, but if you have the cash and can avoid the financing temptation, property ownership still remains one of the best investments to build long-term wealth.

Best Investments: Yourself

Overall Risk: ??

Risk of Total Capital Loss: ??

Returns: ??

One of the best investments you can make is in yourself and your income. This could be in the form of going back to university, taking classes, retraining or earning professional accreditation’s. Your income is your greatest tool in life.

Maybe you have always wanted to work for yourself. You could invest in opening a new business, even if it’s just part-time alongside your regular job or work.

Take this blog as an example. It was never a planned project but I enjoy the finance world so I gave it a try. Creating an online blog is a great way to create extra income. Just blog about what you’re passionate about so you don’t get burned out.

Best Investments: Cryptocurrency

Overall Risk: C-F

Risk of Total Capital Loss: F

Returns: ??

The explosion and implosion of cryptocurrency has the financial world on edge. People became overnight millionaires and then lost it all and company scandals surfaced.

I considered Bitcoin when it was $2 but like many others, I didn’t think much of it at the time and I certainly never thought Bitcoin would reach $50,000+.

Most people don’t understand how to use cryptocurrency, or how it is valued. For example, Bitcoin’s value is based on scarcity and demand and supply. Bitcoin is a limited supply item, capped at 21million units and can be traded 24/7 like a stock. Blockchain technology is here to stay but no one knows where cryptocurrency values will be long-term.

I love Bitcoin but I also know it is speculation. I have friends who bought Bitcoin at $19,000 and were distraught when the price proceeds dropped to $6,900 three months later and then down to $3,000. I also know people who purchased Bitcoin at $1,000 and sold at $50,000.

Since the banks have show their vulnerabilities, money has poured into cryptocurrency once again. A currency like Bitcoin which isn’t controlled by a bank, government or entity is a powerful vehicle. Just understand Bitcoin is has its risks and can be extremely volatile.

Personally I like the volatility so my strategy is to buy and hold Bitcoin for a 10+ year period. It’s a calculated gamble which I think will pay off with patience.

You can read my cryptocurrency 101 guide here.

Alternative Best Investments

Overall Risk: F

Risk of Total Capital Loss: C-

Returns: A+

There are plenty of high-risk alternative investments ranging from buying shares in oil wells to buying and selling cars. I know nothing about either of those.

I have been dabbling in sports tickets since 2014 and my annual returns have been a little over 60% annually. This is high risk and I wouldn’t recommend putting more than a few percent of your savings into this.

The formula is very simple. Buy season tickets for sports teams and resell the single-game tickets online. Season tickets are usually discounted versus single game tickets which is how you profit.

What types of tickets do I buy? USA NBA basketball because I know which teams are popular and understand which games will be in high demand. If you plan on doing this, make sure you buy the tickets directly from the sports clubs themselves and not from third parties.

The risk with sports tickets is that you may not be able to resell them. This has happened during Covid-19 when events have came to a standstill. During normal times, the internet offers many ticket reselling websites. I place the tickets for sale as early as possible then adjust the price as needed. All the tickets are electronic so once the tickets sell online, the tickets are emailed to the buyer.

Some think ticket reselling (scalping) is unethical but it is really just demand and supply. Peer to peer lending where lenders receive 12% returns could be labeled unethical since borrowers are paying 1.5% interest monthly. Jewellery stores sell items for a markup of between 100-300% but it isn’t considered unethical, purely demand and supply. If you consider an investment unethical, you can simply pass.

Buying sports tickets is very risky because of the possibility of an economic decline. When this happens, luxuries such as sporting events are the first to go. There is also the possibility of being unable to sell the tickets or selling them at a loss.

The key to sports tickets is to start small. Buy the cheap seats to test out the market, then take the capital and profit and buy better seats the next season. Again, I consider sports tickets high risk and high return.

I would advise that alternative investments make up no more than 2-5% of your investment portfolio. My sports tickets are only 2% of my investment portfolio.

Bank Savings

Overall Risk: A

Risk of Total Capital Loss: A

Returns: C

Bank savings rates have increased as interest rates have risen which is better news for savers who don’t want investment risk.

Why no A+ grade for overall risk? The only reason banks are considered low risk is because of the governments FSCS (UK) and FDIC (USA) guarantees. In the UK, the government guarantees up to £85,000 of bank deposits per person per bank. In the USA that amount is $250,000. There is always a risk the economy implodes, the banks crumble and the government can’t pay all the guarantees (remember the Iceland financial crisis?). Such a meltdown is less likely in economically powerful countries but it’s still possible. No investment is 100% safe.

For bank safety, you sacrifice returns. For those willing to jump through hoops and have deposit limits, you can get some decent interest rates on some savings accounts. These savings rates are also variable and can change anytime. I’m sure you have gotten the same bank rate drop and increase emails as I have.

Foreign banks offer slightly higher rates but are riskier because they aren’t covered by the same UK and USA guarantees. I don’t think a 0.5% interest bump is worth the extra risk of putting your cash in a foreign bank.

Leaving your cash in the bank getting 4-5% interest is a long-term losing proposition when inflation is high. While inflation has been low over since 2008, it’s increased dramatically so your cash is devalued as goods and services become increasingly expensive.

I do recommend keeping an emergency savings account containing three to six months of your total living expenses. Use the rest of your cash to pay off any loans or credit cards. Any leftover cash, throw at your mortgage or invest.

“Pay off my mortgage?” I hear you asking, “But my mortgage has a low interest rate!”

True but I believe being debt-free is the true way to become wealthy and provides peace of mind. When you have no mortgage payments, you will have lots of extra cash to invest. Also should disaster strike, no bank can ever take your home away if it isn’t mortgaged. I bet some of the people who lost their homes during the 2009 mortgage meltdown wished they didn’t have a mortgage.

Don’t ever think this can’t happen to you. I know many successful people who experienced unexpected hardships and lost their homes. I lost several rental properties in 2010.

Savings Bonds

Overall Risk: A

Risk of Total Capital Loss: A

Returns: C

Another safe but low return investment. No sense in taking a one-year savings bond at 5% when you can get the almost the same interest rate in an easy-access savings account.

Premium Bonds (UK)

Overall Risk: A

Risk of Total Capital Loss: A

Returns: F

Premium Bonds are an investment product issued by National Savings and Investment (NS&I). NS&I is 100% secure savings and investments, backed by the UK’s HM Treasury. NS&I investments are pretty much as safe as an investment as you can make. The downside is the returns are very low.

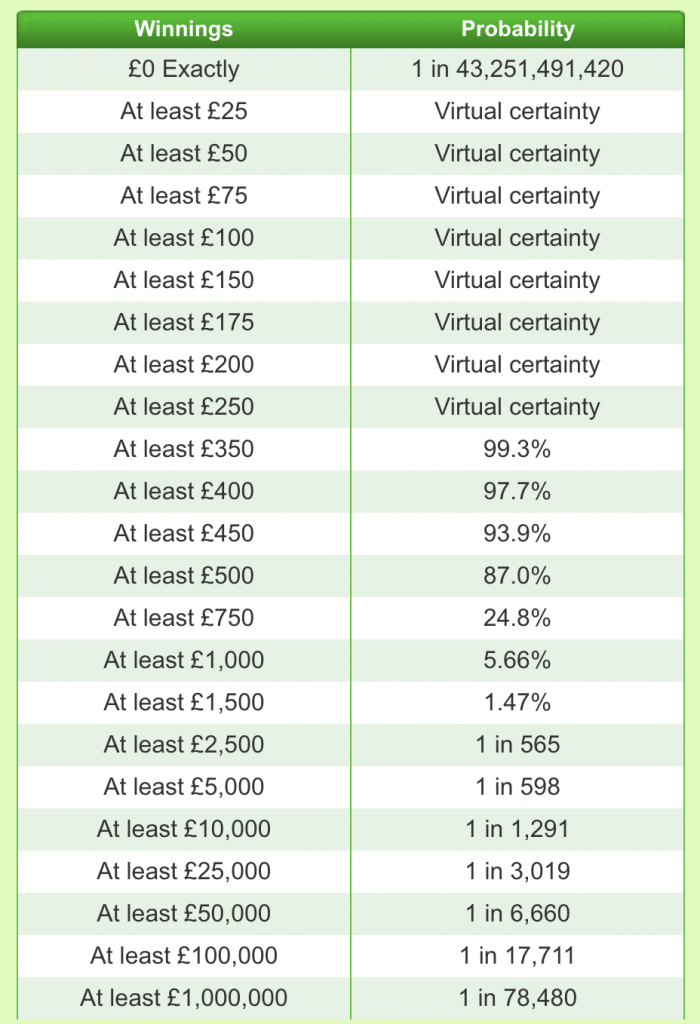

Unlike other investments, where you earn interest or a regular dividend income, Premium Bonds allow you to entered into a monthly prize draw where you can win between £25 and £1 million tax-free.

You can invest a maximum of £50,000 in Premium Bonds. If you have average luck, you are likely to return about 1% per year or £500, tax free. The good thing about Premium Bonds is you have a chance, albeit a small one, at winning some bigger prizes.

In 2015 when interest rates were a little higher, I suggested my mother sell all her Premium Bonds. She pinched me on my arm, told me I was a terrible son and to never speak of such things again.

I then explained to her what a poor investment Premium Bonds are because returns are so low. She was still quite upset after I showed her the odds of winning, but agreed to sell provided she could keep £100’s worth. Mum likes opening the daily post to see if she has won. It’s her way of having a bit of a gamble.

Mum is a tough negotiator so I reluctantly caved to the £100 hold out.

Premium Bonds have been a long-time UK favourite gambling investment vehicle. “But they are tax-free!” you say. “But sometimes I win” you say.

Yes, Premium Bonds are tax-free but the tax benefits aren’t what they used to be. Since the introduction of the UK’s Personal Savings Allowance, 95% of people won’t pay any tax on savings. Savers can now earn up to £1,000 interest tax-free in the 20% bracket, and £500 in the 45% bracket. This negates the Premium Bond tax advantage for most people.

The odds of scoring a big prize aren’t high. If you invest £50,000, here are the odds to win prizes:

These odds change depending on the amount you invest. The more you invest the better your odds.

I used to dislike Premium Bonds because the returns are low but due to interest rates being poo, I think Premium Bonds are a better choice than savings accounts at this point because your returns will be better.

You can play around with this Premium Bond calculator to see how you will fare versus savings.

One other consideration which I think is very important is your age. For older people who don’t want investment risk or are in or approaching, I think Premium Bonds are a great place to invest money with no risk. Plus Premium Bonds are a bit of fun.

You can watch my video about buying £50,000 in Premium Bonds here

Gold

Overall Risk: C-D

Risk of Total Capital Loss: A

Returns: A to D-

My family used to be in the jewellery business so I should be a big fan of gold. In times of turbulent economies, gold salesmen come crawling out of the darkness in droves touting gold as a good investment because of its safety.

The fact is gold is highly timing dependent and has never been a good long term investment and remains as volatile as the stock market. Take a look at how gold prices have fluctuated over the last 100 years:

An ounce of gold in Jan 1915 cost about $450. That same ounce of gold was worth $229 in Jan 1970. Not such a great investment!

If you bought an ounce of gold in May 1974 you would have paid $795. That same ounce in Jan 2001 was worth $359.

You need the same crystal ball to time gold as you need to time any volatile investment.

For me, gold is an insurance policy against a complete economic meltdown. Many countries have experienced hyperinflation so yes, an economic meltdown could happen. Even the USA experienced two currency collapses (1812 and 1861) and we all know that famous German photo:

Even in dire economies, gold is only worth what someone will pay (or trade) for it. I consider any precious metal in the same category as gold.

It is fine to own some gold (I own a gold ETF) if you want a bit of insurance in case of an economic meltdown, but it hasn’t been a particularly good investment unless you happened to nail the low buy in points.

Still aren’t convinced? Ask the people who bought gold in January 1980 when it was $2,000 an ounce. Gold is definitely not one of the best investments.

Best Investments Conclusion

With high inflation present, always remember to factor risk into your choices. An investment that was risky when bank interest rates were 2% is still risky. Don’t let the lower bank savings rates make you feel desperate for higher yields because you may end up in a high-risk investment you wouldn’t have normally considered.

And always remember to diversify!

I hope this article gives you some ideas of where you can look to find the best investments that maximise your savings.

Want to learn more about the best investments. Start here.

If you enjoyed this article and want to learn more about peer to peer lending, click here and receive my complimentary Top 5 Peer to Peer Lending Sites Report.

** This page is for information purposes only. This information is not financial advice and has been prepared without taking your objectives, financial situation or needs into account. You should consider its appropriateness for your circumstances. All investing carries risks. Opinions expressed in this review are opinions based on my own personal experiences. Please don’t invest more than you can afford to lose. **