Unbolted Review

** Unbolted review updated September 14th 2023 **

I began investing through Unbolted in February 2016. Unbolted, launched in 2015, is a peer to peer lending company that facilitates pawn shop style loans to borrowers. Loans are secured by items such as gold, diamonds, watches, and other items. Lenders’ are offered two loan products with different risks and returns. Unbolted’s loan flow has been constant but the amounts of the loans are smaller, so if you have a large amount you want to invest, you may have idle funds sitting waiting to be matched.

I’ve had good results with Unbolted and I still consider it a higher risk investment. Read on for my comprehensively unbiased Unbolted review highlighting my experiences while lending my own money.

My Current Investment Amount: Click here

My annual rate of return: 9.3% (After fees but before taxes)

| Est. Annual Returns: | Up to 10.2% |

| My Risk Rating *: | |

| Launched: | 2015 |

| Early Exit: | X |

| Autoinvest: | ✓ |

| ISA Available: | ✓ |

| Loan Security: | Gold, jewellery, art, books |

| Provision Fund: | ✓ |

| Lender Fees: | None |

| Min Investment: | £1 |

| Time to Become Invested: | Varies on loan supply |

| Time Needed Managing: | Low |

| Lending Agreements With: | Borrowers |

| FCA Regulation: | Full |

| Cashback Offer: | None |

| Sign Up: | Sign Up |

* This opinion risk factors in loan types, interest returns, company history, default numbers and my own investing experience. Risk rating explained here.

Create an Unbolted Account

Sign up to Unbolted (When you sign up for an account through my website, it helps me to continue to keep Financial Thing updated and operating. Thanks in advance for your support).

Unbolted Review: What You Need To Know

Pros

- Lender annual returns of up to 10.2%

- Auto-invest means hands-off and no investment time management

- Pawn style loans backed by secured assets such as gold and silver

- Conservative asset valuations

- Good default recovery

Cons

- Borrowers paying 18% to 63% annual interest on loans. Unethical lending?

- Manual investing difficult due to high demand / no loan pre-funding

- Those looking to invest larger amounts may experience cash drag

- Very little asset information / not even a photo

- Auto-investing puts you into riskier / possibly unwanted loans

- No secondary market for exiting loans other than business loans

- Website lacking functionality, information / FAQ’s

- Provision Trust is discretionary and only covers capital, not interest

I stumbled upon Unbolted quite accidentally. Funnily enough, I was searching for a place to buy bolt cutters and through the wonders of Google, up popped Unbolted. After some research, I dipped a small toe in the water. Things have gone well but like every investment, Unbolted isn’t without its quirks.

Equivalent Competitors

None

Unbolted’s Company Financials

Unbolted doesn’t report its profit and loss statement online but Unbolted has informed me that the company is profitable. You can view Unbolted’s company filings here.

Unbolted Review: My experiences so far….

I have been investing in Unbolted since February 2016. I use their auto-invest tool because all loans larger than £1,000 are allocated to auto-lend, making manual investing very competitive. Because of this, my returns were lower as I opted for the safer gold loans covered by the Gold Trust. I’ve now switched to accepting all types of loans and I’ve noticed all of my funds have been allocated to loans due to a healthy new loan supply. Loan defaults have been appropriately and swiftly handled.

What Is Unbolted?

Unbolted is a peer to peer lending company that mainly focuses on pawn shop style loans with a few unsecured business loans thrown in for good measure. Lenders loan money directly to borrowers who place items such as jewellery, books, art and watches as loan collateral.

How Can I Contact Unbolted?

Email: support@unbolted.com

UK Tel: 0203 567 1300

When Did Unbolted Launch?

2015

Are They Regulated?

Yes, by the UK Government’s Financial Conduct Authority #663780 under full permissions. FCA regulation is nothing like the FSCS (Financial Services Compensation Scheme), which covers consumers when they deposit money in banks. The FCA answers to the UK Parliament and has the ability to pursue criminal action against companies that violate its standards.

How Do I Sign Up?

Click here to open an account. There are no current cashback offers. (When you sign up for an account through my website, it allows me to continue to offer new reviews.)

Who Can Open An Account?

Any person 18 years or older who has a UK bank account and can pass the verification checks. EU and U.S. residents cannot open accounts presently.

What’s The Signup Process Like?

I was able to sign up with no problem

How Are Deposits Made?

Via bank transfer

What’s The Minimum Deposit / Investment?

Bank transfer deposit: No Minimum

Investment into loans: No Minimum

What Investment Products Does Unbolted Offer?

Unbolted offers four types of peer to peer lending:

- Gold Trust Loans: Protected loans for loss of principal and interest, secured by such items as gold and jewellery.

- Provision Trust Loans: Protected for loss of principal

- Sale Advance Loans: Unprotected low loan-to-value and short duration loans

Business Loans: Loans collaterised by company stock and Director personal guarantees

Does Unbolted Offer An Innovative Finance ISA?

Yes

How Much Interest Does Unbolted Pay Lenders?

Up to 10.2% per year

Sometimes a lack of new loans causes cash drag, a term used when uninvested money has a negative effect on returns. My cash drag has resulted in my returns being approximately 0.1% lower than the advertised rate.

Is Interest Paid Immediately Or When the Loan Starts?

Interest starts accruing as soon as your money is matched to a loan

When Is Interest Paid?

Interest is paid at the completion of the loan or semi-annually

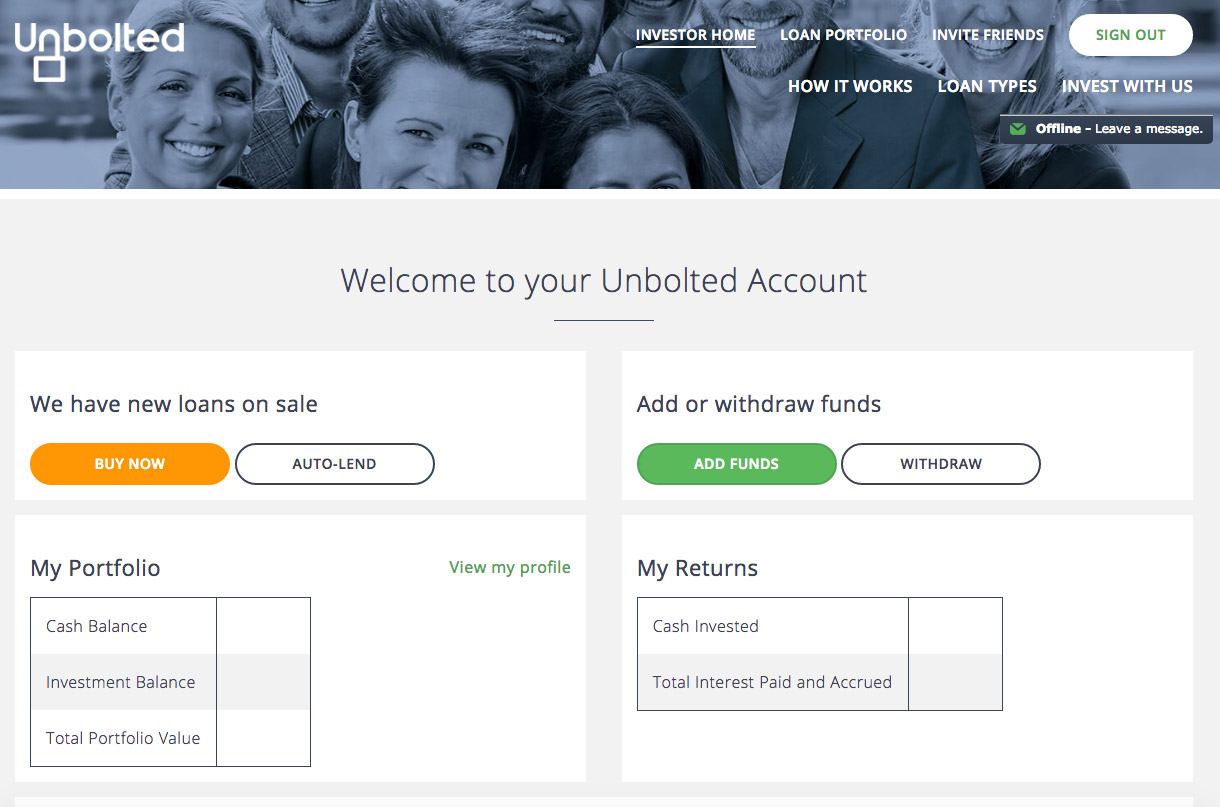

Is There Auto-Investing?

Yes, there used to be three options that were accessed from the main dashboard:

these included:

1. Invest in all loans protected by either the Gold Trust or Provision Trust

2. Invest in only Gold Trust loans

3. Invest in only Bespoke loans (business loans and auto financing loans)

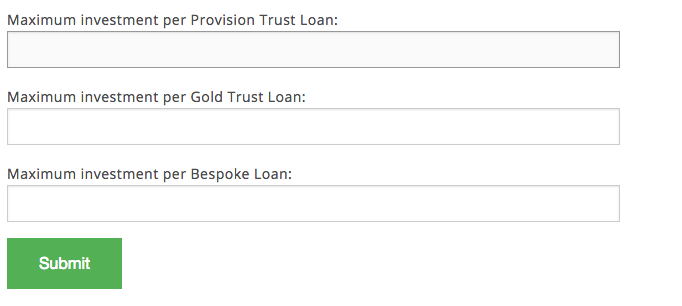

You can set the maximum amounts you would like to invest in each of these loan types:

The last time I logged in I noticed these three options had been removed and there was only a field for inputting the maximum you want to invest in each loans.

Auto-investing is really the only way to secure loans on Unbolted as auto-invest funds receive priority. Since the loans are relatively small, the auto-invest takes most or all of the allocations.

Am I Lending To Unbolted Or The Borrower?

All loan contracts are between lenders and borrowers

What Are The Fees?

Unbolted has no lender fees other than a 1% sales fee on secondary market business working capital loans

How Much Time Will I Need To Spend Managing My Investments?

Absolutely none. Manual investing isn’t really an option as only loans smaller than £1,000 are available and the lenders’ quickly. The only way I’ve been able to receive loan allocations is to use auto-invest, which means no management time. Once you receive a loan repayment, your money will be automatically invested into available new loans.

How Long Are The Investment Terms?

Loans usually run for up to six months but are sometimes renewed.

Is There A Secondary Market To Buy, Sell And Exit Loans?

Yes, you can resell business loans but so far I haven’t seen much for sale

What Security Does Unbolted Lend Against?

Gold, jewellery, diamonds, Rolex’s and other watches secure most of Unbolted’s loans. There are a few unusual loans secured by such things as book collections.

What Are The Loan Default Rates?

Unbolted’s default rates average around 8% which isn’t bad considering most loans are pawnbroking type loans.

Of all defaulted loans, most items are sold for an average 131% recovery. That means for every £1 that goes into default, Unbolted recovers £1.31.

Personally, I have experienced several defaults. They were handled effortlessly and 100%+ of capital and interest were recovered. Pawn lawns will always have a higher default rate than other types of loans but it seems as if Unbolted has a very efficient recovery process.

The upside of pawn loans is the recovery time is much faster than other types of loans.

What Are The Main Risks?

Company Failure: Unbolted is a small operation with a smaller loan book. While this isn’t necessarily a negative, the threat of company failure always exists. I would like to see Unbolted explain their failure wind-down process on their website.

Lowering of underwriting quality: It seems like Unbolted is very experienced at valuing loan items s as long as their loan selection quality remains high, I don’t see foresee an issue here.

Is There A Provision Fund?

Unbolted used to have two provision funds to help protect lenders:

1. The Gold Trust covers every gold and silver loan and is designed to cushion against a fall in gold or silver prices. Since precious metal prices can be quite volatile, this is a nice safety feature. The Trust achieves this protection by purchasing derivative contracts that would pay out if precious metal prices fell by more than 10% to 15%. Derivatives are hedge bets, which try to estimate the future values and reduce volatility risk. All derivative fees are paid for by Unbolted. Unbolted states if there is shortfall in funds, they will attempt to cover the losses with company funds but nothing is guaranteed.

2. The Provision Trust covers jewellery items such as Rolex’s. Unbolted allocates 1% of every loan into the Trust and it is paid out of Unbolted’s fees collected from the borrower. The Fund only covers losses on capital and not interest. The Provision Trust is a nice feature but it’s also discretionary and isn’t guaranteed to cover losses.

Unbolted’s website no longer lists these provision funds and I reached out to them for clarification.

What Happens If Unbolted Goes Out Of Business?

As required by the FCA, Unbolted has a wind-down process in place in case the company ceases to trade. In the event of company failure, Resolution Compliance Ltd. (RCL) would be appointed as a third-party backup provider. RCL would continue to service the existing loan contracts and is authorised by the FCA as an ISA Manager.

RCL will also RCL procure payment of the debts due under the loan agreements, enforce the rights under the loan agreements on behalf of the lenders, receive payments in respect of interest and capital due from borrowers, and make payments in respect of interest and capital due to lenders. RCL will charge a quarterly fee for providing its services. This fee will not exceed any ongoing income receivable by us and RCL will not charge any additional fees.

Please also note that while a back-up servicer has a contractual obligation to service the loans, there will be some residual risks in the event of the insolvency of a platform.

- the majority of balances due to lenders are those due from borrowers rather than from the platform operator itself. The lenders will not have any entitlement to any balances not yet received from borrowers; and

- the back-up servicer will not have the same incentives as the platform operator in managing the performance of the loans. As such in an insolvency or wind-down scenario, redemption of assets or recovery on defaults may be negatively impacted resulting in lower realisation of balances due.

Lenders uninvested funds would be held in a segregated client money account.

You can read more about Unbolted’s wind-down plan here

UNBOLTED REVIEW THUMBS UP:

Competitive Lender Returns

Investor’s can get up to 10.2% interest per year. Unbolted’s rates, while not industry leading, are still acceptable for the risk taken.

Auto-invest

Auto-invest has both pros and cons. Anything to make lending and reinvesting less time consuming is a plus. The auto-invest lets you set the maximum amount you want to put into any single loan.

Pawn Style Loans With Secured Assets

When you lend via Unbolted, you are lending against securities such as gold and silver jewellery. Pawn style loans make sense to me; my dad was a jeweller for 40 years. Unlike assets such as property, gold and silver are generally easy to liquidate as they can be auctioned at scrap prices. As long as the jewellery items aren’t too specialised and are valued correctly, liquidation is a straight forward process meaning lenders can be repaid quickly upon default.

Pawn Style Loans Are Very Profitable

When you lend via Unbolted, while I have no information regarding Unbolted’s revenues, I do know from experience that pawn loans are very profitable. I have calculated that Unbolted generates fees on each loan from 8% to 14.8%+. Why should you care? Because a profitable Unbolted means less chance of the company going out of business.

Conservative Asset Valuations

Unbolted remains conservative in their asset valuations, only lending up to 70% of the wholesale auction or dealer asset value. This conservative lending technique means lenders’ are much more likely to recoup all their money in the event of borrower defaults.

Good Default Recovery

Unbolted uses auctions to resell defaulted jewellery items. All of my defaulted items have been successfully sold and 100%+ of capital and interest has been recouped. Unbolted only takes their fee if lenders recover all capital and interest, if not Unbolted shares in any occurred losses.

UNBOLTED REVIEW THUMBS DOWN:

Borrowers Paying High Interest Rates / Ethical Lending?

This is something I often struggle as while I love peer to peer lending, I dislike the thought of people going into consumer debt. Unbolted borrowers are often paying high interest rates on their loans, which makes me question whether I should be investing. This is purely a personal decision.

Idle Account Funds Can Be An Issue (Cash Drag)

Lender demand is high on Unbolted as most borrower loans range between £140 and £20,000 with the majority being in the £1,000 to £5,000 range. When I started investing in Unbolted, it was possible to manually invest in loans as lender demand was lower. Manual investing enabled me to invest larger amounts into preferable loans.

Nowadays the only way to become invested is to use auto-invest as auto-invest receive priority allocations on loans larger than £1,000. There have been times when smaller amounts of my funds were being reinvested. For example, £37 of my funds were reinvested across six loans over a one week period. Demand and supply vary but sometimes I have experienced a larger cash balance sitting in my account earning zero interest; this is also known as “cash drag”. When cash drag occurs, you can expect your returns to be lower than expected.

Those looking to invest large sums of money through Unbolted may experienced more cash drag because there may not be enough loan availability to accomodate large sums of investment money.

Recently the flow of new loans has increased but the situation changes often.

Manual Investing Difficult Due To High Lender Demand / No Loan Pre-funding

I’m not a big fan of using auto-investing because I like to pick and choose loans. Auto-investing could place you into higher risk loans on items such as artwork or books even though Unbolted hasn’t offered many of these loans recently. Since auto-invest allocations take priority, there is very little loan allocation left for manual investors and no loan pre-funding. Unfortunately I don’t see this changing anytime soon.

No Secondary Market To Exit Loans

Unbolted is one of the few companies that doesn’t offer lenders’ a way to buy and sell other types of loans. A full secondary market addition would be most welcome.

Website Lacking Functionality, Information & FAQ’s

Unbolted’s website is really lacking important information such as a simple FAQ. It also lacks some basic functionality such as being to sort your loan book or export it as an Excel file.

My Strategy

I’ve been using Unbolted’s auto-invest option using the Gold Trust and Provision trust loans. Other than choosing what type of loans you’d like to buy, there really isn’t much of a strategy as Unbolted is very much a set and forget peer to peer lending investment. I have experienced several defaults but Unbolted’s default recovery has been excellent and I receive frequent email updates on the recovery of each loan.

Unbolted Review Conclusion

Unbolted’s pawn shop style loans are very appealing and fill the void once occupied by defunct pawnbroking companies Moneything and Funding Secure. Auto-invest takes the time factor out of investing and you are able to select what types of loans you would like to be invested into.

Unbolted does have some downsides including the lack of a regular secondary resale market for exiting other than working capital loans, cash drag issues and limited manual investing opportunities. Despite the downsides, I remain invested through Unbolted and am happy.

Sign up to Unbolted (When you sign up for an account through my website, it helps me to continue to keep Financial Thing updated and operating. Thanks in advance for your support).

If you enjoyed this Unbolted review and want to know more, click here and receive my complimentary Top 5 Peer to Peer Lending Sites Report.

I love feedback, so if you find any errors or omissions in this Unbolted review or have any website improvement suggestions, I invite you to contact me and be a part of contributing to this website.

Disclaimers: I’m have not been compensated to write this Unbolted review, nor am I an employee of any of the companies I write about. In most cases, I have invested or continue to invest my own money through these companies. The sign-up links on this Unbolted review are referral links. When you sign up for an account through my website, I receive a referral fee directly from the companies, at no cost to you. Your support enables me to continue to operate the Financial Thing website. You can read more about my referral links here.

** This unbiased Unbolted review is for information purposes only and should not be regarded as investment advice. Opinions expressed in this Unbolted review are based on my own personal experiences, investing my own money. Peer to peer lending contains risk so never invest more than you can afford to lose. Thank you for reading my Unbolted review. **