RebuildingSociety.com Review

** RebuildingSociety.com review updated April 8th, 2019**

RebuildingSociety.com offers mouthwatering returns for lenders willing to take the risk and study the borrowers. I ultimately exited the platform due to mixed experiences.

My current rate of return: 0% (I no longer invest)

| Est. Annual Returns: | Up to 21% |

| My Risk Rating *: |  |

| Launched: | 2012 |

| Early Exit: | ✓ |

| Autoinvest: | ✓ |

| ISA Available: | ✓ |

| Loan Types: | SME business loans |

| Loan Security: | Debentures, personal guarantees |

| Provision Fund: | X |

| Lender Fees: | 0.5% loan sale fee, £40 IFISA Transfer fee |

| Min Investment: | £10 |

| Time to Become Invested: | Fast |

| Time Needed Managing: | Low to medium |

| Lending Agreements With: | Borrowers |

| FCA Regulation: | Full |

| Cashback Offer: | £25 bonus when you invest £1,000+ |

* This opinion risk rating factors in types of loans offered, interest rates, platform history, default numbers and my own investing experience. My risk rating explained.

The RebuildingSociety.com Review – What You Need to Know:

Pros

- Industry high lender return rates

- Good availability when loans exist

- Secondary market for exiting loans

Cons

- High risk / higher default rates

- Buyers pay very high-interest loan rates

- Loaning to small businesses

- Some loans unsecured

- Fee to sell loans on secondary market

- Questionable loan choices

- Finicky website

Equivalent Competitors

Assetz Capital, Funding Circle, Ablrate

RebuildingSociety.com Review: My experiences so far….

RebuildingSociety.com was one of the first peer to peer lending platforms I invested through. I was blinded by the high-interest returns without understanding the risks. Small business lending is also time-consuming as research is needed to make sure the companies are in good financial standing. Several months and a couple of stinging defaults later, I decided my time and money was best spent on other platforms.

What Is A RebuildingSociety.com?

RebuildingSociety.com is a peer to peer lending platform allows investors to lend money to businesses. Business types can include retail stores, technology, builders and other small or medium sized business sectors. RebuildingSociety.com uses a bidding system where you set the interest rate you are willing to accept. This requires some hands-on participation.

When Did RebuildingSociety.com Launch?

2012

Are They Regulated?

Yes, by the Financial Conduct Authority #656344 under full permissions granted February 22nd, 2017. Investments made through RebuildingSociety.com are not covered under the FSCS (Financial Services Compensation Scheme). FCA regulation is nothing like the FSCS, which covers consumers when they deposit money in banks. The FCA reports to the UK government and has the ability to pursue criminal action against companies which violate its standards and codes of conduct.

How Do I Sign Up?

Click here and receive £25 when you invest £1,000+ (This is a referral link which pays us both £25 when you register and verify your identity. Referrals like this help keep Financial Thing operational).

Who Can Open An Account?

Customers who can pass the identity checks and have a UK bank account.

What’s the Signup Process Like?

They run the usual identification checks to make sure you aren’t a money launderer.

What’s The Minimum Deposit / Investment?

£10

How Much Interest Does RebuildingSociety.com Pay Lenders?

Annual gross return rates range from 5.5% to 25% depending on the risk level and loan type. It’s extremely important to keep in mind that with great reward comes great risk. At the time of writing, the three highest paying loans were overdue.

Is Interest Paid Immediately Or When the Loan Starts?

New loans: Interest paid once the loan is drawn down. No interest is paid during the bidding process. Some loans can take a while to fill so keep this in mind.

Secondary market: Interest accrues immediately on purchase.

When Is Interest Paid?

First of each month

What Are The Default Rates?

13.5% as of December 2018. You can check the current stats here.

What Are The Fees?

0.5% fee on any secondary market loan sale, £40 IFISA transfer in or out fee, 0.1% IFISA account management fee of assets taken from available balance on the first of each month (defaulted loans are exempt from fee). Lenders’ who hold a £100,000+ account balance or 100,000 loan records may be charged a 1% large lender fee. All fees are listed here.

Does RebuildingSociety.com Offer An Innovative Finance ISA?

Yes

What Are The Length Of The Loans?

5 years

How Are Loans Paid Back?

Principal and interest are paid monthly

What Security Does RebuildingSociety.com Loan Against?

Security varies from loan to loan. Can include first or second charges on property, debentures and personal guarantees.

What Are The Main Risks?

Borrower default: Since loans are to small businesses, defaults tend to be higher than other platforms. Borrowers are sometimes paying interest rates in the mid 20%’s. Most small businesses don’t survive more than five years under normal conditions.

Platform failure: If RebuildingSociety.com were to fail, they have a 3rd party in place to facilitate continued borrower to lender loan payments. Platform failure risk is one of the biggest risks of peer to peer lending.

Economic downturn: When the economy is bad, small businesses fail at a high rate.

Underwriting quality: RebuildingSociety.com has had some issues with defaults leading me to question their underwriting procedures. Currently, their A rated loans have a higher default than their C rated loans.

Is There A Provision Fund?

No

Am I Lending to the RebuildingSociety.com Platform or to the Borrower?

All loan contracts are between lenders and borrowers.

What Happens if RebuildingSociety.com Goes Bust?

In an aptly named section titled “We Might Die”, RebuildingSociety.com briefly explains what would happen if they ceased trading. To summarize, a third party administrator would continue to collect loan repayments and administer them to lenders. Other than that, very little detail is provided. Would this repayment process work in theory? Who knows. My future hopes are that peer to peer companies clearly explain their administration process to lenders. Most companies bury these details inside their terms and conditions.

WHAT I LIKE ABOUT REBUILDINGSOCIETY.COM:

High Returns

For me, the biggest benefit of investing through RebuildingSociety.com is the possibility of high return rates if you can avoid the defaults. It’s possible to buy loan pieces that pay over 25%. Just remember that high returns mean a higher risks.

The Secondary Market

The secondary market is a good place to start investing as it usually has a diverse array of offerings. If you sell on the secondary market, there is a 0.5% fee. Because of this, make sure the loans you purchase are ones you plan on keeping long term.

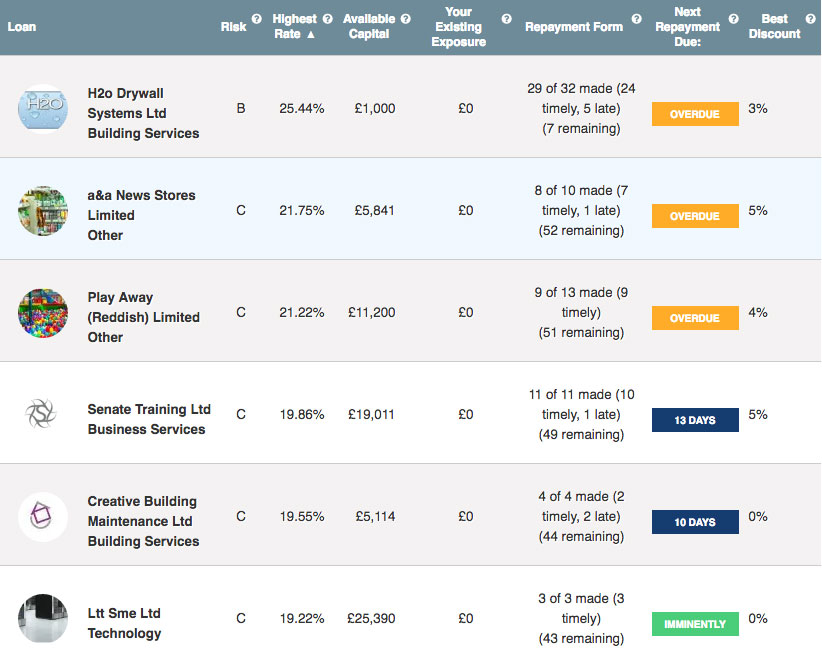

Here is a screenshot of the secondary market:

This self-explanatory information shows risk grades, return rates, existing investment exposure, availability amounts, the number of payments, next payment and discount availability. The secondary market is easy to use and relatively liquid for the good quality loans that pay on time.

Loans Amortize

This means you receive capital and interest payments monthly. When loan balances reduce over time, so does the risk.

WHAT I DISLIKE ABOUT REBUILDINGSOCIETY.COM:

High Interest Rates For Borrowers

Borrowers can be paying interest rates over 25%. As a business owner, I can imagine how difficult it is to survive financially paying high interest rates. Inevitable defaults will happen.

Loan Underwriting Selection

Two of the loans I invested left a very sour taste in my mouth. The first loan defaulted after the first payment and the second loan was given to a borrower whose place of business was closed. This borrower had also taken out an additional loan on another peer to peer platform.

After these two experiences, I decided RebuildingSociety.com wasn’t for me. Could things have improved since then? Absolutely, but with all the alternative peer to peer lending options out there, I decided to invest elsewhere.

Defaults

RebuildingSociety.com seemed to be experiencing a high default rate when I was a lender. Their default rates rose from 2.9% in 2013 and peaked in 2016 at 34.2%, then dropping to 12.6% in 2017.

Overall their “A” rated loans have experienced a 8.9% default rate while their “C” rated loans have defaulted at a 16.7% rate. You can view current statistics here.

Secondary Market 0.5% Sale Fee

Secondary market fees do nothing more that dry up liquidity and make it harder to exit unwanted loans. 0.5% may not sound like much, but it can add up.

Poor Communication

I found the communication response times to be slower. Hopefully, things have changed for the better now but I remember when email response times were five business days or more.

Finicky Website

Rebuilding Societies WordPress website can be annoyingly slow at times. I also experienced some errors with my account balance being incorrect. The issues were eventually fixed but my confidence was damaged. If I hadn’t have spotted the account balance mistakes, would it have gone unnoticed by staff?

Time Factor

RebuildingSociety.com returns are best maximised by due diligence and research. You will need to make sure borrowers businesses are legitimate before you invest. Personally, I don’t have time to do this and would rather be doing other things than analysing business financials and balance sheets.

My Strategy

When I first invested in RebuildingSociety.com, I made the biggest beginners mistake by putting too much money into a single loan which subsequently defaulted. Thankfully I had spread more across various additional loans for diversification purposes. If you don’t have the time to research each business, I recommend picking as many loans as you can and evenly splitting your investment. If you do this, a few defaults won’t destroy your returns.

The RebuildingSociety.com Review Conclusion

RebuildingSociety.com really interested me in my early peer to peer lending days but as time passed, I quickly realized the harsh reality of high return, high-risk lending. I have always considered investing a long-term plan and know abnormal returns only exist if you are willing to gamble. Loaning to small businesses is tricky because you never know which businesses will thrive and which will fail. A borrower could be in trouble even if their financial statements report otherwise.

Capital preservation now remains a priority so this means steering clear of risky propositions. Always remember the general statistics on businesses: a large percentage of them survive fewer than five years. RebuildingSociety.com certainly offers some interesting investment propositions, it just wasn’t for me.

If you want to give RebuildingSociety.com a try, click here to sign up. Click here and receive £25 when you invest £1,000+ (This is a referral link which pays us both £25 when you register and verify your identity. Referrals like this help keep Financial Thing operational).

If you enjoyed my RebuildingSociety.com review and want to learn more about peer to peer lending, click here and receive my complimentary Top 5 Peer to Peer Lending Sites Report.

Disclaimers: I’m not paid by or employed by any of the companies I write about. In most cases I have invested or continue to invest my own money through these companies. The sign up links on this website are referral links. When you sign up for an account through my website, I receive a referral fee directly from the companies, at no cost to you. Your support enables me to continue to operate the Financial Thing website. You can read more about my referral links here.

This unbiased RebuildingSociety.com review is for information purposes only and should not be considered investment advice. Opinions expressed in this RebuildingSociety.com review are based upon my investing experiences. All information was deemed to be correct at the time of writing. Peer to peer lending contains risks so never invest more than you can afford to lose.