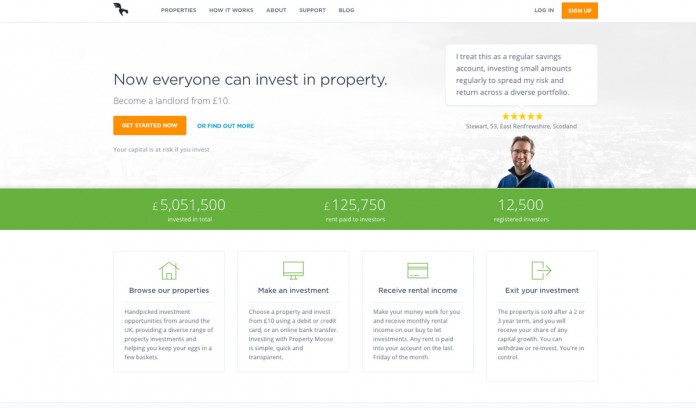

Property Moose / UK Diversified Property PLC

** Property Moose review updated October 28th, 2020 **

I originally invested in Property Moose’s properties as I thought the idea of crowdfunded buy to lets was innovative. My Dad had invested in a similar scheme in the 1990’s which had performed very well and returned him about 15% per year.

Unfortunately, Property Moose changed its business model from crowdfunded shared property ownership to a fund style portfolio whereby all investors hold shares in the total property portfolio rather than in individual properties.

Property Moose’s model was changed because crowdfunded property purchasing didn’t financially work so the Moose’s powers that be made the tough decision to make drastic changes for the survival of the company.

The previous model whereby investors purchased shares in each property and paid monthly dividends was discontinued. All properties were revalued at a four-week sale price to create a final share price of 1p per 1p invested through Property Moose for the new UK Diversified Property PLC which holds all 105 of the Property Moose properties. The portfolio is made up mainly of residential houses with a few commercial properties.

All investors who opted to stay invested received allocations of shares within the new property fund. The share price is determined by the valuations, costs, and revenues generated by the portfolio of properties. The fund to operate more like a REIT (Real Estate Investment Trust) where investors should receive distributions.

Property Moose investors were given the option to remain invested or to exit at a discount. I chose to stay invested.

Remaining investors were originally estimated to receive distributions in the first quarter of 2019 but so far this hasn’t happened, mainly due to economic conditions caused by Covid-19 and other delays.

Once all properties had been transferred to the new company (UK Diversified Property), Property Moose refinanced the portfolio through a bank.

My personal thoughts are that the situation isn’t ideal. But after sitting down with Andrew Gardiner, CEO of Property Moose, it appeared the original business model wasn’t working and Andrew and his team figured out the best possible long-term solution of moving all properties into a single PLC portfolio. This solution was voted on by investors and received a 99.48% majority.

The biggest problem with the UK Diversified Property shares is the lack of liquidity. In order to exit you have to find a buyer and it’s a hard sell, even though the shares will probably be ok in the future.

The UK Diversified Property team is planning a stock exchange listing which should create more liquidity, however, this is taking a long time to implement and there’s no guarantee this listing will take place. If the shares are listed, share prices can rise and fall just like regular company shares.

I’m not a fan of REIT style funds but I have faith in Andrew that he is acting in the best interests of his investors which is why I remained invested in the new PLC.

I love feedback, so if you find any errors or omissions or have any improvement suggestions, I invite you to contact me and be a part of contributing to this website.

Disclaimers: I’m not paid by or employed by any of the companies I write about. In most cases, I have invested or continue to invest my own money through these companies. The sign-up links on this website are referral links. When you sign up for an account through my website, I receive a referral fee directly from the companies, at no cost to you. Your support enables me to continue to operate the Financial Thing website. You can read more about my referral links here.

** This Property Moose / UK Diversified Property PLC is for information purposes only and should not be regarded as investment advice. Opinions expressed within this Property Moose review are only opinions based on my own personal experiences. As with any financial investment, peer to peer lending involves risks, so never invest more than you can afford to lose. Thank you for reading my Property Moose review. **