Mintos Review

** Mintos review updated November 27th, 2020 **

NOTE: Mintos no longer allows UK investors to reinvest or open new accounts. This was due to the FCA denying Minto’s regulatory application in June 2019. Existing UK investors will continue receiving loan repayments from borrowers according to payment schedules and will be able to use the secondary market and withdraw money at any time.

________________________________________________________________________

Latvian based Mintos is a giant loan aggregator that offers thousands of loan options including personal, business, property and cars. These loans are underwritten through European finance companies located in various countries. Mintos has lent over €5.7bn.

Mintos also enables lenders to exchange currency without needing to use a third party. Investing in currency other than £’s does present British residents with some currency risk but the returns are high enough to be intriguing. Read on for my unbiased Mintos review.

My Current Investment Amount: Click here

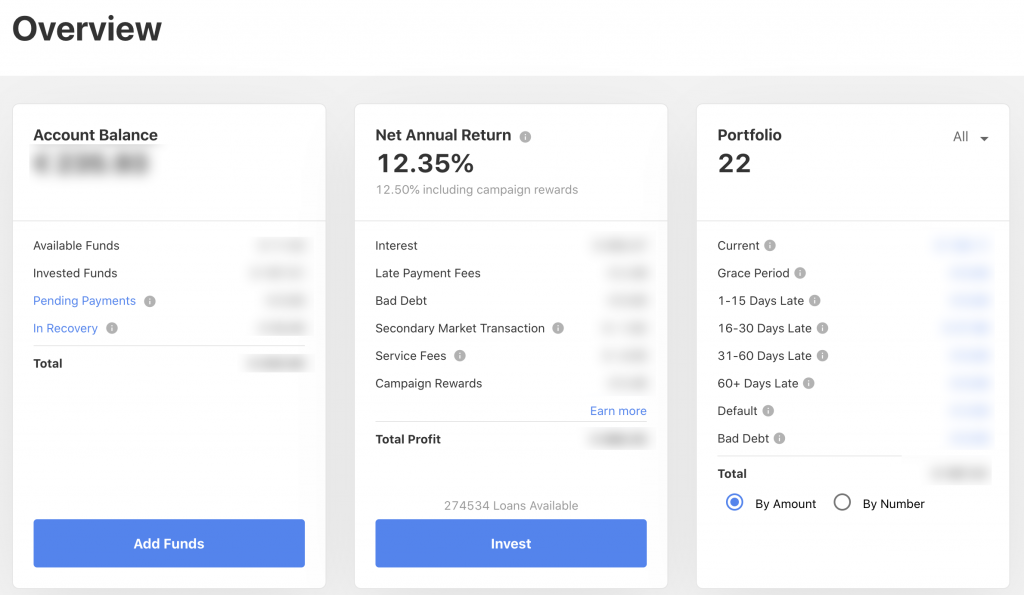

My current rate of return: 12.35% (After fees but before tax)

| Est. Annual Returns: | Up to 20% |

| Recent Return Rate Trend: | ← → |

| My Risk Rating *: | |

| Launched: | 2014 |

| Early Exit: | ✓ |

| Autoinvest: | ✓ |

| ISA Available: | X |

| Loan Types: | Mortgages, car, consumer, business, argriculture |

| Loan Security: | Property, buy back guarantees, grain contracts. |

| Provision Fund: | X |

| Lender Fees: | None |

| Min Investment: | €10 |

| Time to Become Invested: | Fast |

| Time Needed Managing: | Zero (auto-invest) to low (manual) |

| Lending Agreements With: | Borrowers |

| FCA Regulation: | N/A |

| Cashback Offer: | 1% of deposit within first 90 days |

* This opinion risk rating factors in types of loans offered, interest rates, platform history, default numbers and my own investing experience. My risk rating explained.

How Do I Sign Up?

Click here to sign up (No current offers. When you open an account through my website, it helps me to continue to operate and offer new reviews).

The Mintos Review – What You Need to Know:

Thumbs Up

- Return rates of up to 11%

- Guaranteed buy-back loans

- Some loan partners have skin in the game

- Risk grade and assessments on all loan companies

- Wide range of loan options / no lender cash drag

- Currency exchange available through the website

- Close to €2bn+ lent

- Auto and manual invest options

- Mintos doesn’t underwrite loans

- Secondary market for exit / no selling fees

Thumbs Down

- UK residents cannot invest

- Some lending companies seem to be worsening, are higher risk and have defaulted

- High risk

- Mintos doesn’t underwrite loans

- Buyback guarantees only as good as the companies offering them

- Latvian based so regulation is uncertain

- Some loans unsecured

Equivalent Competitors

Mintos Review: My experiences so far….

I began lending through Mintos in June 2015 but no longer reinvest due to Mintos freezing UK investors as it was unable to receive UK FCA regulation to operate. I also believe Minto’s marketplace is becoming less attractive due to the worsening state of some of the lending companies Minto’s offers loans from.

I didn’t have a single default for the first four years but then a lot has changed in the peer to peer lending world since 2015 and my defaults have increased and I expect defaults to rise due to the economic impact of Covid-19. Out of the two European companies I used, (the other was Bondora), Mintos was my favourite. I used to invest solely in Mogo car loans since they offered a buyback guarantee against defaults. I then diversified further to protect against Mogo going out of business by using the auto-invest tool to buy other company loans. This turned out to be a mistake as one of the companies I invested in defaulted. This is the high-risk nature of European peer to peer lending. It’s all good until it isn’t.

I previously experimented with mortgage loans and found the late payments to be too frequent and didn’t think the extra 2% returns were worth the risk. Property recovery takes so long if the borrower defaults, I can’t see much advantage in those types of loans.

At this point, I have little interest in reinvesting through Mintos.

What Is Mintos?

Mintos is a Latvian based peer to peer loan marketplace that couples borrowers with lenders. Mintos offers many different loan types including car loans, mortgages, invoice financing and small business loans. Borrowers and loan companies are based in several different countries including the UK, Latvia, Denmark, Sweden, Spain and more.

Think of Mintos like a giant loan aggregator where many lending companies bring loans to Mintos marketplace.

How Can I Contact Mintos?

Email: Support@mintos.com

UK Tel: +44 157-893-0033

Latvia Tel: +371 66 164 466

When Did Mintos Launch?

2014

Are They FCA Regulated?

No

Who Can Open An Account?

Anyone outside of the UK who has a bank account in the EU or who resides in a country that has similar AML / CFT (Anti-Money Laundering and Combating Financial Terrorism) protocols to the EU. Neither UK or American residents can invest through Mintos.

What’s The Signup Process Like?

I was approved once I passed the identification and money laundering checks. The process was easy. As I mentioned, UK investors cannot currently open an account.

What’s The Minimum Deposit / Investment?

€10

What’s The Easiest Way To Deposit Funds?

My preferred method for transferring money is Transferwise which offers competitive exchange rates and low fees. Mintos also offers instant deposits through an online payment company based in Sweden called Trustly.

Does Mintos Offer An Innovative Finance ISA?

No

How Much Interest Does Mintos Pay Lenders / Investors?

Annual gross return rates are up to 19% depending on the types of loans you purchase.

Is Interest Paid Immediately Or When the Loan Starts?

Interest accrues immediately on purchase

When Is Interest Paid?

Payments are received at different times throughout the month.

Am I Lending To The Mintos The Company Or To Borrowers?

All loan contracts are between lenders and borrowers.

What Are The Fees?

No fees to lenders

How Much Time Will I Need To Spend Managing My Investments?

I used to handle my investments manually as I had trouble making the auto-invest tool work correctly. Now I use auto-invest so my time has been reduced to zero which is great news. Some time is needed reinvesting payments if you chose the manual route.

What Are The Length Of The Loans?

This depends on the type of loan. Some mortgage loans are as long as 13 years while small business loans are as much as 7.5 years. Car loans can be as long as six years while personal loans can be as short as two weeks. Loans can end at any time due to repayment.

What Security Does Mintos Loan Against?

All mortgages are secured by property. Business loans are usually secured by a mix of property, business assets and /or personal guarantees. Personal loans are usually unsecured.

What Are The Loan Default Rates?

Loan defaults have risen due to Covid-19 but default rates change daily so please check them here.

What Are The Main Risks?

Company failure: Since Mintos is a loan aggregator for many different lending companies from different companies, you have two failure risks. One potential failure is Mintos and the other is the lending company failures who put their loans on Mintos. I consider Mintos a riskier company to invest through because it is based in Latvia and is completely unregulated. If Mintos goes bust, I doubt investors would see recoveries on their funds.

Poor lending companies: Not all of the companies Mintos offers loans from are good companies. If these companies deteriorate further, so will investors returns.

Economic: European economies tend to be more volatile than the UK’s. Many of the loans are given to residents of economically volatile countries such as Spain and Lithuania.

Currency risk: Investing in Euros means currency fluctuations can adversely affect your account value. On the other hand, as seen post Brexit, it can be good to have currency exposure.

Defaults: Investing in non-guaranteed loans increases default risk.

Is There A Provision Fund?

No

What Happens If Mintos Goes Bust?

Mintos has hired a company called FORT to act as an administrator in the event Mintos goes out of business. In theory, FORT would collect and distribute loan payments to lenders and distribute them. Who knows if lenders would actually receive their loan repayments.

THUMBS UP FOR MINTOS:

Wide Range Of Loan Options With Great Availability / Minimal Lender Cash Drag

Since Mintos offers so many loan originators, lenders’ can build a wonderfully diversified loan portfolio and I never have an issue with money sitting in account idle other than when my balance is below the €10 loan investment minimum.

Guaranteed Buy-Backs

In my opinion, the biggest benefit of investing through Mintos is the guaranteed default buy-backs offered by some loan partners. If the borrower fails to pay after 60 days, the guarantor loan partner repays all past due capital and interest. This buyback decreases risks to lenders and is the sole reason I invest through Mintos.

But buyer beware, these buy-back guarantees are only as good as the companies who offer them. If the company offering the buy-back runs into financial troubles, those guarantees become worthless.

I’ve always received the buyback funds on time whenever my loans have gone over 60 days past due. On the downside, remember that these buybacks are only as good as the financial stability of the companies who offer them. One of the Buyback guarantee companies I bought loans through defaulted.

Transparent Information On All Loan Originators

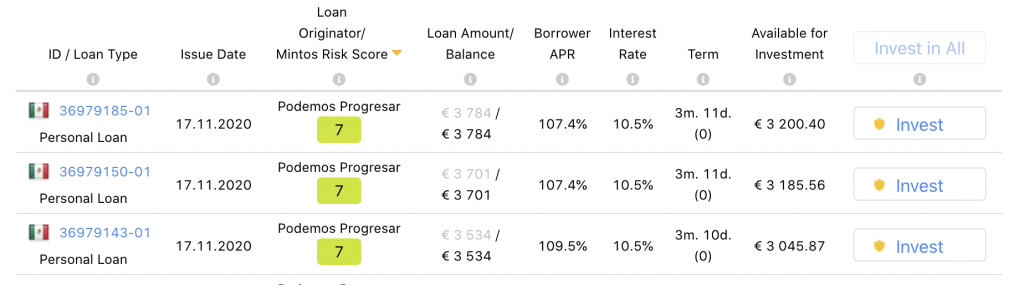

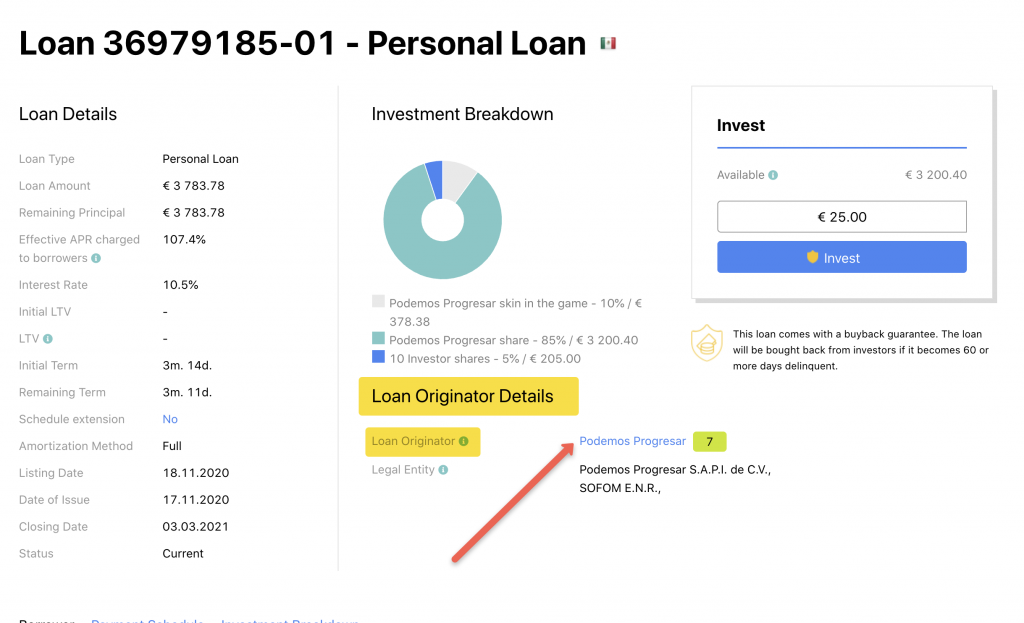

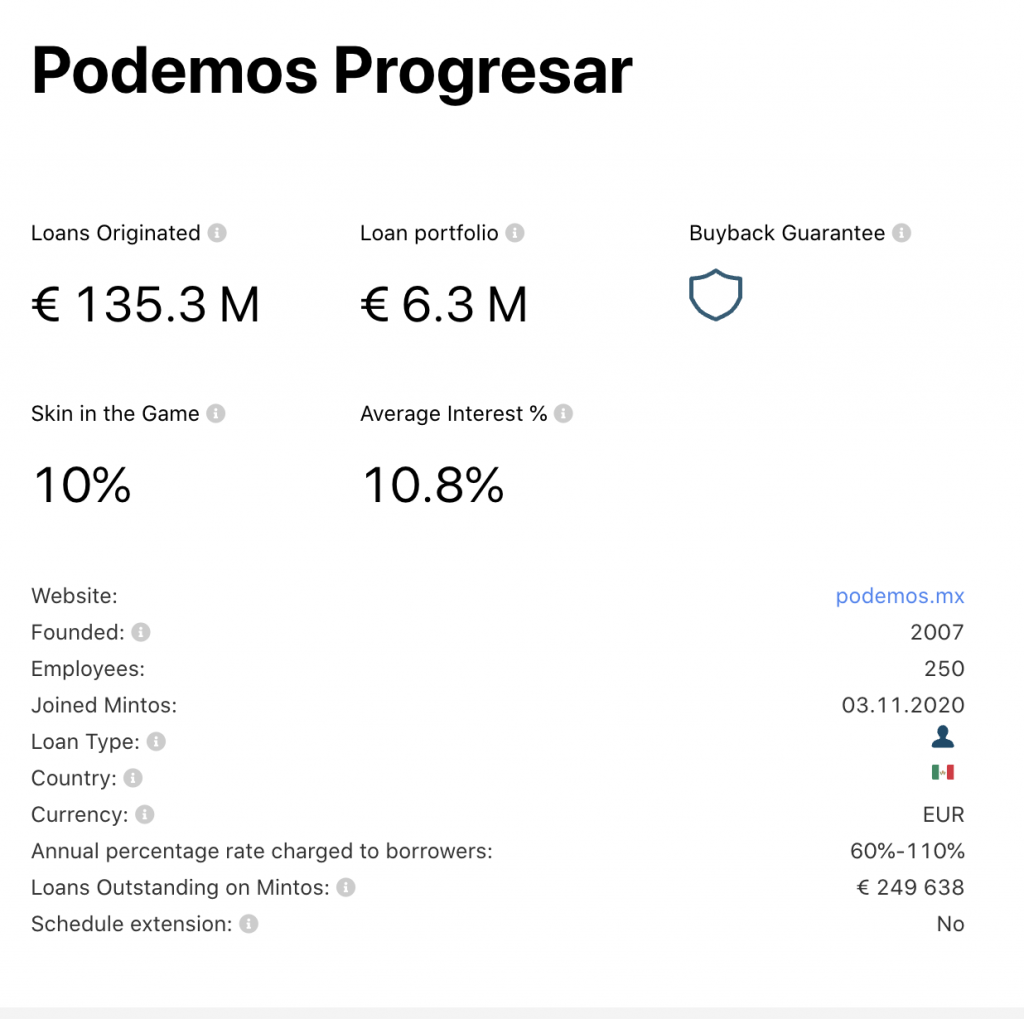

Mintos offers its own analysis on each finance company it offers loans from. Mintos assigns each company with a risk score and shows how much skin in the game each provides:

You can find the company information by clicking on a loan and then clicking on the Loan Originator information:

Interest Returns

Since Mintos is higher risk, it is possible to achieve returns in the 19% range if your risk tolerance is high more risk. I only invested in buy buyback guaranteed loans that paid 12% annual returns but even some of those defaulted and I don’t expect to see much in the way of recoveries.

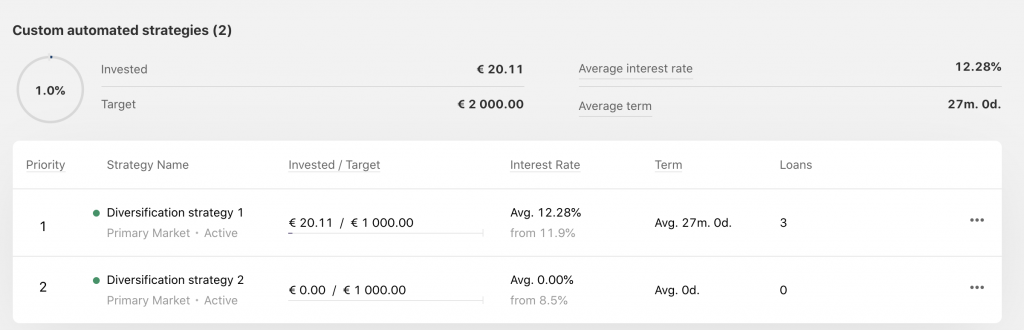

Auto-Invest

Auto-investing takes the time hassle factor out of peer to peer investing. I used Mintos auto-invest tool because I didn’t have the time to manage all my loans. The tool worked well except it invested me into loans from a company that defaulted.

Simply set your investing criteria from the filters and Mintos will do the rest:

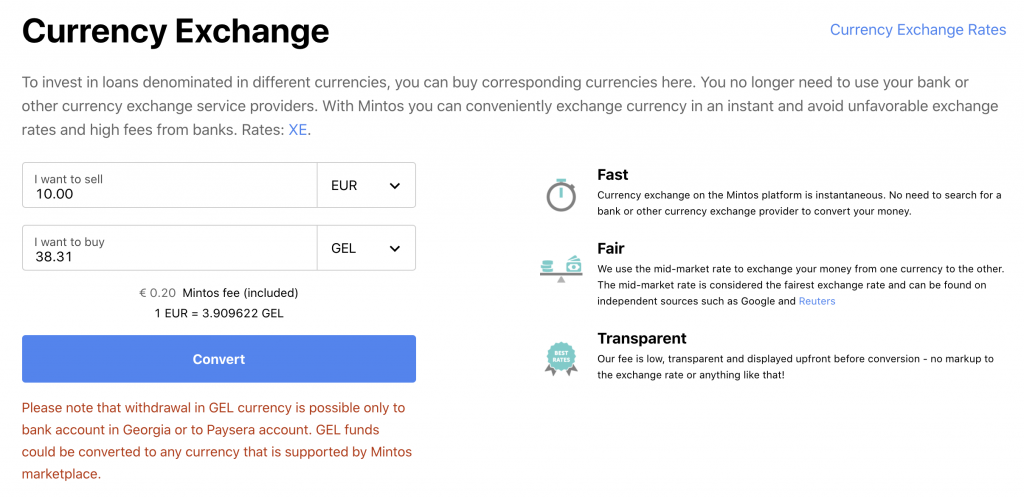

Currency Exchange

Mintos offers lenders a fee-free currency exchange when they make a deposit. On the Deposit page, click the deposit and decide which currency you want to invest in. Mintos uses bank rates without any added fees:

Personally, I haven’t tried this feature as I’ve always used Transferwise to send currency to Mintos.

Skin In The Game

Every Mintos loan originator invests their own money into their loans. This amount varies by loan partner but ranges from 5-15% (see here for the summary). It’s nice to know the loan originators are taking on some of the loan risk alongside lenders!

The Secondary Market / No Selling Fees

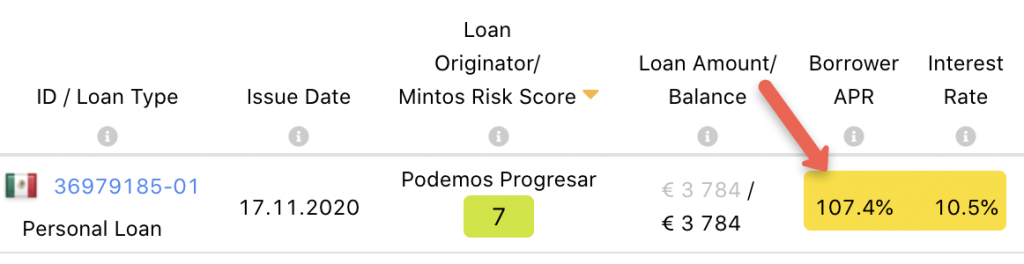

An active secondary market means it’s easy to purchase loans to quickly build up your portfolio. Secondary market loans are often marked up with premiums so be careful when you buy (see yellow highlights below):

Since the high paying guaranteed car loans were removed from the primary market, I starting using the secondary market to buy these loans.

Loans Amortize

This means you receive capital and interest payments monthly. When loan balances reduce over time, so does the risk.

Website

Mintos’s website is very easy to use and features an intuitive design that is easy on the eyes.

Here is the dashboard:

Simply laid out with all the important information. Well done Mintos!

Simply laid out with all the important information. Well done Mintos!

THUMBS DOWN FOR MINTOS:

UK Investors Cannot Open An Account

As I mentioned before, Mintos was forced out of the UK market as it was denied FCA regulation so UK investors were forced to run down their account. Mintos may try to renter the market at some point but I’m not convinced. UK investors will not be able to open new accounts or invest in new loans. Existing UK investors will continue receiving loan repayments from borrowers according to payment schedules and will be able to use the secondary market and withdraw money at any time.

High Risk

Many of the loans on Mintos are in the high risk category, In fact, the lender-borrower spread can be huge indicating large risk spreads:

Fortunately, Mintos transparently displays this information so you make your own decisions.

The average investor returns over 12% interest per year. When returns are this high, there is risk involved. There are spreads and costs involved for Mintos and the loan originators and in some cases, borrowers are paying high-interestest rates on their loans.

Default Issues

As Covid-19 has become worse, it seems that Mintos is having some challenges keeping their loan book current. When I checked Mintos’s statistics page in November 2020, €87m of loans are in recovery. Most of this money is tied up in the suspended or defaulted lending companies.

Out of the €500m total loan book, 74% of loans are current.

European Operator / Currency Risk

Another layer of risk is added because Mintos is based in Latvia. First, let me state that I think Mintos is a legitimate company and I have been happily investing through them for a while. The problem is, if Mintos goes bust, money recovery could be difficult as you will be placing your trust into a European third party administrator for loan collections. Mintos does have offices in several other European countries including the UK, but they aren’t regulated in the UK.

This is why my Mintos investment has stayed small. Mintos has discussed becoming FCA regulated. If this happens, I would consider upping my investment because I like Mintos’s business model.

Being a £ investor, investing in Euros presents some extra risk but this can also be beneficial, as was seen after the Brexit vote.

Non-Guaranteed Loans Are Riskier

At the beginning of my Mintos investing, I tried investing in some high return rate non-guaranteed loans such as mortgages. Multiple late payments made me uncomfortable so I sold them on the secondary market as I know how difficult property recovery can be. I believe it makes much more sense to accept 1.5% less on a guaranteed buy-back loan. I have no idea how effective Mintos’s defaulted real estate recovery process is so I stick to buy-back guaranteed loans.

Buy Back Guaranteed Loans Are Only As Good As The Companies Offering Them

Remember that Mintos doesn’t underwrite loans, so any loan buy-back guarantees offered are backed by third-party lending companies. One of these companies, Eurocent, a Polish payday lender, went bust in 2017. Eurocent was going through a restructuring process but if I were in Eurocent loans, I wouldn’t expect to see much recovery making their loan buyback guarantees worthless.

Other companies listed on the Mintos platform have run into troubles. In November 2020, I counted 21 lending companies that were either suspended or defaulted.

Mintos Doesn’t Underwrite Loans

I consider this both a pro and a con. The cons are if the companies Mintos are using to originate and underwrite their loans aren’t vetting their borrowing customers well, Mintos may be offering low-quality loans from these companies.

To combat this, Mintos seems to do a good job analysing their lending originators.

Some Loans Are Unsecured And Therefore Could Be Higher Risk

In a downturn economy, unsecured borrowers are quick to default on their loan commitments if there’s is no security backing their loan. Just be aware if your loans portfolio contains a large proportion of unsecured loans.

My Strategy

I used Mintos autoinvest tool and have it set to buy a variety of diverse loans ranging from car loans to personal loans. Previously I purchased Mogo’s secured buy back loans but decided I needed further diversification in case Mogo were to fail.

Since Mintos paused all UK investors, I can no longer invest through Mintos and I feel like this was a blessing in disguise as the longer I’m invested in an unregulated company, the less comfortable I feel plus more loans are running into trouble which is never a good thing.

I have little interest in investing in Mintos until the loan book becomes more current and Covid-19 eases.

The Mintos Review Conclusion

Investing through Mintos was a great experience for the first four years and I averaged just over 12% interest per year. It’s important to understand how risky some loans can be when lenders are being paid 10.5% interest per year while the borrower is paying 194% APR.

Unfortunately, Covid-19 has affected Mintos and its lending companies.

Mintos does offer vast array of loans means you can build a diverse portfolio with secured and unsecured loans and there are websites out there that analyse the risk the lending companies Minos offers. There’s never a shortage of loans meaning lender’s experience very little cash drag, meaning money sat in their accounts due to a lack of loan offerings.

Mintos no longer allows UK residents to open Mintos accounts or reinvest funds due to their lack of FCA regulation. Any UK resident that is currently invested will see their loans run out but cannot reinvest.

As I’ve become a more experienced investor and experienced several company failures, my risk tolerance has shrunk so Minto’s wouldn’t be a place I’d invest mainly due to the financial impacts of Covid-19 and the financial impacts I think Covid will have on European loans borrowers.

Click here to sign up (No current offers. When you open an account through my website, it helps me to continue to operate and offer new reviews).

If you enjoyed my Mintos review and want to learn more about peer to peer lending, click here and receive my complimentary Top 5 Peer to Peer Lending Sites Report.

I love feedback, so if you find any errors or omissions or have any improvement suggestions, I invite you to contact me and be a part of contributing to this website.

Disclaimers: I’m not paid to write this Mintos review, nor am I employed by any of the companies I write about. In most cases, I have invested or continue to invest my own money through these companies. The sign-up links on this website are referral links. When you sign up for an account through my website, I receive a referral fee directly from the companies, at no cost to you. Your support enables me to continue to operate the Financial Thing website. You can read more about my referral links here.

** This unbiased Mintos review is for information purposes only and should not be considered investment advice. Opinions expressed in this Mintos review are based on my investing experiences. All information was deemed to be correct at the time of writing. Peer to peer lending contains risks so never invest more than you can afford to lose. **