Lendinvest Review

** Lendinvest review updated November 5th, 2020 **

Lendinvest offers bridging and development lending via loans secured by property at lower loan-to-values and secured bonds listed on the London stock exchange. Lendinvest has lent over £3bn and provides competitive returns. Lendinvest has strong operating history and is profitable which inspires confidence. I love knowing the company can sustain itself financially rather than private investors funding losses during growth.

Lendinvest originally intended to become an FCA regulated peer to peer lending but later changed its course to be classified as an Alternative Investment Find or AIF.

Read on for my in-depth Lendinvest review where I share my experiences as a lender.

My Current Investment Amount: Click here

My current rate of return: 5.64% (Net annual return after bad debt and fees but before tax)

| Est. Annual Returns: | 4% - 7% |

| My Risk Rating *: | |

| Launched: | 2013 |

| Early Exit: | X |

| Autoinvest: | ✓ |

| ISA Available: | X |

| Loan Security: | Property, debentures, personal guarantees |

| Provision Fund: | X |

| Lender Fees: | None |

| Min Investment: | £5,000 deposit, £100 per loan, £1 auto-invest |

| Time to Become Invested: | Fast but varies on loan availability |

| Time Needed Managing: | Manual invest: medium, Auto-invest: none |

| Lending Agreements With: | Lendinvest |

| FCA Regulation: | Full |

| Cashback Offer: | None |

| Sign Up: | Click here to open an account |

* This opinion risk rating factors in types of loans offered, interest rates, platform history, default numbers and my own investing experience. My risk rating explained.

How Do I Open An Account?

Sign up here for a Lendinvest account. (Currently, there are no cashback offers.)

The Lendinvest Review – What You Need to Know:

Pros

- Loans secured by 1st charges on property

- Profitable company (£616,000 Net profit 2018-2019 tax year) / financial stability

- Large company with diverse array of other company arms

- Transparent information / publishes its loan book and lender borrower spreads

- £50,000 of possible FSCS protection for Lendinvest incorrect loan administering or fraud

- £1.7bn+ lent with low defaults

- Reasonable loan-to-values on loans / from 28-75%

- Auto-reinvest £1 minimum

Cons

- Not peer to peer lending. Loan contracts are between lenders’ and Lendinvest rather than directly with borrowers

- No secondary market to exit loans

- Advertised FSCS protection could be misunderstood

- Some loans are quite large (ex. one loan of £6m is in default)

- Money deposited by debit card cannot be withdrawn for 90 days

- Lower interest returns for bridging loans / is the risk vs return worthwhile?

- No access to valuation documents / heavy reliance on Lendinvest’s due diligence

Equivalent Competitors

Loanpad, Assetz Capital, Octopus Choice

Lendinvest Review: My experiences so far….

I’ve been investing through Lendinvest’s loans since October 2016 and my experiences have been nothing other than good. Lendinvest has a constant stream of new loans and payments have always been made on time. After a visit to their offices to see their operations, I have become even more comfortable with Lendinvest.

I do not invest in the secured bonds.

What Is Lendinvest?

Lendinvest is a U.K. based lending company that offers secured 1st charge property and bridging loans and secured bonds listed on the London Stock Exchange. Borrowers are experienced property developers with proven track records.

I only cover the peer to peer investments as I do not invest in property-backed bonds or mini-bonds.

How Can I Contact Lendinvest?

Web

Email: support@lendinvest.com

UK Tel: 0800 130 3388

When Did Lendinvest Launch?

August 2013

Are They Regulated?

Yes, by the UK Government’s Financial Conduct Authority under interim permissions. FCA regulation is nothing like the FSCS (Financial Services Compensation Scheme), which covers consumers when they deposit money in banks. The FCA does have the ability to pursue criminal action against companies that violate its standards, but the FCA is not a government entity and it’s funded by the very companies it regulates.

Who Can Open An Account?

Any person who has a UK bank account and can pass the money laundering and identification checks.

The Dashboard

Lendinvest’s website is very clean and easy to follow. Here’s what the dashboard looks like:

And the portfolio page:

From this page you can see the details of any of your loans that are in arrears or in default.

How Much Time Will It Take To Become Invested?

This always depends on demand and supply. Lendinvest tends to have a decent new loan flow.

What’s The Minimum Deposit / Investment?

Deposit: £5,000 minimum

Loans: £100 minimum

Auto-Reinvestment: £1

How Are Deposits Made?

Via bank transfer which takes up to three business days or via debit card instant deposit with a limit of £100,000.

Does Lendinvest Offer An Innovative Finance ISA?

No

Can I Lendinvest Investments Be Used In A SIPP?

No

How Much Annual Interest Does Lendinvest Pay Lenders?

Loans pay various return rates ranging from 4% to 8%. This tends to be lower compared to other companies offering property bridging and development loans however I view Lendinvest’s loans to be less risky due to the borrower criteria and the lower loan-to-values on the securities.

How Much Interest Do Borrowers Pay On Their Loans?

Lendinvest’s borrowers pay between 6-13%. Lendinvest fully discloses how much borrowers pay in their loan book download which you can access from your account dashbaord. Knowing what borrowers pay helps with risk assessment.

Is Interest Accrued Immediately Or When the Loan Starts?

Interest accrues when your money is matched into loans.

When Is Interest Paid?

Last day of each month

Am I Lending To Lendinvest Or To The Borrower?

All loan contracts are between lenders’ and Lendinvest. Because of the way loans are structure, Lendinvest is not a true peer to peer company.

What Are The Fees?

No lender fees

Is There An Auto-Invest Option?

Lendinvest does offer both auto-invest and auto-reinvest and they both work well. Auto-invest has a minimum investment of £10 investment and allows several lending criteria to be chosen:

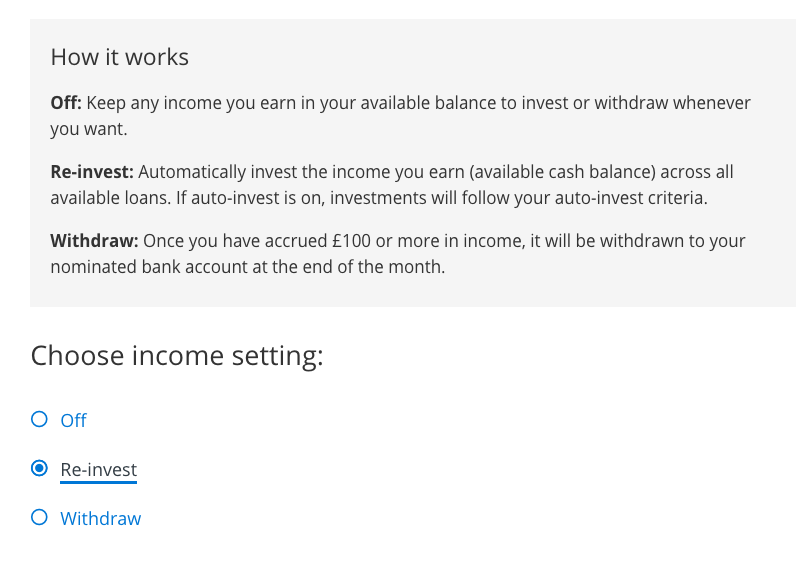

Auto-reinvest works similarly and triggers on amounts as low as £1, but you can only withdraw money once you have £100 in your account:

How Much Time Is Needed Managing My Account and Investments?

This depends on whether you want to use auto-invest and your level of comfort. Lendinvest doesn’t supply property valuation documents so time is needed to research the property valuations.

In a perfect world, one would fully research each loan and invest in only the loans with sensible valuations on the security. Most lenders’ don’t have the time or experience and either invest in each loan to diversify or use the auto-invest function.

If you use auto-invest, time management is reduced to zero.

How Long Are The Loans?

Up to three years but most loans tend to be 12 months.

Is There A Secondary Market To Buy, Sell And Exit Loans?

No

What Security Does Lendinvest Loan Against?

All loans are secured with a first ranking charge over property with reasonable loan-to-values in the 45% to 75% range. In some cases, Lendinvest also takes personal guarantees and the assets of the business (debentures). While personal guarantees are nice, first charges are the only securities you need to pay attention to.

What Are The Loan Default Loss Rates

Lendinvest has very low capital losses resulting from defaults which suggest their recovery process is effective:

Lendinvest’s default rates are (last published June 30th, 2020):

2014: 5.4%

2015: 15.3%

2016: 5.2%

2017: 7.9%

2018: 1.4%

2019: 0%

Lendinvest’s loss rates* are:

2014: 0.06%

2015: 0.10%

2016: 0.30%

2017: 0.19%

2018: 0.18%

2019: 0.13%

Lendinvest hasn’t published any stats for 2020 yet but due to Covid, I expect to see these default rates rise in 2020.

Lendinvest offer loans on properties all over the UK with about 62% in London and the South East.

Default loss rates can change and Lendivest publishes its statistics on the Statements page. You can’t access these statistics unless you have an account.

What Happens If Lendinvest Ceases Operations?

Since lenders’ have agreements with Lendinvest rather than directly with borrowers, a company failure could be a very complicated situation.

Lendinvest has a partnership operation with Pepper UK, a loan servicing company. Lendinvest states that if they ceased trading, Pepper UK would continue to service borrowers loans. In addition, a company called Capita has been appointed as the back-up servicer to manage Lendinvest’s loan book.

What Are the Different Accounts and Investment Options Lendinvest Offers?

Lendinvest only offers loans on property bridging and development projects.

THUMBS UP FOR LENDINVEST:

Loans Secured By First Charges On Property

Property is one the most secured loan collaterals available within peer to peer lending, provided the loan-to-values are at reasonable levels and the valuations are correct. When you lend through Lendinvest, 1st charges are in place on all loans so you can feel comfortable knowing your loan is well collateralised.

Profitable Company & Financial Stability

Lendinvest is one of the few peer to peer lending companies that is profitable. In 2018-2019 tax year, Lendinvest profited to the tune of £661,000 net. A financially healthy company that’s turning a profit is one I am comfortable investing through. If you want to look at Lendinvest’s company accounts you can do so here.

I visited Lendinvest in September 2018 and was extremely impressed with the team and their operation. Lendinvest has many different parts to its company, is well capitalised and its team is experienced.

ARC Rated

Lendinvest has been analysed by the independent credit rating company ARC and has been given a thumbs up for stability. ARC rates companies based on their ability to meet their financial obligations. You can read Lendinvest’s ARC report here.

£2bn+ Lent

Lendinvest’s loan book is steadily growing. When a peer to peer company is writing that many loans, they are generating fees. As long as Lendinvest maintains their borrower quality, fees are what keeps a company in business and that’s a good thing for lenders.

Low Loan-To-Values

Lendinvest lends at very sensible loan-to-values (LTV). My loans range from 35% to 70%, with the majority being in the 55% – 65% range. Provided valuations are correct, lower LTVs hopefully means that in a default event, there would be enough wiggle room to sell the property and pay all expenses plus lenders’ capital and interest.

Auto-Invest / Reinvest

For those looking for more hands-off investing, the auto-investment and reinvestment tool works well. You are able to set investment criteria including maximum amounts, maximum loan-to-values and tranches. Auto-reinvest triggers at £1 so lenders’ who receive smaller interest repayments will be happy their money isn’t sitting idle.

Transparent Information

I love Lendinvest’s philosophy toward transparency. They publish yearly company financials, loan and default statistics, and even their entire loan book. Once you open an account, you can download the entire loan book which shows the spread between what the interest rate the lender receives and what interest rate the borrower is paying. This shows me Lendinvest has nothing to hide and I think some peer to peer companies could learn a thing a two here.

FSCS Protection Due To Incorrect Loan Administering Or Fraud

Lendinvest state that:

“In the event of LendInvest Funds Management Limited being unable to meet its liabilities, an investor may be entitled to compensation under the Financial Services Compensation Scheme. Currently, the maximum level of compensation an investor could receive from the Scheme for a claim against an investment firm is 100% of the first £50,000 per person.

The FSCS might apply if you lose money because your investments have not been administered correctly, or as a result of misrepresentation or fraud, and the authorised firm concerned has gone out of business and cannot pay compensation or return your investments or any cash held on your behalf.

The FSCS will not pay compensation if your investment performs poorly as a result of market conditions.”

Please be aware that this FSCS protection isn’t the same as the £85,000 one that covers your savings account in the event of bank failure.

THUMBS DOWN FOR LENDINVEST:

No Secondary Market to Buy And Sell Loans

My second major gripe is the lack of a secondary market. Secondary markets are nothing more than a perk and should never be relied on as a reliable means of exit, but it’s always nice to have an exit option.

Some Loans Are Large

Lendinvest has some pretty big loans on its books. At one point I spotted a £23m loan but now, there are a couple of £6m loans on the books and a £12m loan that’s in arread. If you have a Lendinvest account, you can download the entire loan book here.

Lower Interest Returns For Bridging Loans

Property development bridging loans can be risky despite lower loan-to-values. Borrowers are paying up to 15% per year in interest so I question whether the returns Lendinvest offers to lenders’ are on par with the risk. When I invest in bridging loans, I look for returns in the 10%+ range. Lendinvest offers between 6-8%.

Advertised FSCS Protection Could Be Misunderstood

Recently, Lendinvest sent out an email stating lenders were covered by FSCS protection. This type of protection is usually given to bank savers and covers up to £85,000 per person in case of bank failure. Lendinvest’s FSCS coverage doesn’t cover your actual loans but covers an investor up to £50,000 in cases of incorrect loan administering or fraud. Don’t mistake this to mean this protection secures your loans in case of default or poor performance. Be sure to read more about Lendinvest’s FSCS protection in their FAQ’s.

Loan Contracts Are Between Lenders and Lendinvest

Since Lendinvest is an AIF (Alternative Investment Fund) and not a peer to peer lending company, when I loan money, I have direct agreements with lendinvest rather than with the borrowers. If Lendinvest were to go out of businesses, the adminsitration process would be different to what we have seen with peer to peer lending companies.

No Access To Valuation Documents / Heavy Reliance on Lendinvest

Lenders who want to perform their own research on properties aren’t privy to the Lendinvest’s valuation documents. This is unusual considering Lendinvest is very transparent with its information and most other peer to peer bridging loan companies freely offer these documents. This means lenders are heavily reliant on Lendinvest unless they want to do their own valuation due diligence. It’s been my experience that peer to peer property valuations can be extremely subjective so I always like to look through them before I invest. It’s a shame this isn’t possible with Lendnivest.

Cannot Withdraw Funds Deposited By Debit Card For 90 Days

This is a strange policy which has some of readers’ perplexed. Let’s imagine you deposit money via your debit card but either change your mind or can’t find any appealing loans, you’re money cannot be withdrawn for 90 days. Just a policy to be aware of.

My Strategy

I believe Lendinvest is a stable company that offers sensible loans. I am lending money to Lendinvest rather than directly to borrowers but since Lendinvest is a stable company, I will live with that. I currently choose the auto-lend product opting for a maximum amount I can invest in each loan for diversification.

My loan book is perfroming well considering the Covid-19 situation with only one loan being in default out of 32 loans.

The Lendinvest Review Conclusion

Lendinvest has many positives. First and foremost it’s a profitably run operation, which many alternative finance companies are not. This inspires long-term confidence in knowing the company can sustain itself financially as Lendinvest has plenty of financial backing through its other companies. Lendinvest’s interest returns are on the lower side for property bridging and development loans and its spreads between what it pays lenders versus what borrowers pay can be quite high.

Lendinvest has continued to perform well through the Covid-19 pandemic.

I don’t like the fact valuation documents aren’t available so lenders have to do their own research in order to identify the good loans. Despite the negatives, if you’re looking to invest through a secure company that also offers a great auto-invest system that requires no time investment, Lendinvest is a good choice.

Sign up here for a no-obligation Lendinvest account.

If you enjoyed my Lendinvest review and want to know more about peer to peer lending, click here and receive my complimentary Top 5 Peer to Peer Lending Sites Report.

I love feedback, so if you find any errors or omissions in this Lendinvest review or have any improvement suggestions, I invite you to contact me and be a part of contributing to this website.

Disclaimers: I am not compensated to write my reviews and I’m not employed by any of the companies I write about. In most cases, I have invested or continue to invest my own money through these companies. In order to keep the website financially viable, the sign-up links on this website are referral links and I do accept advertising. This advertising in no way influences my reviews and opinions. When you sign up for an account through my website, in some cases I receive a referral fee directly from the companies, at no cost to you. Your support enables me to continue to operate the Financial Thing website. You can read more about my referral links and advertising here.

** This page is for information purposes only. This information is not financial advice and has been prepared without taking your objectives, financial situation or needs into account. You should consider its appropriateness for your circumstances. All investing carries risks. Opinions expressed in this review are opinions based on my own personal experiences. The FSCS does not cover peer to peer lending and your capital is at risk. Please don’t invest more than you can afford to lose. **