Fund, brokerage / platform and financial adviser management fees are return killers. Do you know how much these rather insignificant looking fees are really costing you? Read on to be shocked.

Let me ask you a question. Does a 1% annual fund annual management charge or a 0.5% financial adviser annual fee seem insignificant to you? These small innocent fees can be extremely costly over a long period of time. If you haven’t been paying attention to these fees, I’m going to present you with some startling numbers that will show just how much these fees will cost you over a long period of time.

Most uninformed investors fail to look at how fees reduce their overall compounded returns. Before I knew better, I thought fund annual fund fees were insignificant when in fact, they are crucial.

Many managed unit trusts and mutual funds have higher expenses than they clearly advertise in their prospectus. Here’s an example of one of the UK’s most popular investment fund, Neil Woodford’s Equity Income Fund. This fund is very transparent and lists fees that other funds don’t:

Do you see the fees for execution, transaction taxes and spread? Many funds don’t clearly explain these frequently changing fees. Some funds have turnover amounts, also known as trading in and out of stocks, up to 100% per year which increases capital gains taxes, incurs trading fees and reduces overall fund returns. Fund investors pay for all these fees by way of reduced returns. By the way, the fees for the Woodford Equity Fund increased from 0.84% in 2015 to 0.96% in 2016. I can’t stress how important it is to pay attention to the fees your funds are charging.

I always recommend buying low fee index trackers that have low turnover, low taxes, require no research and very little management.

In order for you to really see how damaging fund and management fees can be to your overall nest-egg, see the table below.

Table Explanation

The following tables are designed to show you the difference in end totals from 6% to 7% and 8% to 9%. This 1% loss in returns is a result of fees.

Total investment amounts are shown in the first vertical columns and annual return rates are shown across the top horizontal rows. The interior numbers show the total expected sum accumulated when the lump sum investment is left untouched for a period of 30 years. Interest returns are calculated using monthly compounded interest.

6-7% Annual Return:

| Investment | 6% Return | 7% Return | 1% Fee Cost |

|---|---|---|---|

| £ 10,000 | £ 60,226 | £ 81,165 | £ 20,939 |

| £ 25,000 | £ 150,564 | £ 202,912 | £ 52,348 |

| £ 50,000 | £ 301,128 | £ 405,825 | £ 104,697 |

| £ 100,000 | £ 602,258 | £ 811,650 | £ 209,392 |

| £ 200,000 | £ 1,204,515 | £ 1,623,300 | £ 418,784 |

| £ 500,000 | £ 3,011,288 | £ 4,058,249 | £ 1,046,961 |

| £ 1,000,000 | £ 6,022,575 | £ 8,116,497 | £ 2,093,922 |

You can see how damaging a loss of 1% in returns is to your overall returns over a long period time. A 1% fee loss is standard for most managed unit trusts such as the above CF Woodford Equity Fund.

For example, on a £100,000 investment, a 1% annual fee on a 7% return reduces your annual returns to 6% and will cost you a staggering £209,392 over 30 years!

8-9% Annual Return:

The losses on higher investment amounts at a 1% return increase are even more drastic:

| Investment | 8% Annual Return | 9% Annual Return | 1% Annual Fee Cost |

|---|---|---|---|

| £ 10,000 | £ 109,357 | £ 147,306 | £ 37,948 |

| £ 25,000 | £ 273,393 | £ 368,264 | £ 94,871 |

| £ 50,000 | £ 546,786 | £ 736,529 | £ 189,742 |

| £ 100,000 | £ 1,093,573 | £ 1,473,058 | £ 379,485 |

| £ 200,000 | £ 2,187,146 | £ 2,946,115 | £ 758,969 |

| £ 500,000 | £ 5,467,865 | £ 7,365,288 | £ 1,897,423 |

| £ 1,000,000 | £ 10,935,730 | £ 14,730,576 | £ 3,794,846 |

On a £500,000 investment averaging 9% annual returns over 30 years, a 1% annual fee reducing your returns to 8% costs you a jaw-dropping £1,897,423 in compound interest losses! At first, I thought this number had to be a mistake; surely a 1% management fee couldn’t be that costly? But sure enough, the numbers don’t lie. Feel free to do your own calculations using this handy online compound interest calculator.

How To Cut The Fees And Save A Fortune

Since even a 0.25% fee cost savings can amount to a small fortune over a long period of time, picking low-fee funds and trading brokerages is essential. There are three fees that you can either cut down or eliminate.

Fund Fees: With over 20,000 UK unit trusts and 9,000 U.S. mutual funds to choose from, investors are often overwhelmed by the fund choices and the variances in fees. To bypass this confusion, I love (did I mention love?) the low-cost Vanguard index tracker funds. The trackers have low annual fees ranging from 0.10% to 0.25%. Read this article on which trackers I love and why.

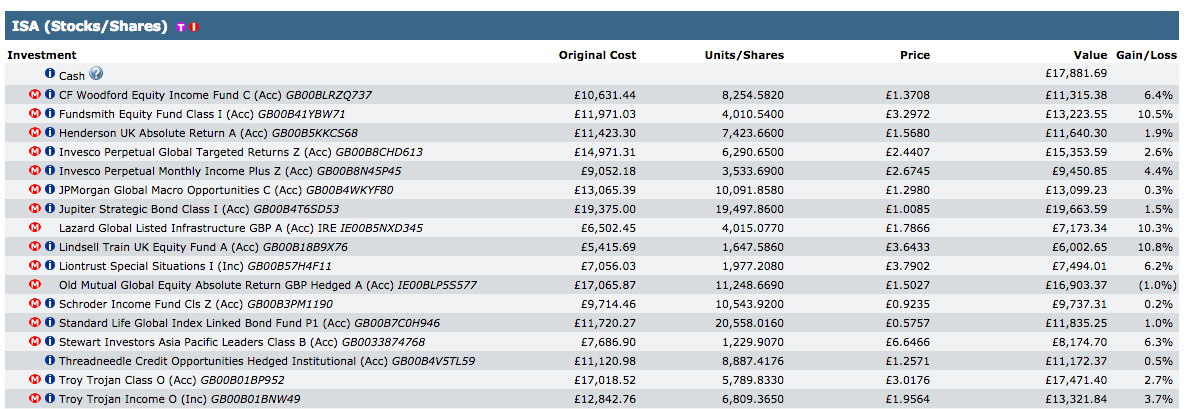

Financial Adviser Management Fees: These fees average 1% annually, but I’ve seen them as high as 2%. If your adviser is consistently bringing you 12% net returns, you probably won’t mind their fees but most advisers average 5-6% net returns so the annual fees can be a real drag. Advisers tend to spread clients money over lots of managed funds or worse, across single stocks. This diversification method racks up management and traduing fees and drags down returns. The problem is picking funds that consistently outperform the indexes is extremely difficult. In most cases when you invest through a financial adviser, your portfolio looks something like the one my friend recently showed me:

My friend’s financial adviser invested his money into a variety of funds, some of which have performed well, others not so much. This portfolio returned my friend 2% over a six month period during a time when the stock market was booming.

Some advisers also invest their clients into funds that have a front-end load charge. In other words, the fund appreciates your investment so much they charge you a 5% fee for the privilege of doing business with them and therefore, your investment starts at negative 5%. This archaic investment strategy is still prevalent within the financial industry however, investors who know better are refusing to invest in loaded funds.

Did you also know some funds pay advisers a continued annual fee of 0.5% of their clients investment balance? I think this is a terrible practice since this 0.5% added fee comes out of the funds’ costs which are detrimental to investors overall returns.

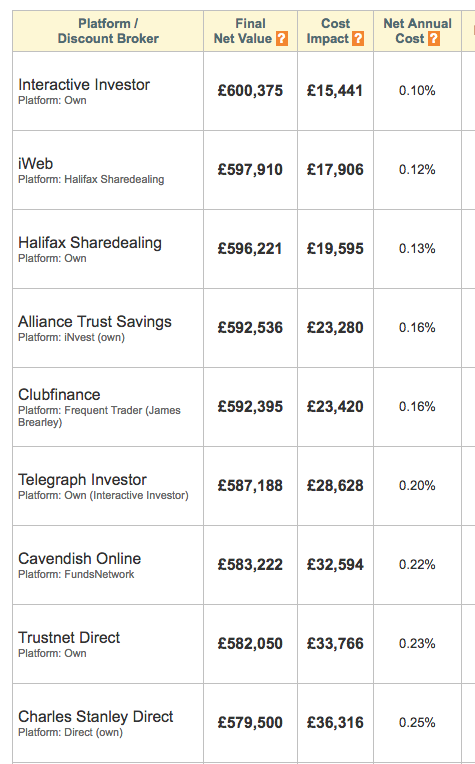

Platform / Brokerage Fees: These fees are different on each platform and the best rule to go by is, the lower the fees the better. Some platforms advertise such things as research tools but research is freely available all over the internet. In most cases, avoiding the dreaded annual platform fee is the best path unless you make lots of purchases. I tend to make about 6-12 tracker purchases annually and I now buy directly through Vanguard. If I buy through a brokerage, I have found Halifax’s / iWeb platform to be the most cost-effective. Read my latest article on why you want to consider buying directly from Vanguard and what the fees cost.

This handy Compare Fund Platform Fees tool will give a snapshot of how much in fees you will expect to pay depending on your investment and purchase amounts. This is what the tool shows (£50,000 investment over 30 years returning 7% average per year and making 12 trades annually):

You can see the cost difference between Interactive Investors and Charles Stanley is over £21,000 over 30 years! Maybe I care too much about fee savings but £21,000 is a lot of money.

How To Fire Your Financial Adviser

One of my readers recently sent me an email:

Breaking loyalty with a financial adviser is something many people struggle with. The best antidote for overcoming fear in this situation is to look at the above tables to see how much your adviser is going to cost you over the long run. The reality of losing a few hundred grand to fees and lost compounding interest was enough to silence my fears when I gave my adviser the boot.

Conclusion

Learning how to ditch your financial adviser, DIY invest, pick the lowest fund fees / brokerage fees will save you unimaginable amounts of money over your investing lifetime. If you are a high net worth investor it could save you millions.

I love feedback, so if you find any errors or omissions or have any website improvement suggestions, I invite you to contact me and be a part of contributing to this website.

Disclaimer: This article is for information purposes only and should not be regarded as investment advice. Opinions expressed are my opinions based on my own personal experiences, investing my own money.