Assetz Capital Review

**Updated February 1st, 2023 **

**Assetz Capital is no longer open to retail investment. This article is being updated and in the meantime the info provided below is for informational purposes only **

I have been investing my own money through Assetz Capital’s peer to peer loans since June 2015. I expect defaults to rise further due to businesses being affected by the Covid-19 pandemic. Assetz Capital offers four different investment products that offer attractive returns to investors who lend against secured business and property loans.

Click here to watch my interview with Assetz Capital Founder & CEO Stuart Law.

Assetz Capital statistics: Click here

My Current Investment Amount: Click here

My current annual rate of return: 7.72% (Net return before tax)

Assetz Capital – What You Need to Know:

Unfortunately in late 2022, Assetz Capital announced they would be closing their doors to retail peer to peer lending instead choosing to focus on institutional Lending. Assetz Capital offered competitive lender returns through a good mix of secured small and medium business loans.

Assetz Capital Review: My experiences so far….

I started investing in Assetz Capital in June 2015 and I didn’t really understand how their website or products worked. For me, calling a company to ask for guidance is worse than asking for directions at a petrol station (pre-Google Map days). After a week of being annoyed and confused, I finally broke down and spoke to a friendly Assetz Capital staff member and after an explanation, the system became clear and I placed my first few investments through the Manual Lending Investment Account.

Prior to the addition of the Quick Access Account (QAA), there was a lack of new loans and my excess account funds sat idly by earning no interest. I constantly fought the urge to invest more than my comfort level in current loans but common sense and patience ultimately prevailed and while it has taken some time, I’m now invested in a diversified range of loans. Idle balances are automatically swept into the Quick Access Account which targets a 4.1% return annually but is likely lower due to Covid-19.

In November 2019 Assetz Capital announced the closure of the Great British Business (GBBA) and the Property Secured accounts (PSA). I will discuss my thoughts on the removal of these accounts later in this review.

I find it very difficult to assess risk when manually selecting business loans so I now use the QAA & 30-Day Access Accounts. I believe most inexperienced lenders’ will be far better off using an auto-invest product for diversification as manual loan risk assessment is difficult and time-consuming.

I have noticed quite a few defaulted loans in my portfolio although since some of the older loan balances have been reduced, the defaults aren’t as detrimental providing an effective asset recovery plan is executed.

What Is Assetz Capital?

Assetz Capital is a UK based peer to peer lending platform that offers lenders’ investments in British business and property loans. Businesses can include manufacturing, industrial, wind turbines, law offices, hotels, restaurants, pubs, and property developers. Investors can choose between a manual lending account or three different auto investment accounts that hold baskets of loans for a hands-off investment experience. Every loan is secured by a mix of property, equipment, debentures and personal guarantees.

How Can I Contact Assetz Capital?

Email: enquiries@assetzcapital.co.uk

UK Tel: 0800 470 0430

When Did Assetz Capital Launch?

February 2013

Are They Regulated?

Yes, by the UK Government’s Financial Conduct Authority #724996 under full permissions granted September 1st, 2017. Investments made through Assetz Capital are not covered under the FSCS (Financial Services Compensation Scheme). FCA regulation is nothing like the FSCS, which covers consumers when they deposit money in banks. The FCA reports to the UK government and has the ability to pursue criminal action against companies which violate its standards and codes of conduct.

Who Can Open An Account?

No one as they are closed to retail investors

Can I Exit My Investments?

Since the closure, you can only withdraw cash balances and there are no early exit options. Investors will have to wait for loans to be run (completed) before they can access their funds.

Did Assetz Capital Offer An Innovative Finance ISA?

Yes

How Much Interest Does Assetz Capital Pay Lenders?

Annual gross return rates range from 3.75% to 15%, depending on the risk level and loan type. Interest rates have recently fallen recently and the new norm for new loans will be in the 4.5% to 9% range. The secondary market still offers loans that pay 10% but they are becoming scarce as interest rates fall and lender demand increases.

Is Interest Accrued Immediately Or When the Loan Starts?

On new loans, interest accrues once the money is issued (drawn down) to the borrower. On secondary market loans, interest accrues once you purchase a loan part and it is allocated to you. On the auto-invest accounts, interest accrues once your money is invested.

When Is Interest Paid?

Various times of the month depending on which investment product you select.

Am I Lending To The Assetz Capital Platform Or To The Borrower?

All loan contracts are directly between investors and borrowers.

What Are The Fees?

Assetz Capital has announced a 0.9% annual management fee beginning May 1st, 2020. This fee was deemed needed by Assetz Capital due to the Coronavirus effects on their business and the fee will likely be eliminated in the future.

How Much Time Is Needed Managing My Accounts and Investments?

This depends on which accounts you choose to invest through:

Quick Access Account (QAA): No time needed once invested

30 Day Access: No time needed once invested

90 Day Access: No time needed once invested

DISCONTINUED Property Secured Investment Account (PSIA): No time needed

DISCONTINUED Great British Business Account (GBBA): No time needed

Manual Loan Investment Account (MLIA): Low to medium amount of time needed analysing new loan offerings and buying and selling loans on the secondary market.

How Long Are The Loans?

Assetz Capital loans are 6-60 months but loans sometimes redeem earlier while others are extended.

What Security Does Assetz Capital Loan Against?

All property loans are secured by property at reasonable loan-to-value percentages. Business loans are usually secured by a combination of commercial or residential property, debentures and personal guarantees. I don’t think personal guarantees or debentures hold much security weight so I stick to loans that are secured by property or other disposable assets.

What Are The Loan Default Rates?

Default and loss rates frequently change so please check Assetz’s statistics page here.

What Happens If Assetz Capital Goes Out Of Business?

Assetz Capital is required by the FCA (Financial Conduct Authority) to have a sufficient wind-down plan in place. Assetz Capital has a trust in place in which the trustees would have the power to appoint a managing agent to wind-down the loan book. Assetz Capital doesn’t provide any detailed information about this wind-up process but I expect this to change due to the more stringent FCA regulations.

In addition to this, an administration company would work on behalf of the creditors (people owed money by Assetz Capital) and customers (borrowers) to recover as much money as possible. It’s important to know that we (lenders) are not considered creditors.

Winding down a loan book would involve large administration fees that would be taken from any recovered money so lenders would likely see a loss of capital if Assetz Capital were to close its doors. This is part of the risk of peer to peer lending.

I also recommend reading Assetz Capital’s Terms & Conditions here prior to investing.

What Are the Different Accounts and Investment Options Assetz Capital Offers?

Assetz Capital is unique in that it offers investors four accounts / investment options. Three of the four accounts have targeted interest rate returns achieved by investing in baskets of loans.

1. Quick Access Account (QAA) – £1 min, £200,000 max investment

By creating the Quick Access Account (QAA), Assetz Capital has solved two of the biggest peer to peer lending problems 1. idle funds making zero returns and 2. investors not being able to access funds. Unfortunately, liquidity has slowed due to the economic effects of the Coronavirus. When there aren’t any buyers to take over loans from sellers, liquidity slows down. Being able to exit your QAA investments isn’t guaranteed and may take a while until the economy returns to normal.

Assetz Capital now offers linvestors the option to discount their QAA loans in order to exit.

Under normal economic conditions, since loans can be paid off at any time, it is likely you’ll have idle funds sitting in your account as you wait for new loans to be offered. These idle funds can be automatically swept into the QAA which targets an attractive annual return rate of 3.75%.

The QAA is also covered by a small discretionary provision fund which aims to help cover missed loan interest or capital repayments.

Withdrawing Money: The QAA is advertised as being instant access under “normal market conditions”. Currently, because of the Coronavirus, we aren’t in normal economic conditions.

In order to understand what “normal market conditions” means and how it can affect you, it’s important to know how the QAA operates. The QAA holds a basket of loans with between one month and five-year durations. When money goes into the QAA, the account automatically buys loan pieces. When money goes out of the QAA (investor withdrawals), the fund either draws on its cash reserves or sells enough loan pieces to fund the withdrawal. So “normal market conditions” assumes that the QAA either has enough cash reserves or can sell loan pieces to fund the withdrawal.

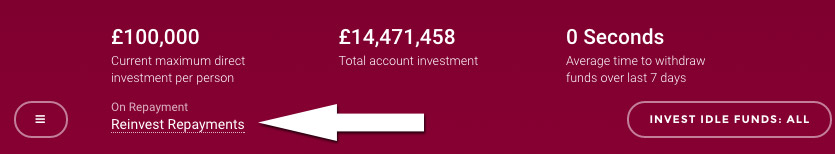

One enticing feature of the QAA is that if you select “reinvest repayments”, all repayments will be automatically swept into the QAA:

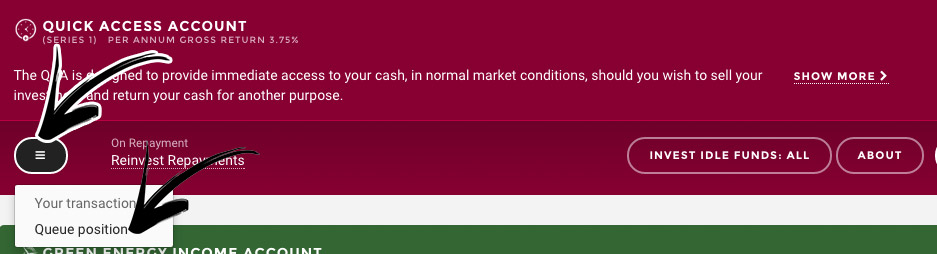

When the QAA first opened, it was immensely popular and investment deposit amounts were capped, meaning you had to wait in a queue to become invested. Currently this isn’t the case and the cap has been removed. If the cap is reinstated, there is a nifty feature which shows you where you sit in the allocation queue:

Investor’s have used the QAA as an instant access bank account but are now seeing the risks of this. Remember that your money isn’t FSCS insured.

One thing to note, if the money in the QAA is in the investment queue, then it won’t earn any interest. If you click on the “Your Transactions” link shown on the above image, you can see if your funds are being invested into loans.

Again, due to the Coronavirus and the poor economic conditions, exiting isn’t guaranteed. This is the risk that comes along with peer to peer lending. For now “normal market conditions” do not exist so all QAA exit requests have been placed in a queuing system due.

As of June 1st, 2020, the provision fund held £400,000 which would cover 0.12% of the outstanding loan balances. You can view current statistics here.

2. 30 Day Access Account (30DAA) – £1 min, no current max investment

The 30 Day Access Account offers access to money under “normal market conditions” after giving a 30 day notice of withdrawal. You cannot withdraw money any sooner than 30 days, even if there are lenders waiting to buy. This account is covered by a small provision fund and is made up of lower risk secured business loans that “have passed Assetz Capital’s strict credit policies”. This account operates almost the same way as the QAA operates except for the 30-day withdraw notice. This account also is advertised as holding a high cash reserve. The cash reserve has changed due to the harsh economic conditions.

The gross annual target return is 5.1%. I personally don’t use this account at the moment as all my investing is done through the Manual Loan Investment Account (see below).

As of June 1st, 2020, the provision fund held £470,000 which would cover 0.17% of the outstanding loans. You can view current statistics here.

3. The 90 Day Access Account

The 90 Day Access Account operates the same way as the 30 Day Access Account except you need to give 90 days notice to withdraw money and its provision fund is very small. This account pays a higher interest return than the 30 Day account.

Remember exiting capability has drastically slowed on all the accounts due to the economic effects caused by the Coronavirus pandemic. All exit requests in the 90 Day Access account have been placed in a queue system. I’m hoping normal market conditions will return once the economy recovers.

As of June 1st, 2020, the provision fund held £110,000 which would cover only 0.02% of the outstanding loan balances. You can view current statistics here.

4. The Great British Business Account (GBBA) – CLOSED TO NEW INVESTMENT

As of November 13th, 2019, the GBBA account is closed to new investment but will continue to operate until all investor funds are repaid. Assetz Capital made this decision to simplify the platform and stated that this account had remained static in growth compared to the Access accounts.

Personally, I was surprised to hear about this closure of the GBBA. There were some investors who were unhappy with the way the account operated but personally I found it to be useful. The wind-down of the GBBA will force investors to either manually invest using the MLIA or use the lower-paying Access accounts.

Inexperienced lenders will have a hard time identifying which loans are good through the MLIA as risk assessment is extremely difficult and takes time. I’ll personally be using the Access account (likely the 30-day one) at the expense of some lower interest returns.

The GBBA account gave the investor a truly hands-off experience by investing funds into a basket of small and medium-sized business loans. The GBBA operated similarly to the QAA and was made up of loans that “have passed Assetz Capitals strict credit policies” and are secured by appropriate company assets such as property, account receivables, and machinery. The GBBA offered diversification in the way it tried to equally proportion its loan investments. For example, if there were 50 loans with availability, the GBBA would invest 2% of its money into each loan. If there were 5 loans available, then 20% of monies would go into each loan and so on.

I tested the GBBA account in September of 2017 and found it took five weeks to become fully invested. My funds were spread across 31 different loans.

Unfortunately for new lenders, the GBBA Series 2 target return rate fell from 7% to 6.25% but this was to be expected due to increased peer to peer competition. Existing lenders will continue in the Series 1 GBBA product until their loans mature, at which point, new funds will be invested into the Series 2 product. Even with the interest rate drop, I still considered the GBBA to be a viable investment product due to Assetz Capital’s strong business model.

The GBBA account will continue to be covered by a discretionary provision fund (read more about the discretionary part here). Repayments will be directed into either your cash account or the other active account choices.

The GBBA did have some downsides:

For example if there were large amounts of only a small amount of loans available, all of your available money could be invested across those loans. If those loans were to default, then your returns could be severely affected.

The GBBA wasn’t always open for immediate investment. Simply put if there wasn’t any loan availability, the GBBA placed your money into an allocation queue. This was true for new deposits and reinvestment of payments. The good news was that you could set your idle funds to be invested in the QAA while they awaited investment into the GBBA.

The hands-off GBBA account was an attractive option for those with less time to manage their investments.

As of June 1st, 2020, the provision fund held £520,000 which would cover 1.14% of the outstanding loan balances. You can view current statistics here.

5. The Property Secured Investment Account (PSIA) – CLOSED TO NEW INVESTMENT

As of November 13th, 2019, the PSIA account is closed to new investment but will continue to operate until all investor funds are repaid. Assetz Capital made this decision to simplify the platform and stated that this account had remained static in growth compared to the Access accounts. Interest and capital will continue to be paid to investors to which they can allocate these repayments where they want.

This account operated in the same way the Great British Business Account operated except the loans held within this account were property loans. Assetz has certain criteria that the property loans met to be included in the PSIA:

Just like the GBBA account, money was spread across available loans. So for example, if there are were only two available loans within this account, all your money could theoretically have been spread across those two loans hindering diversification. I didn’t use the PSIA account.

6. The Manual Loan Investment Account (MLIA) – £1 min, no current max investment

This manual account used to be my preferred investment method until I decided that assessing loan risk was too difficult and time-consuming. Returns on newer loans have dropped due to market competition as Assetz Capital’s team isn’t willing to compromise loan quality by dropping underwriting standards and offering sub-par quality loans. In other words, they don’t want to throw just any crappy loans on the platform.

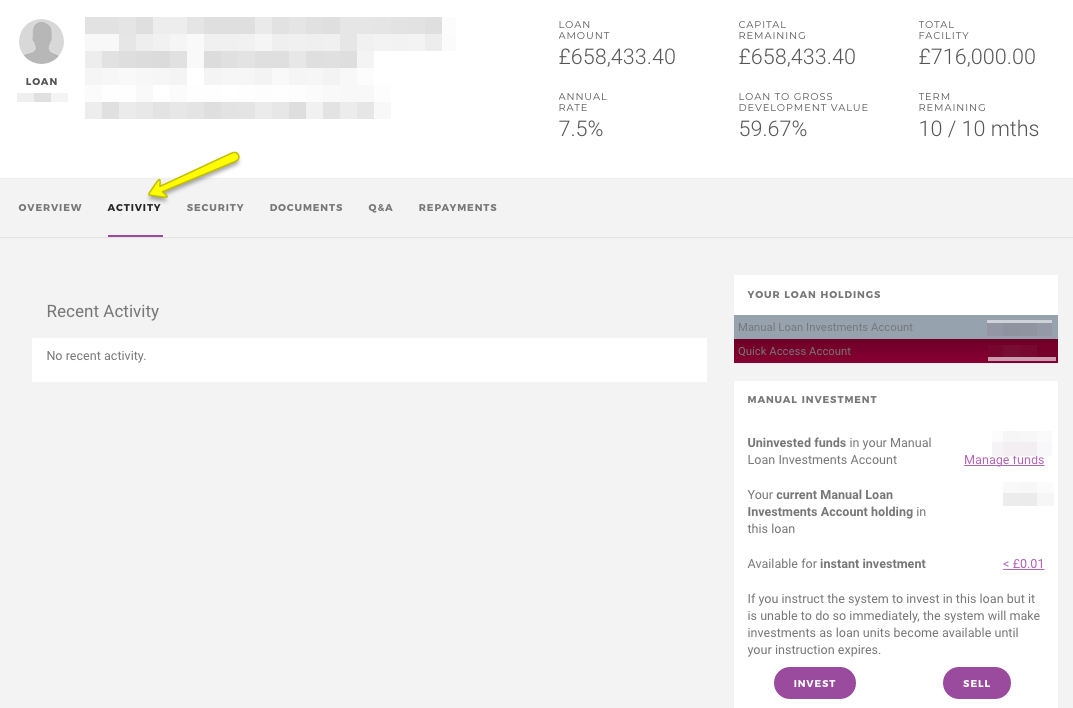

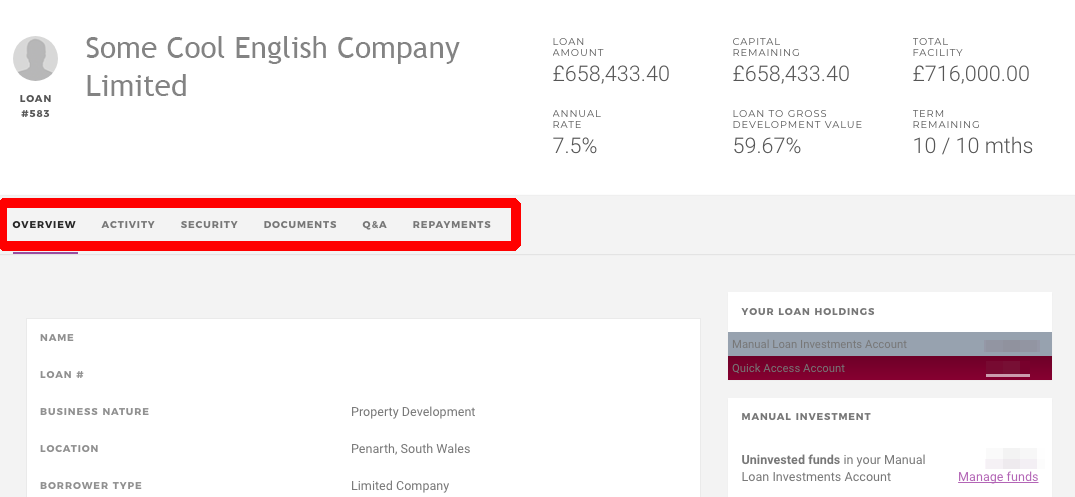

If you perform due diligence and select sensible loans, I believe annual target returns should be in the 7-9% range. If you want to avoid defaults, you have to keep an eye on loan repayments to make sure the loans are current and this can be time-consuming. Loan updates are posted in the Activity section under each loan:

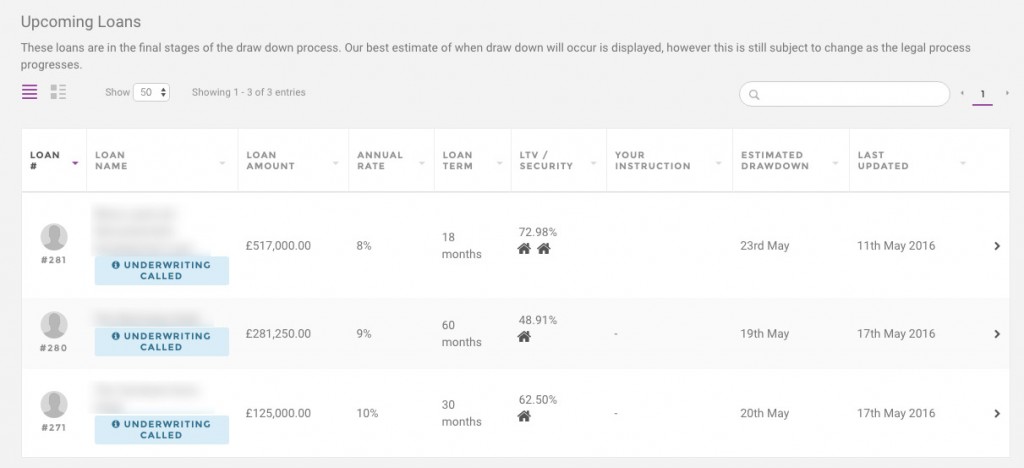

Here’s how the MLIA account works. Upcoming loans are listed here:

Loan information including documents and security is here:

Loan information including documents and security is here:

Here’s where you decide on your investment amount:

Set your target investment amount and you’re done. I’ve always received my allocated target amount but this depends on demand and supply and how much you are asking for.

Early exit from loans is the same as the GBBA Account. You click the sell button, set your sell amount and if lender buying demand exists (it currently is low), you can sell. Most of the older loans with higher interest rates are very easy to sell. The lower paying interest loans are much more difficult to sell since lenders’ are always chasing higher return loans.

The Assetz Capital Review Conclusion

Assetz Capital used to be one of my favorite peer to peer lending companies however after the pandemic issues, the company started to fall out of favor likely due to its operating size and nature of its SME business loans.

After the post pandemic reopening, I noticed my own account had more and more loans that were considered distressed which is always concerning.

It is now apparent that companies the size of Assetz Capital tend to transition away from retail peer to peer lending in favour of more stable institutional funding.

As investors now we just have to wait and see if can run down its loan book in an efficient and responsible manner.

If you enjoyed my Assetz Capital review and want to know more about peer to peer lending, click here and receive my complimentary Top 5 Peer to Peer Lending Sites Report.

I love feedback, so if you find any errors or omissions or have any improvement suggestions, I invite you to contact me and be a part of contributing to this website.

Disclaimers: I have not been paid to write my reviews and I’m not employed by any of the companies I write about. In most cases, I have invested or continue to invest my own money through these companies. In order to keep the website financially viable, the sign-up links on this website are referral links and I do accept advertising in the form of banner ads. This advertising in no way influences my reviews and opinions. When you sign up for an account through my website, in some cases I receive a referral fee directly from the companies, at no cost to you. Your support enables me to continue to operate the Financial Thing website. You can read more about my referral links and banner advertising here.

** This Assetz Capital review is for information purposes only. This information is not financial advice and has been prepared without taking your objectives, financial situation or needs into account. You should consider its appropriateness for your circumstances. All investing carries risks. Opinions expressed in this review are opinions based on my own personal experiences. The FSCS does not cover peer to peer lending and your capital is at risk. Please don’t invest more than you can afford to lose. **