Peer To Peer Lending Starter Guide

** This page is for information purposes only. This information is not financial advice and has been prepared without taking your objectives, financial situation or needs into account. You should consider its appropriateness for your circumstances. All investing carries risks. Opinions expressed in this review are opinions based on my own personal experiences. The FSCS does not cover peer to peer lending, crowdlending or crowdfunding and your capital is at risk. Please don’t invest more than you can afford to lose. **

I was speaking to a friend recently and he asked me to explain peer to peer lending to him. I gave him a link to my website and asked him to read a few articles. Two days later my friend said, “Laurence, I still don’t understand peer to peer lending”.

After the realisation that many people who land on my website are complete beginners, I decided to update this guide. If you are a person who already invests in peer to peer lending, you can still learn from this guide.

Forgive me in advance, but I’m going to pretend you are brand new to peer to peer lending like I was in 2015. As peer to peer lending rapidly grows, more and more companies are launching while others have failed, some due to economic conditions caused by the Covid-19 pandemic. If I were a peer to peer lending beginner, the sheer number of peer to peer lending investment choices would be overwhelming. I believe that peer to peer lending has its place in a well-diversified investment portfolio once you understand the risks.

Some of my younger readers prefer the higher risk / higher return investments and enjoy the variety while many retirees I speak to are investing through companies such as Loanpad, Kuflink, and Easymoney as a way of providing monthly income. Peer to peer lending in many ways can act similarly to a fixed income bond product that can be extremely useful for those nearing or in retirement age.

I know what you’re thinking, “Laurence, where do I begin?”

Whether you’re a complete peer to peer lending beginner plucking up the courage to make your first deposit, or a seasoned investor looking to shake up your peer to peer lending portfolio, this peer to peer lending guide is a great starting point.

What Exactly Is Peer To Peer Lending?

Peer to peer lending is best explained through an example.

Bob the borrower needs £10,000. 100 people lend Bob £100 each. Bob receives his £10,000 and pays his lenders an interest return. Now I realise that’s a very basic explanation so here’s more information:

Step 1: Bob the borrower needs £10,000.

Step2: Bob applies to peer to peer Company A so he can borrow £10,000 from Company A’s lenders

Step 3: Company A evaluates Bob the Borrower, sees him as a safe bet and approves him for a loan where Bob will pay x% per year interest based on his credit risk

Step 4: Company A lists Bob the borrower’s loan on its website

Step 5: Company A receives £10,000 from its lenders’ / investors

Step 6: Company A lends £10,000 to Bob the borrower

Step 6: Bob the borrower makes monthly capital and interest payments to Company A which Company A distributes to its lenders / investors

Step 7: Bob the borrower pays off his loan over a period of (x) months and everyone is happy

Peer to peer lending is really crowdfunding.

Various peer to peer lending companies offer different types of lending and investment opportunities and products. Some companies offer peer to peer loans that are asset secured loans, while other companies offer unsecured loans. Secured loans mean that if the borrower doesn’t pay, the security can be recovered and sold to recoup investor money. No different from bank selling a home to recoup the monies owed on a mortgage.

Unsecured loans have no security backing the loan, just like a credit card or personal loan. If a borrower doesn’t pay, the peer to peer lending company tries to recover the owed money leaving a black mark on the borrower’s credit history.

That’s the basic details of peer to peer lending. Peer to peer lending is actually a very smart product because it solves two issues. Borrowers need money and lenders need better returns than the banks can offer. Bring the two together and voilà, problem solved providing the peer to peer lending companies are sensible with their borrowing screening and loan underwriting.

When Was Peer To Peer Lending Created?

I’m not going to tell you the history because quite frankly, Wikipedia has a fine explanation.

In short, some very intelligent Englishmen created Zopa (believed to be the very first peer to peer lending company) in 2005. This was closely followed in 2006 in the USA by Lending Club, which is now a multi-billion $ publicly traded company. Many other companies followed.

It Can’t Be That Easy To Make Money Right?

I know what you’re thinking, “Laurence, peer to peer lending can’t be that easy, what are the downsides?”. Of course, as with any investment, there are risks. The two major risks are borrowers not repaying their loans and the peer to peer lending companies going out of business. I’ll tell you about how to reduce these risks shortly.

Peer to peer lending has other risks that have come to light as the industry steps out of its infancy stage. I will discuss these risks in this guide.

Let’s Begin….

I’ve been peer to peer lending since 2015. It’s been a journey with some bumps along the way. If I were able to travel back in time and tell myself about peer to peer lending…

…here are some of the primary considerations I’d tell myself to ponder before investing.

How Do I Choose Which Peer To Peer Companies To Invest Through?

When beginning your peer to peer investing journey, I want you to be very cautious.

One thing you need to understand about peer to peer companies. No company is perfect and all of them have positives and negatives so if you’re looking for the perfect resting place for your cash, you’ll be searching forever.

Some companies offer good loans and lending accounts but don’t offer enough new loans for new lenders to become properly diversified. Other companies offer lots of loans but the offered interest rate returns are too low to justify the risk. Some companies have more underwriting, credit analysis and default recovery experience than others. Some companies have a functioning secondary market to attempt to sell loans when you want to exit your investments, others do not.

And a small number of companies (Lendy, Collateral, Funding Secure, Moneything) have failed to act in their investors best interests by providing poor quality loans dressed up to look like A rated investments.

When I began peer to peer lending, I had to overlook some of the negatives and dive in because there wasn’t much information available about the companies as there is now. Did I make some mistakes? Plenty. But the industry fascinated me so I learned and kept moving forward.

My advice to you is to assess all the positives and negatives before you invest and make sure you fully understand the risks and never invest more than you’re prepared to lose. In regards to losses, if you invest your money through several different peer to peer companies and into many loans, the chances of you losing all your money are very small.

I don’t want to scare you but you need to know I have invested through a few peer to peer lending companies that have failed. Collateral, Lendy, Funding Secure, Moneything and The House Crowd.

Now that the Financial Conduct Authority has severly tightened their regulations on financial companies, I expect future failures to be few and far between. But that doesn’t mean failures can’t happen. Any financial company can fail, even outside of peer to peer lending. Woodford Fund, London Capital and Financial, and Wonga are high profile examples.

In my early investing days, inexperience got the better of me as I chased unsustainable high-interest returns. I now know believe some borrowers who were lent money were unqualified and the assets securing the loans were overvalued. Those aspects were out of my control. What was in my control was underestimating the risk I was taking when investing.

So how can you reduce your risk?

I recommend reading my peer to peer lending reviews, and downloading my current Top 5 peer to peer lending company list to learn more about the different companies and what they offer. If you really want to get serious, drop me an email and I’ll gift you a 15 minute Skype session so we can create a plan based on your age, investing goals and risk tolerance.

The key to successful investing is diversification and knowledge. Learn about the companies you are interested in and call or email them and ask questions. Research the company owners and their experience in finance. Invest through several peer to peer companies so if one experiences difficulties, it won’t drastically affect your overall portfolio. I only recommend self-selecting loans if you are experienced in due diligence. For begining investors, auto-select products that invest your money across many loans is best.

Be Very Careful Chasing High Lender Interest Rate Returns

As a lender, it is very easy to focus purely on the interest return rates that peer to peer companies offer. This is an investor character flaw that plagues most of us. It’s similar to novice stock pickers chasing performance rather than studying company fundamentals.

Here’s the problem. Interest rates paid to investors often don’t correlate to risk levels. A loan paying 9% interest could be less risky than a 6% interest loan. Most of the time, peer to peer investors have no idea how much interest loan borrowers because they don’t read the loan details.

For example. Peer to peer Company X may offer a loan to lenders that pays 6% annual returns while the borrower is paying an 8% interest rate. Peer to peer Company Z may offer a loan to lenders that pays 7% annually while the borrower is paying a 14% interest rate. It is likely that Company X’s loan is a much safer bet than Company Z’s loan because the borrower has been assessed as higher risk and is, therefore, paying more interest.

Think about this from a logical perspective. If you were looking to borrow money, you’d shop around for the lowest interest rate. Lending companies offer their interest rates based on perceived risk, security quality and value. So when a peer-to-peer company is offering lenders double-digit return rates, it’s usually because the security and the borrower are considered higher risk.

What types of security could be considered high risk? Undeveloped land without planning permission, rare antiques (could be misvalued), property developments in rural areas (hard to resell), unusual property developments (large estates or schools being repurposed), or specialised businesses.

If you are receiving 12% annual returns, the borrower could be paying 20%+ per year. This is so often overlooked in peer to peer lending as lenders place so much trust into the hands of the peer to peer companies underwriting process.

Making investment decisions based upon returns can be all well and good while times are rosy, but when the economy sours and loan defaults rise, you might be wishing you’d paid more attention to why the offered lender return rates were so high.

Start Slowly

I would recommend choosing five reputable peer to peer or crowdlending companies to start and splitting your money evenly. Once you become more comfortable, you can expand and diversify further. I think investing between five to seven companies is a good target. You can read to my Top 5 List to see which companies I currently like but be aware this list can change anytime.

How Much Time Do You Have?

Most peer to peer lending companies offer auto lending and some don’t offer manual lending. Manually picking out loans is time-consuming and it’s easy to pick the wrong loans if you’re inexperienced. I used to manual lend but I’ve found auto lending is my preferred choice now. I still manual invest when it makes sense when companies don’t offer auto lend.

Company History Is Important….Sometimes

When I first started peer to peer lending, some of the companies I invested through had very little trading history. Part of my investing decision was based on speaking with the people in charge and the research available on the internet. I also read through the company website and decided how comfortable I felt.

If my gut said no, I didn’t invest. In some cases my choices were wrong. As time progressed and I became more experienced, I made several adjustments by moving out of certain companies and investing through other ones. There are now additional resources on the web to help you perform due diligence on the companies and its owners.

Company Failure Is A Risk That Investors Overlook

The peer to peer lending companies themselves are prone to failure. This could be the greatest risk to investors.

Four of the companies I originally invested through ceased trading and it’s unknown how much of investors’ money will be recovered. While company operating history is important, it’s not the most important factor when making investment decisions.

Director and founder experience are also very important. Sometimes entrepreneurs launch companies but have little experience in certain sectors. Sometimes I feel more confident in companies that have less trading history versus the ones that have been established longer depending on who is in charge.

If a peer to peer company fails, they are required by the FCA regulator to have a wind-down process in place. This administrator handles all aspects of the company including consolidating bank accounts, collecting loan payments, default recovery and paying investors.

The administration is costly and time-consuming. It’s estimated that Collateral’s administrators will earn approximately £1m for their services and Lendy’s administrator will earn over £4m. This money is deducted from recovered money that should be paid to investors.

Secured Vs Unsecured Lending

I invested through Ratesetter and Lending Works. Both companies lend to unsecured borrowers and claim to lend to higher-quality borrowers. I now mainly invest in secured loans through Loanpad, Kuflink and Crowdproperty. Havening a secrity backing a loan is superior to non security or a personal guarantee.

Remember the quality of the companies you are investing through is equally as important as the loan offerings. I’ve been fortunate to have contact with the founders and operators of most of the peer to peer lending companies I invest through. If I feel comfortable with most of the companies, I’m happy to leave my money on the platform.

Lending Products Are Vastly Different

Since each peer to peer lending company offers different lending options, it’s easy to be swayed towards a secured loan because its security is something unusual like a boat or a plane. At the end of the day, whether you are investing in loans for chickens, Donald Trump’s diary or a house, a loan is only as good as its security and valuation.

When considering secured lending, the things that truly matter are:

- The loan security and the peer to peer companies ability to accurately assess the value

- The borrower’s ability to repay the debt and interest

- The lending companies ability to collect timely loan payments and interest

- The lending companies ability to quickly legally acquire the security upon a default

- The ease in which the security can be sold (it might be easier to sell a cow than a power plant)

- The lending companies competence in cost-effectively disposing of the security upon default

You may be more comfortable lending against one type of loan security versus others. I have a friend who is a property surveyor so he’s able to easily identify whether or not a property valuation is accurate. My friend knows nothing about jewelry or cars, so his natural lending choice is property loans. I have another friend who’s extremely knowledgeable about cars so he chooses only to invest in auto loans.

If you have a certain expertise in a particular lending sector then it would be wise to invest in this sector because you can evaluate the accuracy of the valuations.

Always remember that whether you loan money against a shipping container full of Monster Munch or a Ferrari…

…your number one concern is the return of your capital and then your interest.

Every Lenders’ Experience and Returns Will Be Different

I receive many emails from Financial Thing readers who tell me about their investing experiences through various peer to peer companies. One thing I have come to realise is that two people manually investing through the same company can have vastly different experiences.

One reader will tell me about all the great loans they have manually invested in that have been repaid while another reader will be spitting mad because some of the loans he or she invested in have defaulted. The only difference between these lenders’ are the loans they invested in. It’s quite possible for an inexperienced lender to invest in a bad batch of loans that leaves their returns in the negative and their ego hurt.

If you are inexperienced in peer to peer lending, oftentimes it is better to invest through auto lend products that diversify for you. I relate this to manual stock picking versus buying an index tracker fund that owns thousands of stocks. Index trackers remove the difficult decision-making process of stock picking.

Risk

If we compare peer to peer lending to other investments such as bank savings accounts or index tracker funds, there is obvious risk involved. When you buy a tracker fund, you might lose 10%, 20% or even 50% in a stock market crash, but it’s unlikely your funds will go to zero. If they do, an economic downturn of catastrophic proportions would be occurring.

With peer to peer lending, it’s very unlikely you would lose 100% of your capital, but there’s a chance, especially for example if you only invested through a tiny amount of loans. Therein lies the risk.

Peer to peer lending contains other layers of risk.

I used to consider unsecured business lending far riskier than secured property lending, however, I soon discovered that this isn’t always the case.

For example, one defaulted property loan I invested in was misvalued and sold for 50% of its value.

Another defaulted property was found to have subpar building materials so extensive remediation was required to bring the building to code. This caused delays and extra expenses. Another defaulted property loan I owned, a disgruntled subcontractor who hadn’t been paid by the developer poked holes in all the plumbing pipes causing extensive water damage behind finished walls. Again, more fixing and more cost.

Two other loans I invested in were subject to borrower fraud.

Risk isn’t always easy to assess but I consider lending against accurately valued cars riskier than lending against a piece of scrap gold because cars depreciate daily and can take time to sell. Scrap gold can be liquidated quickly.

Some peer to peer companies are riskier to invest through than others. A smaller company may be operating at a loss and might not have enough funding to continue operating in this manner. A larger growing company may be backed by venture capital and have the resources to operate at a loss for many years.

On the other hand, a large peer to peer company with high operating expenses can run into trouble during economic downturns while small companies with fewer expenses thrive. We have seen this through Covid-19 where both Ratesetter and Lending Works were sold to investment companies while a smaller more flexible company like Loanpad was able to maneuver through the downturn and continue to grow.

Lenders often overlook loan risk because it is difficult to gauge. Most investors have little knowledge on how to assess asset valuations so they rely on the peer to peer companies to correctly asses valuations. There are a few simple things you can do to reduce risk. For example, if you are lending against a residential property, check on Zoopla for previous sales in the region to see if the valuation is somewhat close. This is harder to do if it is a redevelopment loan.

As I mentioned before, a 9% return loan may be less risky than a loan paying 6% because we don’t always know how much interest the borrower is being charged. Because many lenders don’t have the time or experience to evaluate loan risk, they often assume the 9% loan is riskier.

Risk also changes as interest rates change. When it was possible to buy a one-year bank bond yielding 5%, I wouldn’t have invested in peer to peer lending at 6%. The extra 1% for the added risk doesn’t make any sense. Now savings rates are poor, my risk tolerance rises as peer to peer looks more attractive. If and when interest rates increase, my risk tolerances will change and adjust.

Finally, when considering risk, this changes depending on how much of your net worth you are investing. If you are investing 1% of your liquid net worth, your risk tolerance is might be higher than if you were investing 50% of your net worth.

Remember, when it comes to investing in peer to peer and crowdlending….

Loan Security

When I invest money into self-selected secured loans, I pay close attention to loan security and the peer to peer loan company’s ability to recover the security in order to repay investors’ capital and interest.

For example, scrap gold has shorter legal recovery times and is easier to sell providing the price of gold is stable and items were valued correctly. Compare this to real estate where a peer to peer company must weave through the legal system to be foreclosed. This can take several months, if not years. Once the legal red tape has been cut through, the property must then be marketed and a buyer sought. This lengthy process can be costly and leaves lenders’ money tied up in the loan indefinitely.

Some companies are more effective at recovering defaulted loans than others and if you dig deeper, you will find some companies are better at recovering certain types of loans. One company may offer both gold and property loans but have no experience in property recovery. After all, what good is a secured loan if the defaulted security can’t be recovered?

While seeing the dreaded “loan defaulted” tag next to a loan you own is poo, defaults are a natural part of the risk that occurs within peer to peer lending and will happen, so it’s important to decipher which companies are competent in default recovery.

As one Financial Thing reader who worked in banking told me, “Bankers have always understood that part of any loan book will sooner or later be labelled non-performing”.

Even A Perfect Loan Can Go Wrong

I learned this the hard way when I invested a larger sum of money into a high rise property development. I studied the numbers and deemed this particular loan to be one of the better ones offered through any peer to peer lending company. When the loan defaulted well into the development stage, I soon realised that even the best loans are prone to failure. This defaulted loan only repaid me 50% of my capital.

Contrarily, some of the worst looking loans I have invested in have defied logic by being repaid on time.

Diversify, Diversify, Diversify

Even if I were not writing content for this website, my peer to peer lending portfolio would be very diverse.

I invest money across various types of lending products that pay varying interest returns. I do this in order to reduce risk. If a company I invest through fails (hello Collateral and Lendy), my total portfolio would not be decimated. For those seeking maximum returns, you are probably looking to sink all your cash into the highest paying return companies. Just understand this is a high-risk move.

The same goes for loan diversification within a single company. I choose not to put too much money into any one single loan because if that loan defaults, loss of capital will really hurt overall returns.

Also, think about sector diversification. If you invest all of your money into property and the property market downturns, your returns will suffer. I diversify by investing across various sectors such as property, cars, businesses, jewellery and consumer loans.

Have Realistic Return Expectations

No longer do I have expectations of 12%+ annual earnings. If I diversify correctly, is my target. Diversifying between high, medium and lower risk peer to peer lending investments make this a 5-7% annual return realistic.

Don’t Put All Your Investment Eggs Into The Peer To Peer Lending Basket

This goes along with the diversification point. Sometimes I hear of lenders who invest frightening percentages of their net worth into peer to peer lending simply because the returns seem easier to achieve than other forms of investing.

I think this is crazy. I can’t explain how sick I felt when I lost six figures during the 2008-2010 property crash. This experience taught me an expensive diversification lesson.

No matter how good the outlook, one change in the economic environment can bring an investment sector to its knees. Always remember this when deciding how much of your hard-earned savings to invest in peer to peer lending.

I currently have about 10% of my liquid net worth in peer to peer lending. I doubt this will increase any higher than 15%. This is what I’m prepared to risk. Yes, losing 15% of net worth would be sickening but it won’t bankrupt me.

When people ask me how much of their nest egg they should invest in peer to peer lending, I answer, “How much can you afford to lose and continue to sleep at night?”

This is a very personal decision that varies from person to person. Age plays a factor in regards to how much time you have to recover from a loss. Is it likely you would lose all of your money in peer to peer lending? No, but it’s possible.

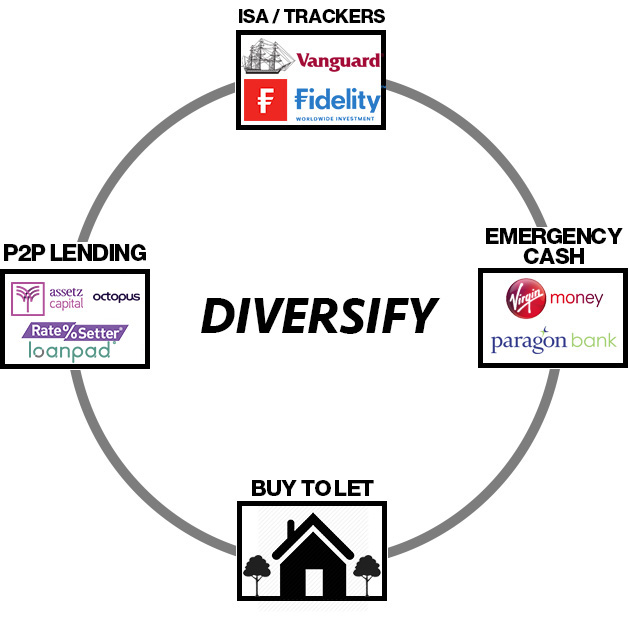

My ideal investment portfolio would look something like this (plus some cryptocurrency):

How Much Time Do You Want To Spend Managing Your Peer To Peer Lending?

Peer to peer lending can be extremely time-consuming so ask yourself how much time you want to be spending managing your investments. Different companies require different time commitments depending on the loan lengths and the new loan activity.

There are several companies including Assetz Capital, Loanpad, Lending Works, and Zopa that offer completely hands-off investment products that require very little management. Some of these companies pay lower returns for the convenience so there is a trade-off, but I think this trade-off is worthwhile.

Don’t Be Loyal / Make Changes As Needed

I know email inboxes can become overwhelmingly full, but it’s important to read the peer to peer companies emails to see if they have made any changes, particularly to the way they operate or to the products they offer.

Sometimes peer to peer companies make changes that affect the lending products they offer. I have no problem exiting a company if I’m unhappy with their product changes or reduced interest rates. I can always reinvest later.

Don’t feel the need to remain loyal to any particular company if you feel uncomfortable. Just as you would with your savings accounts, it’s okay to search for better peer to peer company alternatives if you’re not happy.

Director and Staff Experience

The experience of the Directors and staff running the peer to peer and crowdlending companies was mostly an afterthought for me when I started lending. As I have more lending time under my belt, I realise how essential Director and staff experience really is. If the Directors fail to evaluate credit and borrower risk accurately, those companies will not survive long-term and your capital could be at risk.

My website has enabled communication directly with many of the people in charge of the peer to peer lending companies. This, in turn, allows me to gauge the experience of the company Directors and the company staff. While there’s no guarantee that these Directors will lead their companies to success in the long term, it’s certainly helpful to have these types of conversations.

I encourage you to watch my YouTube video interviews so you can become familiar with the people who you are entrusting your money to. Do not be afraid to call the companies and ask difficult questions. Remember, it’s your money.

Tax Considerations / ISA

When factoring in tax costs, peer to peer lending returns can be less than expected. Using an ISA to invest in peer to peer makes tax sense for most people, but individual tax positions vary and should affect your peer to peer lending decisions.

The strange IFISA rule doesn’t allow lenders to invest their current year ISA allocation into more than one peer to peer company. Lenders can reinvest previous years ISA into multiple peer to peer companies although many companies have a £5,000 minimum ISA investment amount. For many people, using the current years ISA allocation can prevent them from truly diversifying their peer to peer lending.

Thankfully ISA rules do allow a split into Cash, Stocks and Shares and the IFISA such as peer to peer lending so that allows some diversification.

If you’re confused about whether or not a peer to peer lending ISA is right for you, consult your tax professional.

FCA Regulation

The FCA or Financial Conduct Authority is an independent regulatory body which reports to the UK Treasury department and the Parliament. The FCA’s board is chosen by the Treasury and this board manages the senior executives. In order for a peer to peer or crowdlending company to receive FCA regulatory status, they must go through a long and arduous process.

It’s important to make sure any company you invest through is operating under FCA permissions. You can use the FCA’s search tool for verification.

I often question how competently the FCA has handled the authorisation and regulation of certain peer to peer lending companies. After the Collateral, Lendy and Funding Secure failures, it became apparent that the FCA has failed investors. Financial regulations within the alternative finance sector need to be much stronger in order to protect investors.

For example, Collateral assumed they were operating under FCA regulatory permissions but were not. When the FCA discovered the regulatory issue, it forced Collateral into administration. I believe the FCA could have done a better job vetting both Lendy and Funding Secure before authorisation.

Company Accounts

Readers often ask me why I don’t pay more attention to company accounts. It is possible to view some peer to peer company accounts but these can be difficult to analyse. Accountants are creative and can use business tax laws to manipulate profit, losses and debt structure.

I’m not an accountant but I do know accounting numbers can be manipulated far beyond my comprehension. Just think of the countless news stories about multi billion pound companies falsifying their books in order to manipulate share prices.

For example, in 2014, social media goliath Twitter reported a loss of $0.96 per share using one accounting measure but also reported a profit of $0.34 per share using another.

Company accounts don’t always accurately portray company financial health and it’s very difficult to know what goes on behind closed doors. Obviously, it’s better if a company is operating profitably but this isn’t always transparent. I try to provide company account information on my reviews but you can search for company accounts using the Companies House website.

Patience

I no longer make rash decisions when it comes to peer to peer lending. When I pick a company to invest through, I wait 24 hours before making a deposit to really consider my choice.

I practice patience when picking out investments. Just because a company is offering loans doesn’t mean they’re good loans. Sometimes it’s better to sit on the sidelines and wait for a more favourable opportunity, even if this means your money isn’t collecting interest.

Early in my investing days, I made some hasty decisions I regretted. For example, I would buy a loan on impulse, do some further research and find the loan was a bad investment and end up selling it a few weeks later. If I’d had waited before investing, I wouldn’t have purchased the loan.

It has taken me several months to become fully diversified through certain companies but I am glad I practised patience.

Also when you sign up for a new peer to peer company, take things slowly and make sure you understand what you are doing. Moving too quickly can cost you, as it did for this Funding Circle investor who didn’t set his diversification correctly.

What About Investing During Covid-19?

Many investors have understandably gotten cold feet during the Covid-19 pandemic. I wouldn’t blame anyone for sitting on the sidelines during economic uncertainty. You can always invest when things settle.

My strategy during Covid-19 has to been to stick to the “safer” peer to peer lending companies and avoid the higher risk loans. I’ve also limited my exposure to SME (small and medium businesses) lending.

I’ve continued to invest through property-backed loans.

So Why Invest In Peer To Peer Lending?

You may have been reading this guide thinking peer to peer lending is quite scary and full of pitfalls. Truthfully there are quite a few good companies to invest through. Obviously Covid-19 has put many companies to the test, some of them passed with flying colours while others have closed their doors.

Peer to peer lending offers a way for investors to achieve return rates on their money. Other investments have their positives and negatives just like peer to peer lending:

- Savings: Rates are the lowest they have been in decades and most savings products pay less than inflation meaning the money sta in a savings account is losing its value. I expect savings rates to remain low for many years.

- Savings Bonds: Like savings rates, saving bond rates pay very low-interest rates

- Stocks and Shares: During a market correction, your investments could lose value and take months or years to recover

- Gold and precious metals: These are volatile and prices can fluctuate. Making money in precious metals is highly dependant on when you enter the market. For example, in January 1980 gold was $2,000 an ounce. On September 1st, 2020, gold was priced at $1,966 per ounce.

- Buy To Let: Property has a high entry price and buy to let’s are subject to high amounts of stamp duty, reducing returns. Tenants can be an issue.

- Cryptocurrency: While I’m very bullish on certain cryptocurrency (especially Bitcoin), nearly all other coins are extremely speculative, volatility is high (this is actually a good thing) and returns are highly dependant on when you purchase.

As you can see, every investment has pros and cons and I believe the best strategy is to diversify and use as many investments vehicles as you can, including peer to peer lending.

Conclusion

In this peer to peer lending guide, I have highlighted some of the main considerations I pay attention to when making investment decisions. Peer to peer lending comes with risk, as does any investment. If you invested your money into the stock market in 2007, you likely saw a loss of 40% following 2008’s financial crisis. I believe peer to peer lending is an effective tool to complete a diverse portfolio providing you invest through the right companies. Personally, I won’t invest more than 10-15% of my available liquid cash into peer to peer lending.

Investment diversification is very important and remember not to invest more than you can afford to lose.

If you are looking to get your peer to peer lending feet wet, read my current Top 5 Peer to Peer Lending Sites guide and also read the many unbiased peer to peer lending site reviews.

Thanks for visiting Financial Thing.

I rely on reader support to keep Financial Thing operational so would you consider making a secure donation via PayPal? Whatever you feel my information is worth, please feel free to donate any amount if you feel I have been helpful.

Just click the “Donate” button above to enter your donation/gratuity. Thanks in advance for your support! From my heart to yours – Laurence.

If you enjoyed this page and want to learn more about peer to peer lending, click here and receive my complimentary Top 5 Peer to Peer Lending Sites Report.

I love feedback, so if you find any errors, omissions or have any improvement suggestions, I invite you to contact me and be a part of contributing to this website.

Disclaimers: I am not paid to write my reviews and I’m not employed by any of the companies I write about. In most cases, I have invested or continue to invest my own money through these companies. In order to keep the website financially viable, the sign-up links on this website are referral links and I do accept advertising in the form of banner ads. This advertising in no way influences my reviews and opinions. When you sign up for an account through my website, in some cases I receive a referral fee directly from the companies, at no cost to you. Your support enables me to continue to operate the Financial Thing website. You can read more about my referral links and banner advertising here.

** This page is for information purposes only. This information is not financial advice and has been prepared without taking your objectives, financial situation or needs into account. You should consider its appropriateness for your circumstances. All investing carries risks. Opinions expressed in this review are opinions based on my own personal experiences. The FSCS does not cover peer to peer lending, crowdlending or crowdfunding and your capital is at risk. Please don’t invest more than you can afford to lose. **